5 Practical Tips on How to Trade on the Go (With 15 Minutes a Day)

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

After trading and travelling to 48 countries across the world, I realised that it is actually not very difficult to trade on the go, since in most countries you can get wifi or buy a data plan, so as long you have your mobile phone, you can easily place trades as you move along.

Here are some useful and practical tips I have picked up along the way:

Table of Contents

1. MAKE SURE YOU HAVE A GOOD INTERNET CONNECTION

This is a no-brainer, as the last you want is to be left handing with no internet after entering some trades, and not being able to input your stoploss and targets. Don’t forget to take full advantage of Wifi hotspots at hotels and cafes, or even better, purchase a local SIM card and data plan.

If you have intermittent access to the internet, perhaps because of flights, then make sure you always have a stoploss in place for all your trades.

2. FOCUS ON A HANDFUL OF SETUPS AND PRODUCTS

Since you don’t want to spend too much time browsing the markets, it is a good idea to prepare a simple watchlist beforehand. For me, I usually focus on about 20+ forex/commodity pairs, so that I can scroll through all of them quickly in a few minutes with my mobile phone to look for any good trading opportunities.

And since I won’t be taking many trades, I can choose the best of the best trades, which means that I can focus only the very best setups that I see. When you see an AWESOME setup, it should jump out of the chart and right in your face, and you should feel the rush of adrenaline and excitement to take the trade. If you have to squint at the chart and think thrice about whether it is a good trade, then I would suggest you just let it go.

3. USE A LARGER TIMEFRAME TO PLACE YOUR TRADES

If you are on the move, then obviously you won’t have time to be staring at the charts all day, which means you should not be using smaller timeframe charts like the 5-minute or 15-minute charts. Actually, I won’t recommend using anything less than a 1-hour timeframe.

By using longer timeframes (1-hour, 4-hour, daily), it means that you only need to check the charts at very infrequent intervals, such as every hour, every 4 hours, or once a day. This way, you do not have to constantly worry or stress about your positions, because your stops will naturally be wider (and your positions smaller), so you do not have to worry about the smaller market fluctuations.

4. DO NOT SPEND MORE THAN 15 MINUTES A DAY

Since you do not have to constantly monitor the market, this means that you only have to periodically check and update your positions. You can easily do this by utilising the “wasted” pockets of time that you have throughout the day.

For example, when you are waiting for a bus/taxi/mrt/plane/train, or waiting for your ordered food to arrive, instead of playing some mindless mobile app game or reading random articles of facebook, why not open up your trading app and place some trades instead? This way, you can make some additional income with your spare pockets of time.

5. LEVERAGE ON A GOOD NETWORK OF TRADERS

Lastly, by leveraging on other good traders, you can learn from their trades and hone your skills as a trader.

You can check out our private communities and trading signals here: https://synapsetrading.com/the-synapse-program/

See you soon! 😀

P.S. For my full travel photo log and list of countries travelled, please visit: https://synapsetrading.com/travel-log/

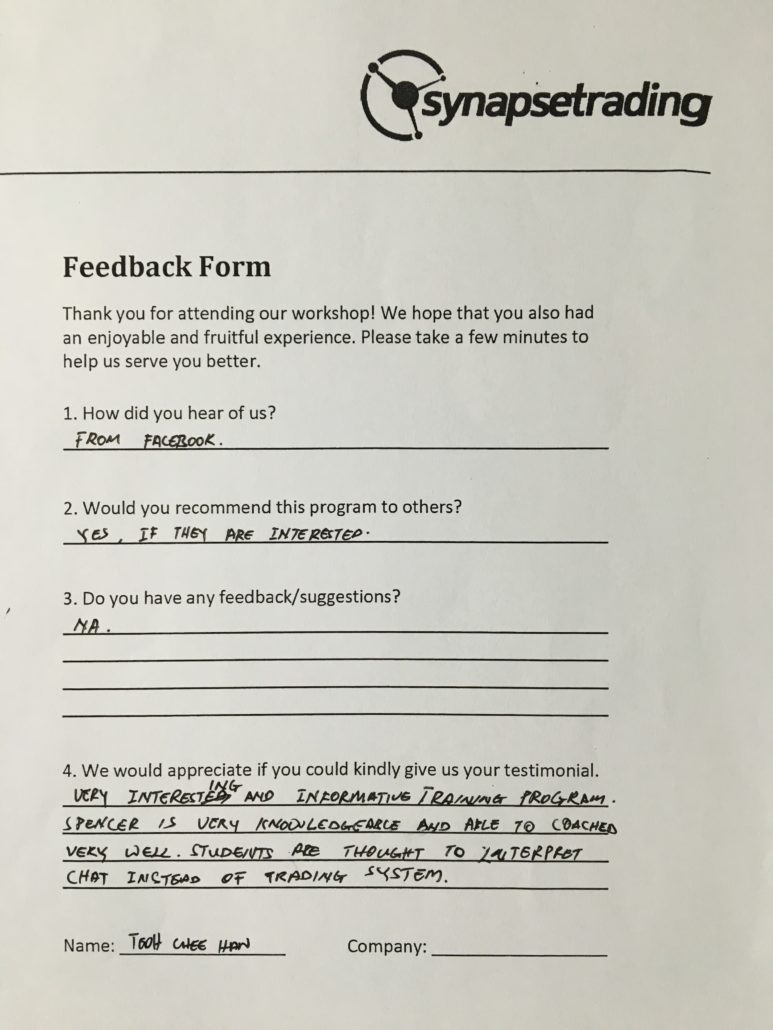

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!