Last month, I took a short 2 week break with some friends to Boracay Island in the Phillipines, and for those who are looking out for your next holiday destination, this could give you some good ideas! 😀

To see the full photo albums for this trip, please visit: https://synapsetrading.com/travel-log/

Where is Boracay?

Boracay is a tropical island surrounded by stunning white sand beaches about an hour’s flight from Cebu or Manila just off the larger Philippines island of Panay.

For beach connoisseurs it competes with the best beaches of more popular destinations such as the Caribbean and the South Pacific as well as neighbouring Thailand, Malaysia and Indonesia. For those wanting to just lounge around and top up their tan, beach-front hotels usually have lounge chairs set up just a few steps away from the hotel entrances.

The more active will appreciate water sports and activities such as sailing, wind surfing, snorkelling, diving and jet skiing. The fun in Boracay doesn’t end when the sun sets. Boracay night-life pulsates with many bars and restaurants serving food, drink and fun until dawn.

1. Splurge on cheap cocktails

Because these 4 drinks add up to about $10 SGD

2. Splurge on seafood

Double-check to make sure they’re alive

Mutant prawns

3. Cliff-diving after drinking

After 3 beers and 2 cocktails

After a few more beers…

4. Helmet-diving 20,000 leagues under the sea

Not photo-shopped btw lol

5. Kite-boarding

Let the kite drag you out to sea…

6. Island-hopping & Snorkelling

Singapore, Sweden, Korea, Canada, Australia

Ship-wrecked

Preparing for dinner later

7. Paddle-boarding

Harder than it looks

8. The Legendary Pubcrawl + Post Party

Trying to feel young again 🙂

Looking for some good setups 😉

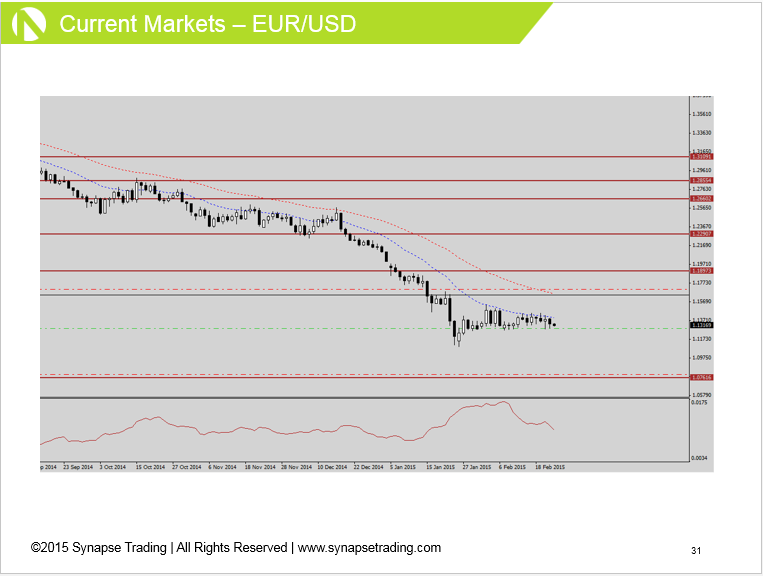

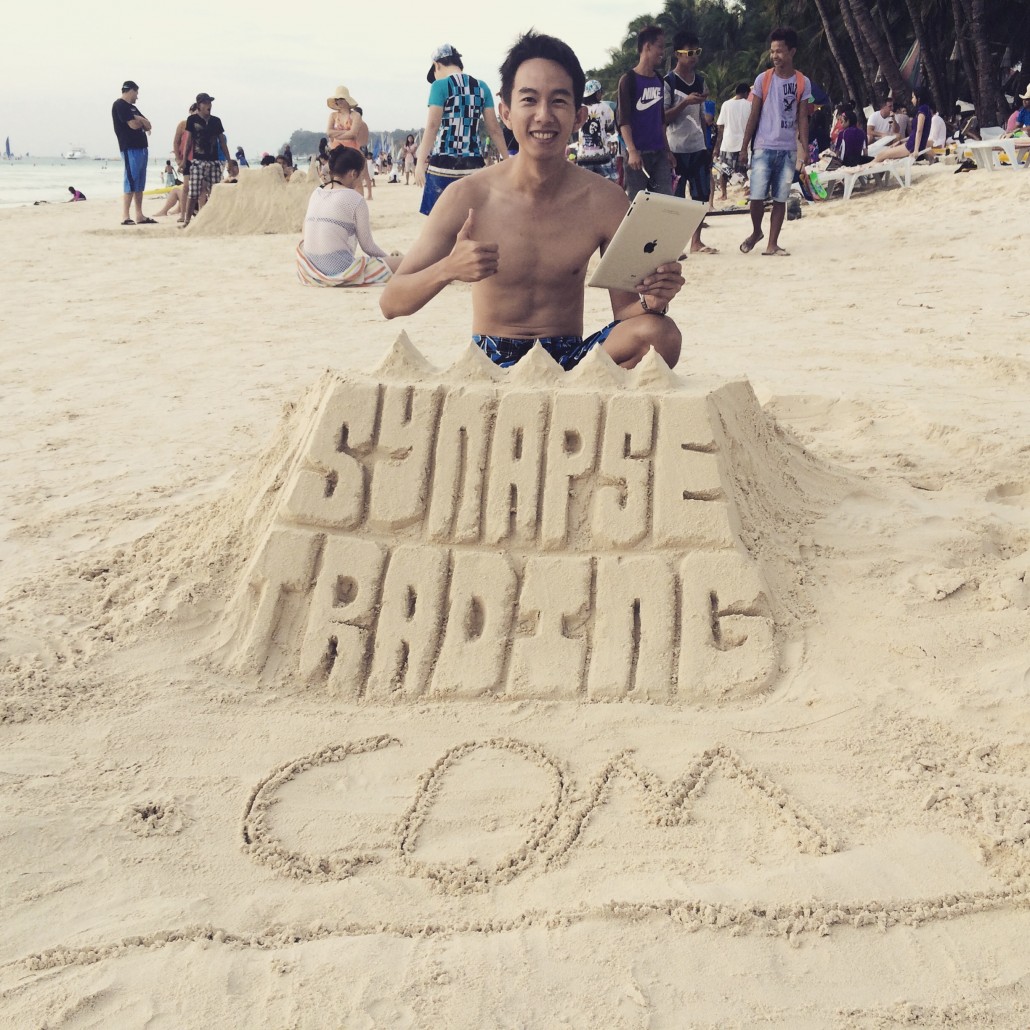

9. Trading at the Beach

Have to trade a bit to cover the cost of the holiday

10. Building Sandcastles with Style 🙂

A few years back, if anyone had told me that travelling the world was just a childhood pipe dream, I would have nodded in agreement. But after learning the truth about passive income, I realised that it was the only way to break free from the rat race and accumulate wealth more quickly that I ever imagined.

Sure, there will be many skeptical people who say that this is too good to be true. I understand that this might be out of their comfort zone, and all I can say is that once you have experienced it, there is no turning back.

Till then, stay tuned for the next holiday destination! 😀

P.S. Once again, to see the full photo albums for this trip, please visit: https://synapsetrading.com/travel-log/

Enjoy! 😀

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.