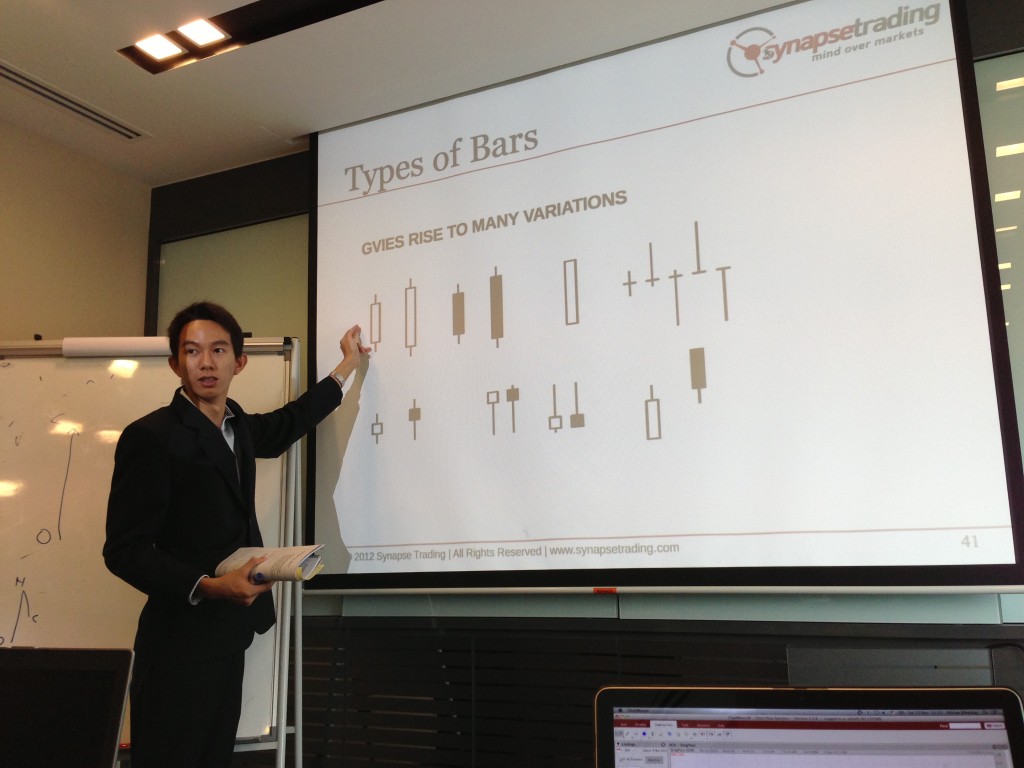

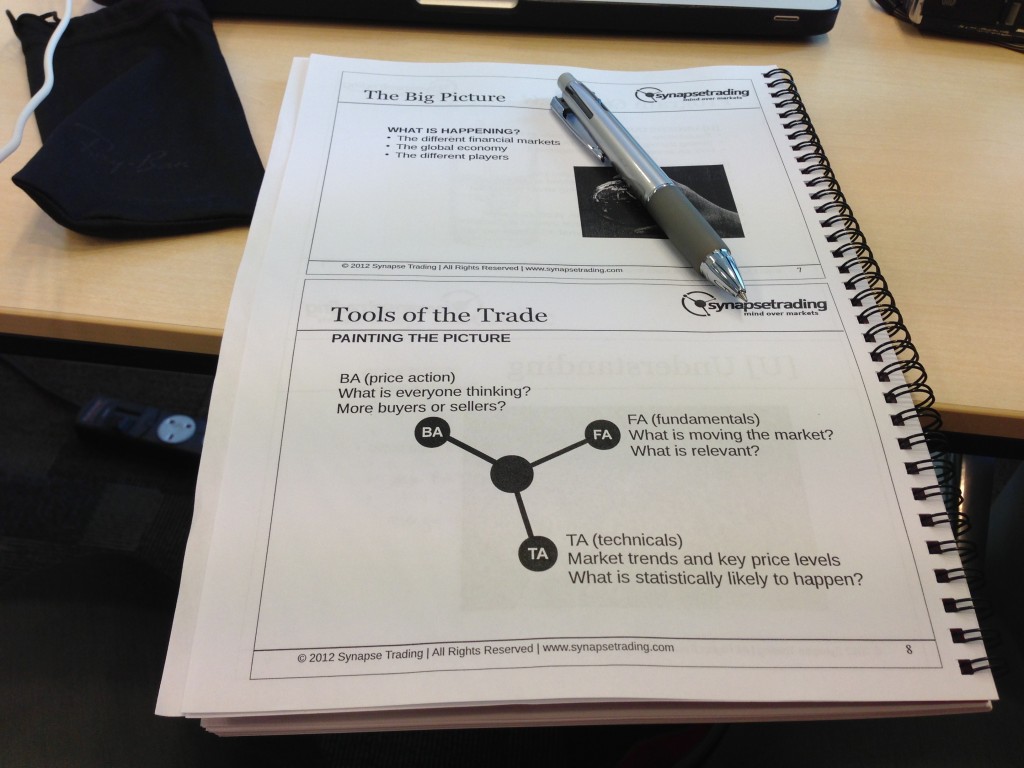

On Monday, the stock markets were rather quiet, but the forex markets were setting up a nice trend play on the EUR/USD and GBP/USD. This observation was made simply by observing the price action, as I do not believe in using wave counts or esoteric patterns to forecast the future. That is not what real trading is about.

I took large short positions in both currency pairs and shared it in the private discussion forum for our graduates.

For those new to forex, 1 pip is 1 tick of increment on the forex movement, and for EUR/USD and GBP/USD, it is 10 USD for 1 lot of a contract. For a 50 pip move, it would be calculated as such: 50 pips x 10 USD = 500 USD.

Today, after returning from my game of morning tennis, I was delighted to find that my targets have been hit for both pairs. Overall, the trend is still bearish, and I will continue to look for high probability setups.