Noble (N21) – Is it time to short yet? | Technical Analysis | Singapore Stocks

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

Many people have emailed me saying that I have missed this rally because I was too bearish and not flexible, but it really depends on your strategy. My strategy is to take high probability “with trend” trades, and even if I am wrong a few times, catching a strong “with trend” move more than makes up for all the wrong entries. Countertrend moves, on the other hand, is a fun gamble at picking bottoms, and easy to spot on hindsight, but definitely not easy to trade and not worth the risk. That’s my opinion.

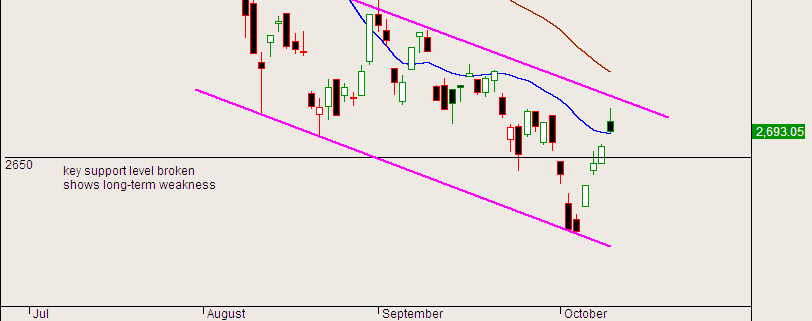

For the past 2 months, there has not been more than 3 white candles in a row on the STI chart. I thought that today might be different given that Dow that surged 330 points up the night before, but the STI gave back some gains near the close, forming a black bar. While I cannot be certain that this marks the end of the rally, I think it is worth the risk to take a small short position if today’s low is taken out tomorrow.

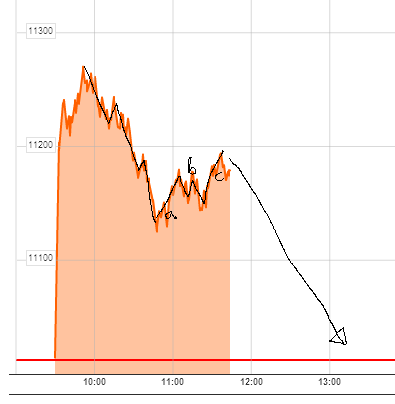

Noble is testing the middle channel line, and there was a bearish bar today on high volume. I would be watching to short if price falls below 1.360. Please read the disclaimer on my website and take note that my strategy is likely different from yours. I will cut my losses fast once I realise I am wrong, but I may not have the time to blog about it until the end of the day. Good luck!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!