Weekly Market Wrap: Markets Continue to Crash!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

With the market in risk-off mode and making new lows, it is a good thing our current largest positions are in cash and yield-farming, which is why our portfolio is still net positive even though most markets have dropped by 20-80% from the highs.

Recently, a lot of our currency trades have been very profitable, because the market started trending strongly, which makes it easy to ride and profit from these trends (as compared to the stock and crypto market which is more choppy).

At this point, I have quite a sizable short position in stocks, and I will close it only when I think the market has fallen enough. When that happens, I will take my profits and switch to going long. When will that happen? Stay tuned in my “daily trading signals”!

[Photo: Dublin, Ireland – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Forex Market Highlights

All the safe-haven assets are now at the top, showing that the market is in risk-off mode.

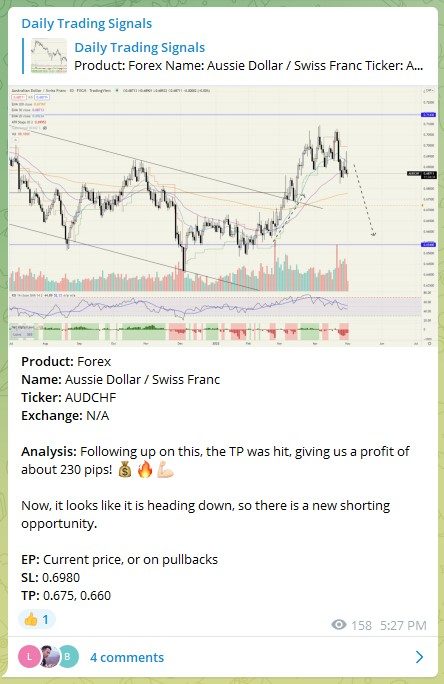

Product: Forex

Name: Aussie Dollar / Swiss Franc

Ticker: AUDCHF

Exchange: N/A

Analysis: Following up on this, the TP was hit, giving us a profit of about 230 pips! ????

Now, it looks like it is heading down, so there is a new shorting opportunity.

EP: Current price, or on pullbacks

SL: 0.6980

TP: 0.675, 0.660

Product: Forex

Name: US Dollar Index

Ticker: DXY

Exchange: N/A

Analysis: The USD continues to spike up, but such a pace of increase is not sustainable, so it should have a pullback soon, maybe when it hits the major resistance near $105.

Product: Forex

Name: Euro vs US Dollar

Ticker: EURUSD

Exchange: N/A

Analysis: Following up on this trade (weekly chart), our first TP has been hit, with 800+ pips profit! ????

Now, let’s see if it can break the support and reach the next TP.

EP: 1.13 to 1.15, or on pullbacks

SL: 1.16

TP: 1.055, 0.920

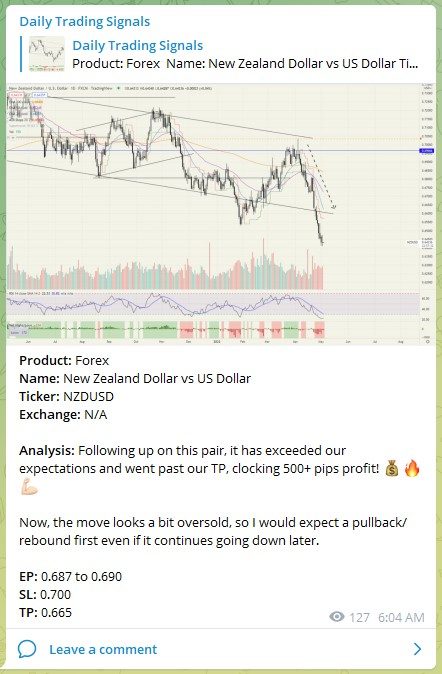

Product: Forex

Name: New Zealand Dollar vs US Dollar

Ticker: NZDUSD

Exchange: N/A

Analysis: Following up on this pair, it has exceeded our expectations and went past our TP, clocking 500+ pips profit! ????

Now, the move looks a bit oversold, so I would expect a pullback/rebound first even if it continues going down later.

