Market Outlook for April – historically the strongest month | Technical Analysis | Stock Indices

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

Based on my research, historically April is a strong month, ranked 2nd after December in terms of returns and the probability of closing up by the end of the month. However, after the long run-up, there does not seem to have any positive catalyst left, and may even be overbought, especially after the window dressing during late March. Hence I am expecting a brief pullback/consolidation of sorts.

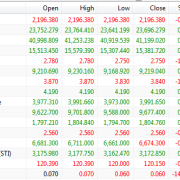

Looking at the chart of the STI, we can see that it has tested and rebounded strongly from the support zone, and is close to breaking above the pivot of the W-bottom. However, due to its long run-up, it is very likely that there will be a pullback after the breakout in the event that one does occur. That will be a more optimal time for a long entry.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Trackbacks & Pingbacks

[…] at the STI, it has certainly started off April strongly (refer to the last post), without even pausing to take a breath from the long run-up. Unfortunately, contrary to what I […]

[…] at the STI, it has certainly started off April strongly (refer to the last post), without even pausing to take a breath from the long run-up. Unfortunately, contrary to what I […]

Leave a Reply

Want to join the discussion?Feel free to contribute!