Straits Times Index: Entering the RED ZONE – where is the bottom?

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

As early as August last year (2015), which was the time I went for my one month tour in USA/Mexico/Cuba, the STI Index entered the dangerous RED ZONE, which signified a change in its long-term trend.

This was one of the major warning signs and red flags which made me liquidate almost all my long positions.

https://synapsetrading.com/im-back-from-one-month-of-travelling-exciting-times-ahead/

At the end of last year, I also prepared a long-term chart to study the 30-year trend of the STI, so as to pin-point a possible buying point near the market low. Since then, the STI has dropped alsmost 1000 points from the peak.

WE ARE CURRENTLY AT A MAJOR SUPPORT LEVEL

Currently, the STI is at hovering near the 25xx level, and the major support level is around 2500-2520.

The STI is consolidating around that level, and it is does manage to break below that, then the next level of support will be around 2200, which will be the buying zone predicted in the long-term 30-year charts in the previous post. That will be a good level to accumulate long positions for the next bullish cycle.

I will be watching patiently from the sidelines.

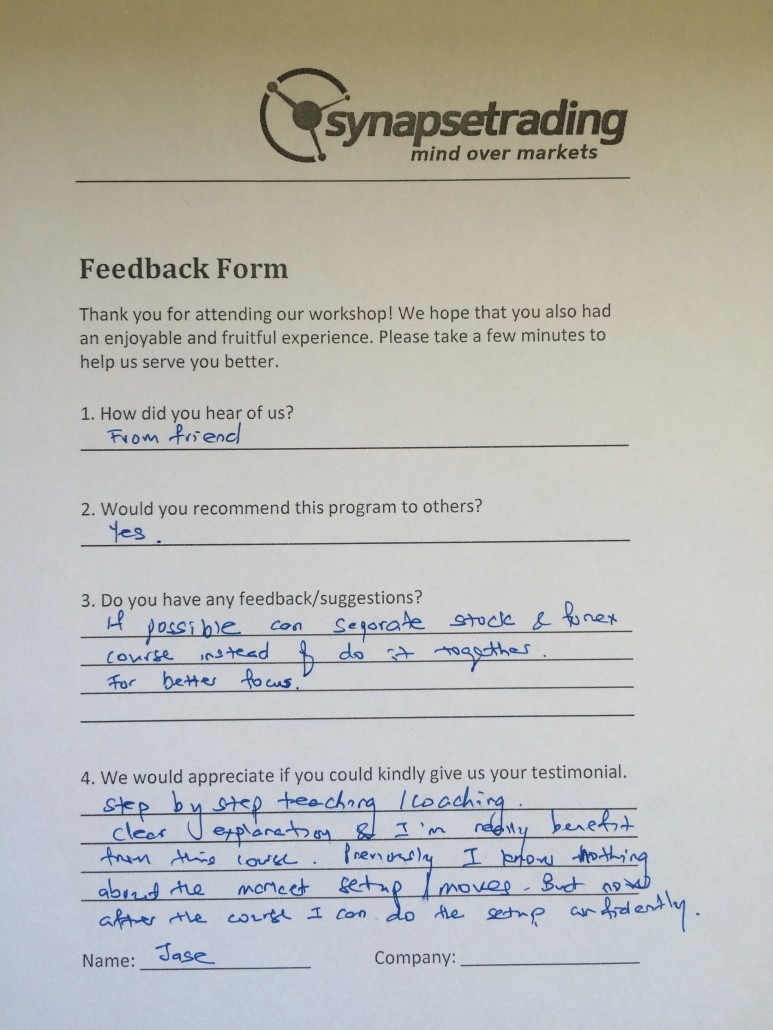

New to Trading? Make your first live trade today in this workshop! Meet Spencer live for 3 hours of hands-on training! No prior experience required! Learn all the basics of trading, and step-by-step guidance to make your first trade!

New to Trading? Make your first live trade today in this workshop! Meet Spencer live for 3 hours of hands-on training! No prior experience required! Learn all the basics of trading, and step-by-step guidance to make your first trade!

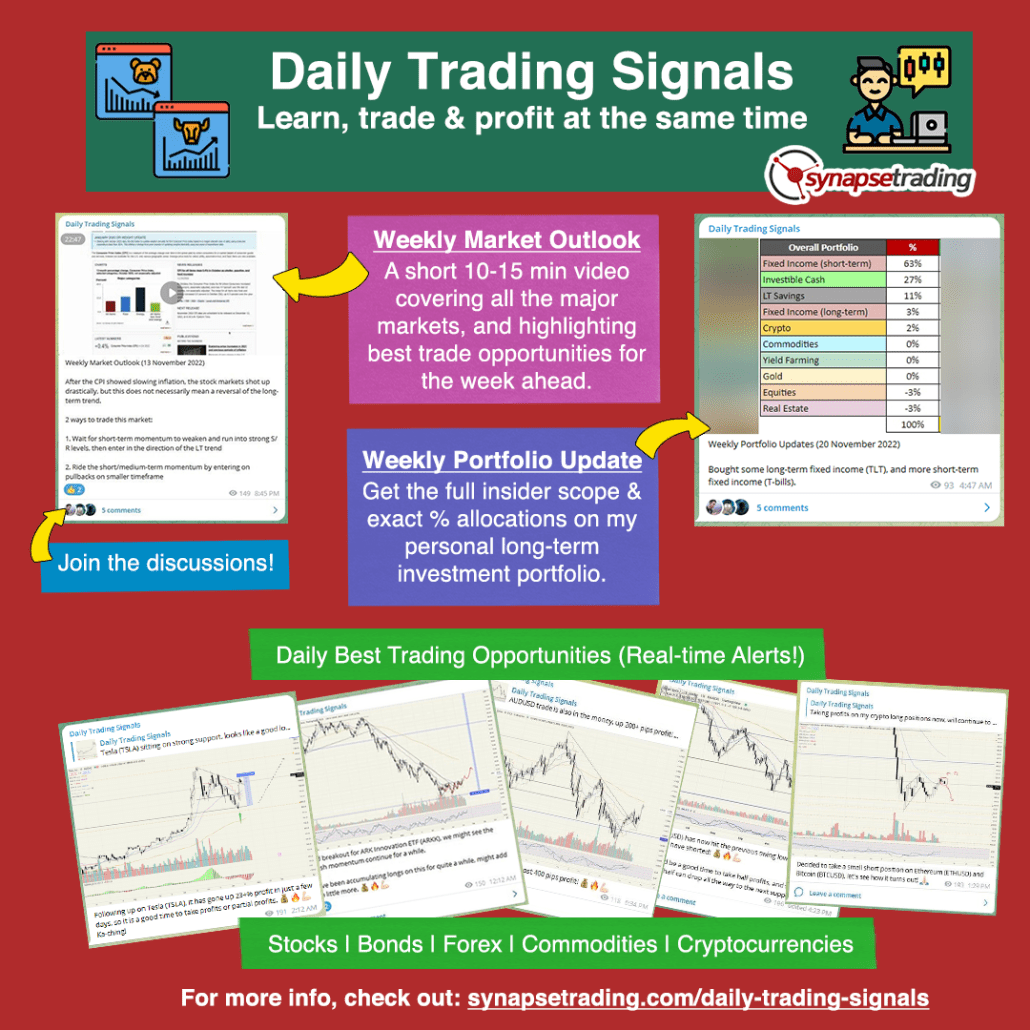

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!