The Brexit Debate – What are the Possible Outcomes?

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

The ongoing Brexit Debate has been keeping markets around the world jittery for the past few days, especially the Pound (GBP), which has been declining sharply for the past 2 weeks.

The date that everyone is looking out for is 23 June, where the referendum will take place, with the big question, “Should the United Kingdom remain a member of the European Union or leave the European Union?”

Prime Minister David Cameron wants Britain to stay in the EU. US president Barack Obama also wants Britain to remain in the EU, as do other EU nations such as France and Germany. But according to polls, the British public seems pretty evenly split on the issue.

From what I see, the Brexit (Britain + Exit) is a unique situation that could develop into one of three paths.

Table of Contents

PATH 1: TOTAL INDEPENDENCE (UNITED STATES MODEL)

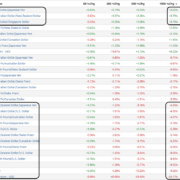

One possible arrangement is for Britain to be completely independent of the EU. This would make Britain as “separate” as the United States. Among the chief concerns would be the hefty protectionist taxes levied on U.S exports. It is widely-known that American cars are more expensive in Europe than those sold in America. Some dooms-day economists claim that this could lead to disaster for Britain’s already negative trade balance.

Source: tradingeconomics.com

If you follow this line of reasoning you might expect the pound to become like the current depreciated USD. A country cannot have sustained deficits without experiencing a sharp fall in its currency value in the long run.

PATH 2: PARTIAL INDEPENDENCE (NORWEGIAN MODEL)

Another possibility is for Britain to leave the EU but remain in the EEA (European Economic Area). David Cameron seems to be very pessimistic about the Brexit, citing concerns of pensions, the healthcare budget, and the defense budget; which he feels would all be adversely affected. This option is a compromise between the two extremes, and it is called the Norwegian model.

In return for access to the EEA, Britain will then have to comply with the EU’s law relating to the internal market. However, Britain will not have a say on the rules that are made in the EU.

PATH 3: NEGOTIATE A TRADE DEAL (HIGHLY UNLIKELY)

Britain can negotiate for a trade deal that would allow certain goods to be exported freely to the EU. However, this is highly unlikely to happen as the EU would also demand for the labor market to be opened up (to immigrants and asylum seekers), which is clearly something the Brit voters do not want.

HOW TO TACKLE THE MARKET?

As with most unique news events, the markets will start trending based on anticipated outcomes, and remain inactive as traders start to close out their positions to stay on the sidelines. Many brokers have increased the margin requirements in anticipation of a huge move.

For me, I personally do not like to trade on such news, as there will be huge spreads and slippage when the market is moving too fast. Hence, I will likely scale out of my existing positions and take profits off the table as we get nearer to 23 June.

If I were to take a gamble, I would go long on the Pound (GBP), firstly because it has already dropped quite a lot to “discount” the possibility of a Brexit, and secondly because I think that Britain is more likely to stay in the EU. These are just my random musings. 😀

Good luck!

Sources:

http://www.bbc.com/news/uk-politics-32810887

http://www.bbc.com/news/uk-politics-eu-referendum-36511598

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!