EP: 0.687 to 0.690

SL: 0.700

TP: 0.665

Stock & Bond Market Highlights

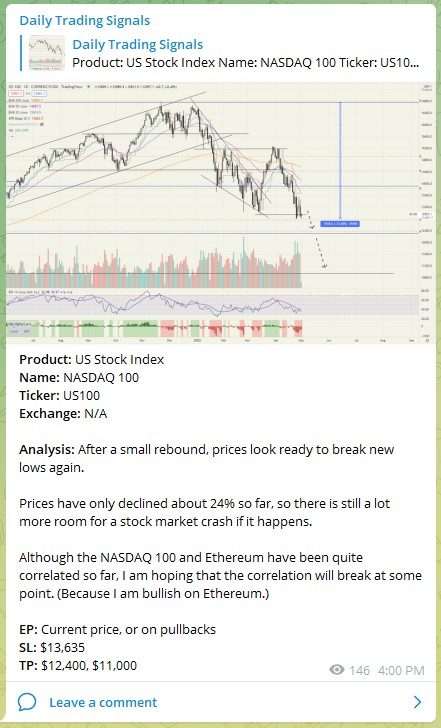

Product: US Stock Index

Name: NASDAQ 100

Ticker: US100

Exchange: N/A

Analysis: After a small rebound, prices look ready to break new lows again.

Prices have only declined about 24% so far, so there is still a lot more room for a stock market crash if it happens.

Although the NASDAQ 100 and Ethereum have been quite correlated so far, I am hoping that the correlation will break at some point. (Because I am bullish on Ethereum.)

EP: Current price, or on pullbacks

SL: $13,635

TP: $12,400, $11,000

Crypto Market Highlights

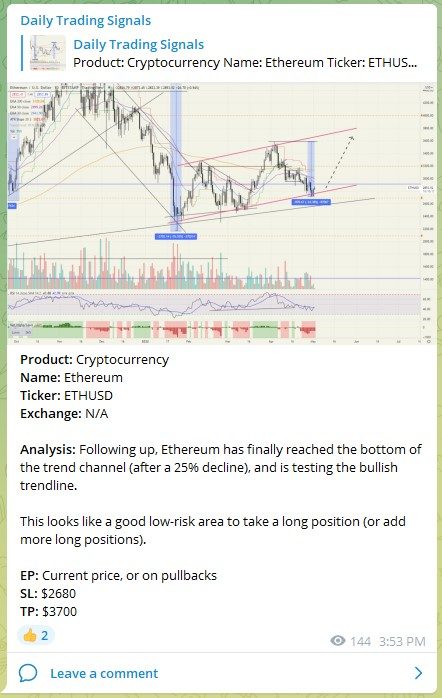

Product: Cryptocurrency

Name: Ethereum

Ticker: ETHUSD

Exchange: N/A

Analysis: Following up, Ethereum has finally reached the bottom of the trend channel (after a 25% decline), and is testing the bullish trendline.

This looks like a good low-risk area to take a long position (or add more long positions).

EP: Current price, or on pullbacks

SL: $2680

TP: $3700

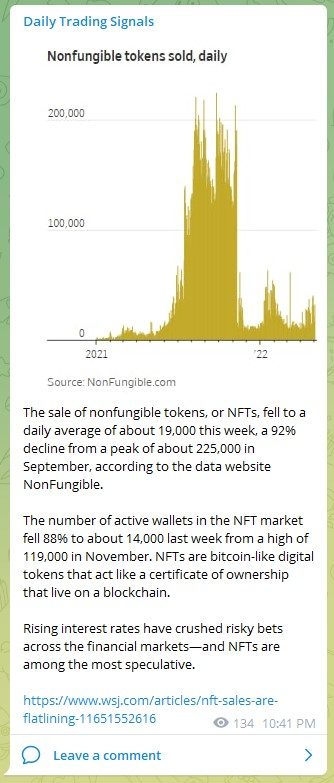

The sale of nonfungible tokens, or NFTs, fell to a daily average of about 19,000 this week, a 92% decline from a peak of about 225,000 in September, according to the data website NonFungible.

The number of active wallets in the NFT market fell 88% to about 14,000 last week from a high of 119,000 in November. NFTs are bitcoin-like digital tokens that act like a certificate of ownership that live on a blockchain.

Rising interest rates have crushed risky bets across the financial markets—and NFTs are among the most speculative.

https://www.wsj.com/articles/nft-sales-are-flatlining-11651552616

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!