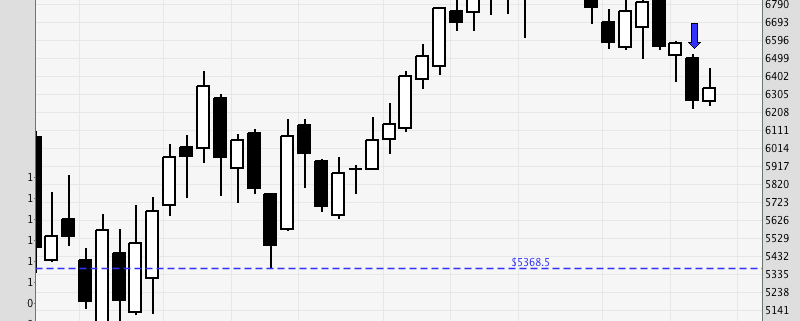

Last week, we saw a strong bullish bar breakout of the range, however this week ended with a strong bearish bar back into the range. This shows the strength of the bears, and bulls will not be looking to buy until prices have dropped to the area of the green horizontal line. If prices fall through, we will see a double top; if prices hold, we will see more range trading. A key event is the EU Summit this Thursday, where Spain may or may not request for a bailout, and this will have a significant impact on the sentiment.

Highlights from “The Synapse Forum”

The falling apple is acting as a drag on the NASDAQ, and hence the US markets in general. The US markets are likely to be ranging or bearish.

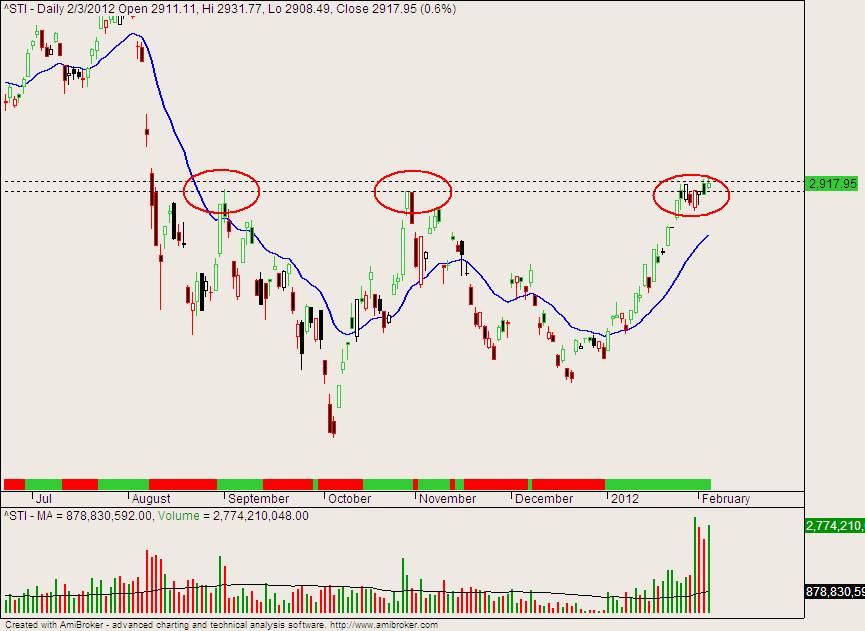

Although the general market is bearish, the commodity stocks are showing signs of bullishness, such as this chart of Noble.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.