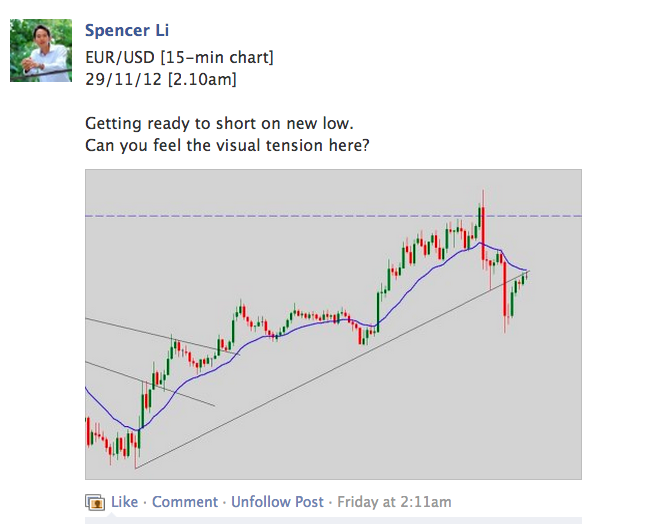

A quick follow-up from yesterday on the short trade I mentioned in my previous post. I shorted after the spike up once I saw weakness in the price behaviour. It was evident to me even without any indicators. Currently, it is 43 ticks in the money with 10 lots, which is roughly SGD 5,000+ in one night.

One good trade a day is more than sufficient for a good trader, the question is whether you have the skills required to find that one good trade a day by reading the charts. What is the point of having a scanner that spits out 10 “good picks” a day when you only have the time and resources to make one or two trades a day?

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.