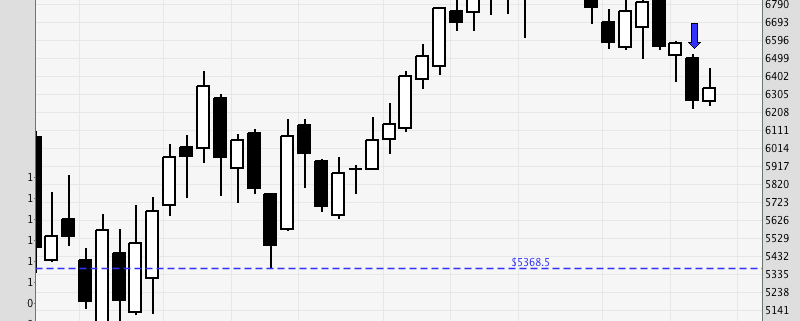

All 3 indices attempted a pullback over the week, and overall the Singapore market was the weakest, closing down for the week, albeit almost flat. Prices may attempt a sideways movement or rebound next week, but overall it still remains bearish, and prices are expected to continue drifting down in the absence of any major positive news. I am holding shorts and waiting for a chance to short more.

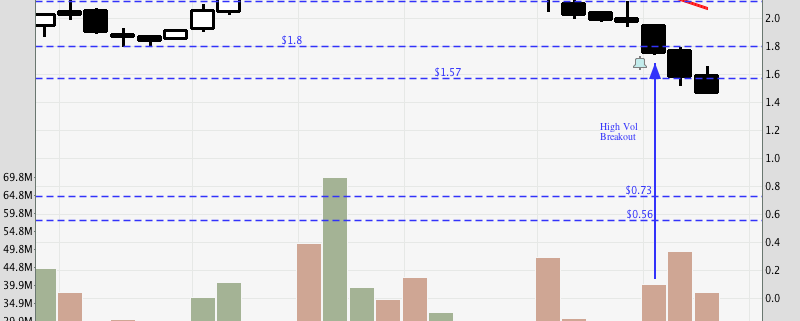

This is the weekly chart of Sakari, and we can see that it has had 10 consecutive weeks of decline. This shows that it is obviously on a downtrend, although the possibility of a pullback is quite high seeing how extended the move is. That said, new lows are expected after the pullback, since the support of 1.57 has been broken. The next support I can find is at 0.73, but that is very far, so a trailing stoploss is recommended instead if one chooses to short on the pullback. I will be watching it closely.

After a climatic plunge and a small 3-bar pullback, Olam broke to new lows on increased volume. This looks bearish, so I took a short position @1.720 with a stop @1.755. Let’s see how it fares tomorrow. If it takes out my stop, then it will enter a narrow range or have a larger pullback. The R/R is in my favour.

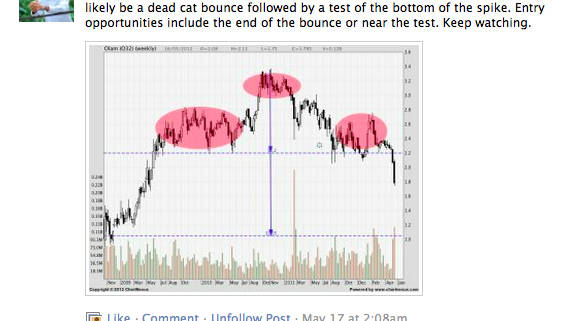

Source: http://www.facebook.com/groups/synapseforum/

This is the CRB Commodity Index, which I shared in the private mentoring forum on Monday to show that the Commodity sector is still on a downtrend. I hope no one tried to catch falling knives like Olam, Sakari etc. Sometimes, a dead cat bounce can look like the start of a new trend, but I prefer to trade with the established trend.

Another big danger to new traders is the idea of the holy grail of trading.

To many, the holy grail of trading is deemed to be the ultimate solution to all their trading problems, the magic bullet that will allow them to profit without effort, the secret trading method or tool that will allow them to predict the market and win on every trade. However, far from being the solution, this mentality often acts as a stumbling block to all traders, if not a brick wall.

Many people hop from tip to tip, from guru to guru, from one software to another, attending every seminar and learning from every guru, but they will never be contented, and they will never become good traders, because they are too busy finding the holy grail to put their knowledge into practice. So what is the holy grail?

The holy grail can appear in many forms – a “sure-win” indicators, a “100% win rate” trading system, a “legendary” guru, or a “unique proprietary” software guaranteed to make you rich overnight.

They all hold the same promise – to make you rich quickly with little effort.

Unfortunately, there is no shortcut to success, no magic bullet that will make you a super trader overnight.

To them, the answer is always so near, yet always slightly out of reach. Every time they see a new method, they think “this must be it, this must be the missing ingredient.” They test it out for a few days, realise that it’s not perfect, then skip off to find the next new toy. Many don’t realise that no method is 100%.

Many people also mistake sophistication for perfection, opting to fork out money for automated systems that will print money for them as they sleep at night. However, when the system stops printing money, as all do eventually, they are once again off to find the next holy grail.

It took me many years to realise it, and I have been through at least 200 books and tried almost every method or tool available, before I finally realised that to find the holy grail, one has to look within. So if you want to start learning the skills to make consistent money on your own, you need to first get rid of this stumbling block.

Many people in trading start off with the wrong ideas, and after sacrificing a lot of time and spending a lot of money, they wonder why they still cannot get the results they desire. Others think that hard work can solve everything, and given enough time, they will naturally pick up the skills themselves. Not many succeed in re-inventing the wheel. As a world-class tennis coach used to say, “Practise makes perfect, nut make sure you are not practising the wrong thing.”

“It’s not the method or system, it’s the trader.”

So, my advice to new traders is to stop jumping from system to system, hoping to find the holy grail (which does not exist).

Instead, start learning as much as you can, then find a good system and work with it until you find success.

If you would like to learn how to get started in trading, also check out: “The Beginner’s Guide to Trading & Technical Analysis”

Latest Blog Posts

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm

Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

Contact Us

Synapse Trading Pte Ltd

Registration No. 201316168H

FB Messenger: synapsetrading

Telegram: @iamrecneps

Email: info@synapsetrading.com

Disclaimer

Privacy policy

Terms & Conditions

Contact us (main)

Partnerships