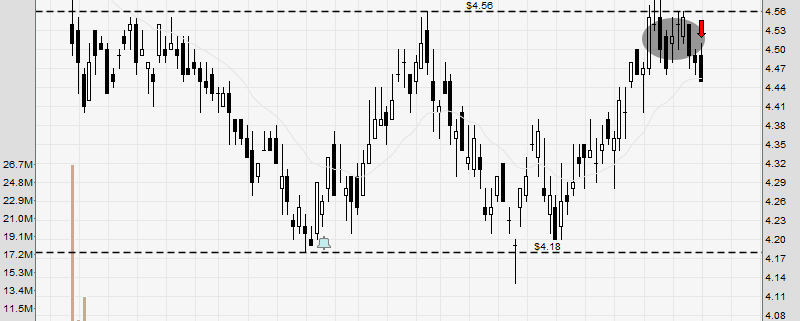

Last week, I did some range trading for this pair, fading the resistance zone near the top of the range. I was in the money not long after, however I got stopped out by a strong price spike later in the day. Much later, the price came back down again, but by that time I was already out of the market.

On hindsight, it might seem stupid having a stoploss, but in reality, it is crucial to long-term trading success. This means that such small losses are a necessary price to pay for long-term profitability. Only those who truly understand the true nature of trading will be able to comprehend the necessity for losses.

Hence, new traders should not be too bothered about taking a loss, as long as you have done your due diligence, and traded according to your plan. Even a good trading system cannot possibly have a 100% hitrate, so losses are surely inevitable.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.