Weekly Market Wrap: Stocks End First Half of 2023 on a High Note!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

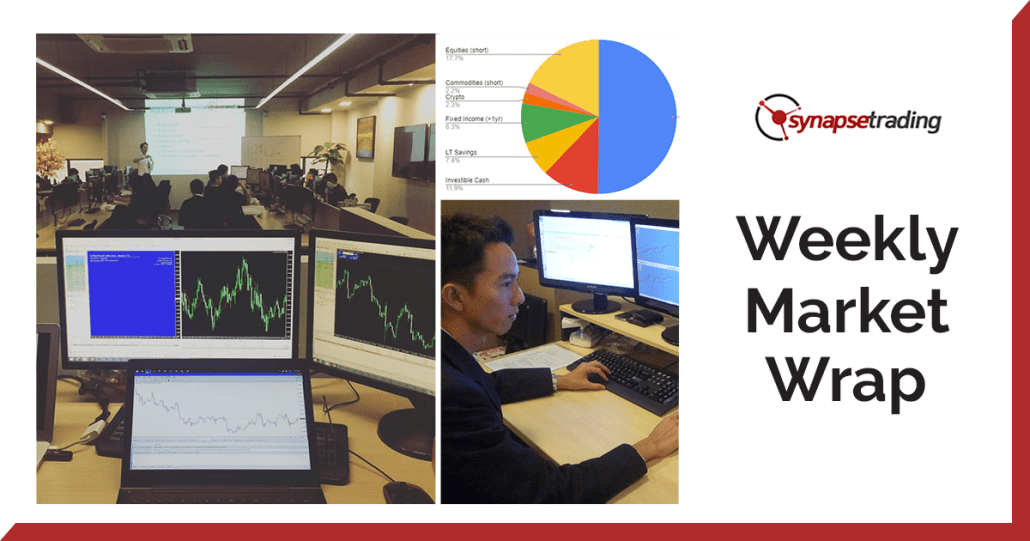

For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technicals, economics, and portfolio management:

Click here for last week’s market report (26 June 2023)

Click here to subscribe for the latest market report (03 July 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

Last week, investors demonstrated increasing optimism as bullish options bets surged on stocks across various sectors, including AI stocks, small-scale economically-sensitive companies, and regional banks.

This positive sentiment was reflected in the significant market rallies seen in 2023, with the S&P 500 and Nasdaq Composite climbing 13% and 29% respectively. Despite a brief pause in the rally after Federal Reserve officials reiterated their intention to continue raising interest rates, traders remained bullish, with the fear of missing out driving investors to participate in potential future gains.

In AI news, Baidu Inc., China’s leading search engine, claimed that its AI service, Ernie 3.5, outperformed OpenAI’s GPT-3.5 chatbot in general abilities and exceeded GPT-4’s performance in several Chinese-language tasks. Baidu plans to integrate Ernie Bot across various business areas and has earmarked a $140 million venture fund for investing in AI startups.

Meanwhile, the Biden administration is considering imposing further limitations on the export of AI chips to China, potentially preventing companies like Nvidia from shipping chips to China without prior licensing. Lastly, Oracle Corp is investing heavily in Nvidia chips and CPUs from Ampere Computing and AMD as it seeks to expand its cloud computing services and compete in the fast-growing cloud sector.

In the upcoming week, market participants should brace for a flurry of significant economic events that could potentially trigger increased market volatility. The week kicks off with a holiday-shortened trading schedule due to the U.S. Independence Day, which could result in thinner trading volumes.

However, the focus will quickly shift to crucial labor market updates, including the Job Openings and Labor Turnover Survey (JOLTS) and ADP’s National Employment Report, both slated for release on Thursday. These reports will provide valuable insights into the state of the U.S. labor market, setting the stage for Friday’s nonfarm payrolls report, which will track job growth in June.

In addition to labor market data, investors should also keep an eye on the Purchasing Managers’ Index (PMI) readings from S&P Global and the Institute for Supply Management (ISM). These indices provide a gauge of the economic health of the manufacturing sector, which is a key driver of economic growth.

Furthermore, the Federal Reserve will release the minutes from its latest policy meeting, offering deeper insights into the central bank’s views on the economy and potential future policy shifts. Given the current market sensitivity to changes in monetary policy, these minutes will be closely scrutinized for any hints of changes in the Fed’s stance.

Daily Trading Signals (Highlights)

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

AUDNZD – Trade moving as planned, halfway to the profit target. 🔥

NZDUSD – Prices are starting to head down again.

C3.ai (AI) – This US tech stock is currently resting on strong support, offering a good RR ratio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!