Last Saturday, I conducted another market outlook seminar for 2013, sharing how to read charts using behavioral analysis and how to identify the 4 major behavior patterns. This was done on-the-spot using real examples, and without using any indicators or special software.

I will be taking a break until CNY, and focus on helping my students in the Synapse Club forum. After this seminar, I already spotted some good picks which I can’t wait to share in the forum later on.

For those keen on future educational events, kindly sign-up for our mailing list and reply quickly once you receive the invitation (usually sent about a week before the event). The seats for such seminars are usually filled within a few hours, so it is best to reserve early.

Feedback

“Comfortable with the pace, good for beginners. Speaker is competent.”

– Natarajan (Accountant, 3 years experience)

“Straight forward delivery and sharing, no frills. Speaker is good and knowledgable. One key take-away is Spencer’s impressive track record.”

– Matthew Liang (Trader, 6 years experience)

“This seminar covers on basic to intermediate trading skills and experience and also current market and stocks outlook. Most of the other seminars outside covers only trading skills and marketing information only. Now I have a better understanding of the price action movement. The current market outlook is very good, as it covers USA, Singapore and commodities. Spencer is a very experienced trader.”

– Bernard Lim (Commercial manager, 8 years experience)

“Speaker is humble, soft-spoken and down to Earth for 1st impression.”

– Ernest (Software Engineer, 2 years experience)

“Ver informative, some original techniques were shared.”

– Edwin

“Fresh and honest perspectives. Good learning session. The emphasis on behavior analysis is different from what i have heard out there. Speaker is not flamboyant & very honest and clear.”

– Leonard

“A different perspective compared with other trainers. Speaker is pretty good.”

– SJ (3 years experience)

“Explanation was clear and information shared was generous. My key takeaway was the 4 setups shared.”

– Kwan Ming Wei (5 years experience)

“The best part is I get to see the trainer does his analysis. I also get to know more about accumulation & distribution phase. Another thing I learnt is how to get the longer term view of the market to trade on the shorter timeframe. My key takeaway is how to do chart-reading & identify the accumulation phase such that the price is ready for the big move. Speaker is humble.”

– Jody Ong (2 years experience)

Today, I saw a low risk shorting opportunity on the USD/JPY, and shorted with hesitation. I knew there would be important news tomorrow, but I calculated that it would be able to hit my TP by today.

Unfortunately, my calculation was wrong, but because I used my dynamic position-sizing and risk management techniques to manage my trades, I managed to scratch out with no loss even though I had miscalculated.

Even when you have reached a high level of skill, there will be times when you will make mistakes. Taking a small loss is no big deal, it is part of trading. The important part is knowing how to manage your risk and psychology effectively, something which I have to help many new traders with.

I will be sending out the invitation for my talk during lunch today, so this is the last chance to sign up for the exclusive events mailing list in the sidebar. After this, there won’t be any more talks for a while due to Chinese New Year.

I just posted some key charts on SGX and UOB in the private “Synapse Club” forum, which I think have some good trading opportunities, and is an important signal of what is to come in the market. I shall share more during the talk this Saturday, and everyone will get a chance to talk to me, so bring your questions if you have any.

See you there!

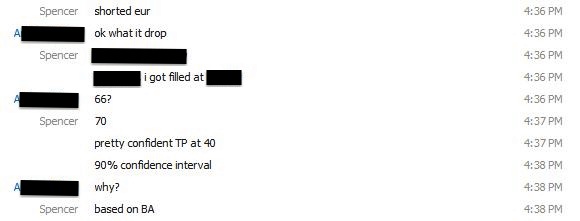

In one of the private Skype chatgroups (this one is for full time professional traders only), I openly shared with other traders that I was 90% confident of my predicted target price.

From the chart, you can see the 2 black horizontal lines, showing 1.3370 and 1.3340. This was a quick and easy 30 pips profit trade, using one of the price behavior patern readings.

How can I be so sure that price would reach 1.3340 before correcting? Well, that is the science of precision market timing. I will be sharing more in my seminar next week.

Latest Blog Posts

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm

Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

Contact Us

Synapse Trading Pte Ltd

Registration No. 201316168H

FB Messenger: synapsetrading

Telegram: @iamrecneps

Email: info@synapsetrading.com

Disclaimer

Privacy policy

Terms & Conditions

Contact us (main)

Partnerships