Here are some simple trades I held during CNY, which is a good example of hands-free position trading. This means that after taking a position, you do not have to keep watching the screen. You go visiting, play tennis, play mahjong, have family meals, etc. The idea is to leverage on time by taking a strategic position using the direction given by charts.

Here, I took a long position on the USD/JPY, as I am expecting it to head to 95 or even 100. At one point, I was up over $2k in profits, but there was some G7 news which caused a spike down, and I only got away with slightly over $900 in profits. Oh wells. I will be looking to buy again at cheaper prices.

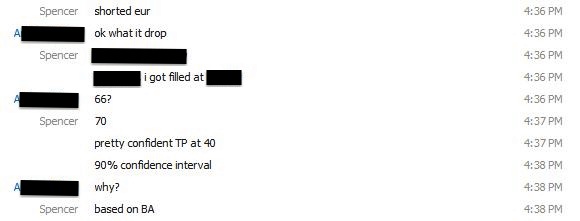

I have taken long positions on the EUR/USD and the GBP/USD, both for different strategic reasons. Do note that I have reduced my position size drastically to accomodate for the increased risk of not watching the screen while having the open position.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.