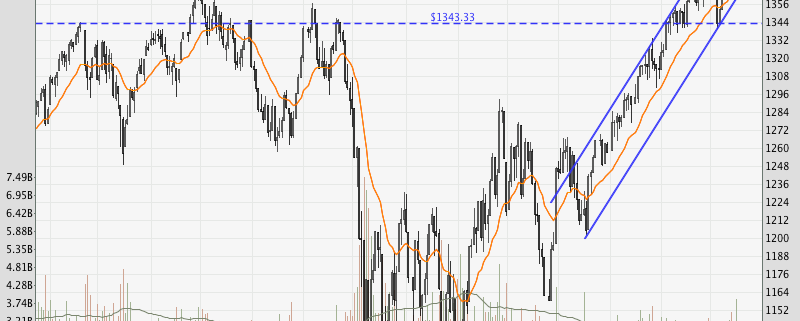

S&P 500 – Bernanke’s Comments Provide Fuel for Stocks

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

Although there was weakness in the STI today at closing, the European and US markets have rallied strongly after comments from Bernanke.

“U.S. stocks advanced, sending the Standard & Poor’s 500 Index to the highest level since May 2008, after Federal Reserve Chairman Ben S. Bernanke said accommodative monetary policy is still needed to spur jobs.” – Bloomberg

Looking at the chart, the S&P 500 has rallied strongly since the beginning of the year, and during the time employment has marginally improved, while the Fed has continued to keep interest rates low. Clearly, it seems the liquidity that is fueling the stock market is not translating into improvements in the real economy. This could prove problematic if the divergence continues to unhealthy levels.

For traders, it means that we should join the party and ride the trend however high it goes, but be ready to pull out when the music stops. For the STI, the last 2 weeks of ranging action makes the market hard to trade, and I am seeing more signs of weakness. Let’s see if today’s boost from the US markets can translate into gains for the STI.

Historically, April is one of the most bullish months of the year, but we will have to keep an eye on earnings, which may be lackluster since there has been no clear signs of economic bullishness.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!