Kicker Pattern

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

A kicker pattern is a two-bar candlestick formation that signals a potential reversal in the direction of an asset’s price trend.

This pattern is marked by a sharp reversal in price over the span of two candlesticks, making it a significant indicator for traders who seek to understand which group—buyers or sellers—is currently in control of the market.

Table of Contents

Key Characteristics

- Reversal Indicator: The kicker pattern is known for predicting a change in the price direction, usually due to a significant shift in investor sentiment.

- Two Candlesticks: The pattern consists of two candlesticks where the first follows the prevailing trend, and the second sharply reverses direction, gapping away from the first.

- Market Sentiment: The pattern typically follows the release of impactful information about a company, industry, or the broader economy, leading to a sudden change in sentiment.

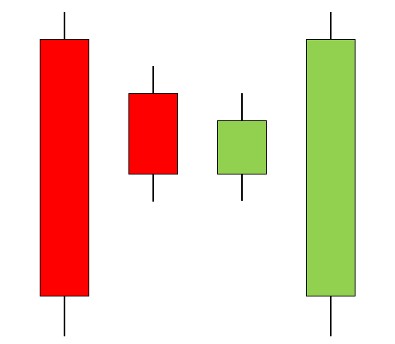

Types of Kicker Patterns

- Bullish Kicker: Begins with a bearish candle, followed by a bullish candle that gaps up, indicating a shift from bearish to bullish sentiment.

- Bearish Kicker: Starts with a bullish candle, followed by a bearish candle that gaps down, signaling a change from bullish to bearish sentiment.

Understanding the Kicker Pattern

The kicker pattern is considered one of the most reliable and powerful reversal signals in technical analysis.

Its significance is often amplified when it occurs in overbought or oversold conditions.

The pattern indicates a dramatic shift in investor sentiment, often triggered by new and valuable information affecting the market.

The pattern’s sharp reversal is not to be confused with a gap pattern, as the kicker pattern implies a complete shift in market control, not just a continuation in the same direction.

How the Kicker Pattern Works

When the kicker pattern forms, it typically catches the attention of traders because it suggests that the price has moved decisively, possibly too quickly.

While some traders may wait for a pullback, the strength of the kicker pattern often leaves them wishing they had acted immediately.

This pattern is rare, but when it appears, it serves as a strong signal that the prevailing market sentiment has dramatically shifted.

Concluding Thoughts

The kicker pattern is one of the most potent reversal indicators available to technical analysts, providing a clear signal of a significant change in market sentiment.

Although it is a rare pattern, its appearance often coincides with dramatic shifts in investor attitudes, making it a critical pattern for traders to recognize.

Given its reliability and the strength of the signal it provides, the kicker pattern should be used in conjunction with other technical indicators to confirm the potential for a trend reversal.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

The Synapse Network is our dedicated global support team, including event managers, research teams, trainers, contributors, as well as the graduates and alumni from all our previous training program intakes.

Leave a Reply

Want to join the discussion?Feel free to contribute!