As 2013 comes to a close and a new year commences, it is the best chance to review your hits and misses, and think of how to make this year the best year of your life. Here are some handy tips which I have found especially helpful.

Tip #1 Set aside some alone time to plan your goals

No one succeeds without a plan, so invest some time to plan not just for the year ahead, but also for the next few years ahead. Feel free to share your resolutions with your close friends to enhance your resolve.

Tip #2 Do something nice for your family

Remember that your family is always there to support you, so do treasure them. It doesn’t have to be something grand, for example I brought my family out for a dinner & movie.

Tip #3 Learn a new skill

Instead of spending your free time on facebook or watching TV/videos, invest the time to learn a new skill, by reading more books or attending a course. For myself, I have signed up for some enrichment courses, and I am planning to continue my research on psychology and behavioral analysis.

Tip #4 Do not neglect your health

The 3 key assets a person needs to keep in balance: heath, wealth, time. If you lack any of these, it is unlikely you will be able to enjoy yourself. So this year, make it a resolution to hit the gym or take up a new sport!

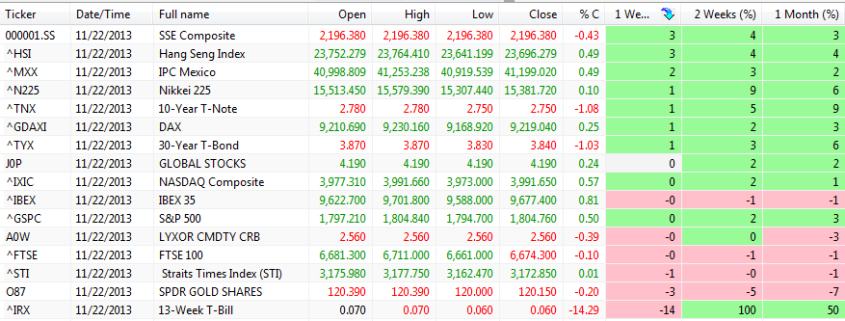

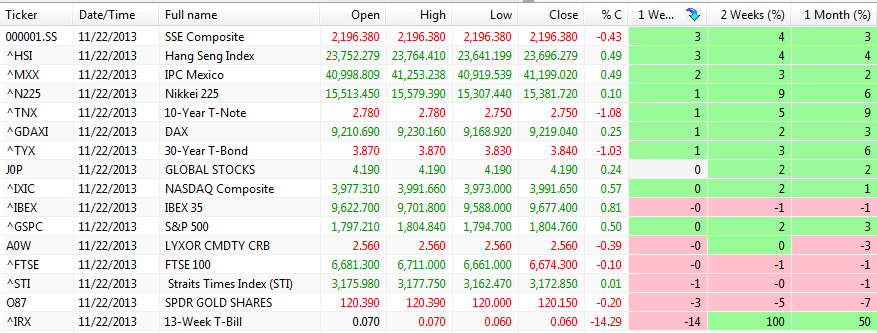

Tip #5 Start building your retirement portfolio NOW!

You might think I’m crazy, building my retirement portfolio at 27, but personally I feel that we should always begin with the end in mind. After all, if you start planning only when you want to retire, it might be too late by then. It is best to start early when time is on your side, and who knows, you might be able to retire earlier than expected! :p

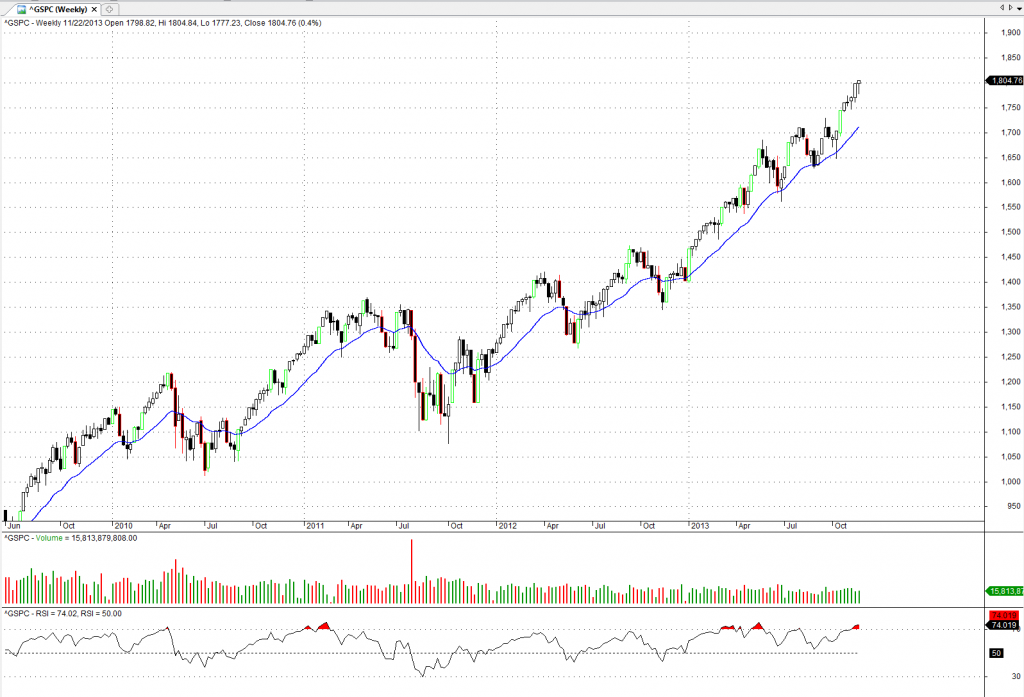

The picture above is my portfolio ending 2013. It should give you some useful insights for building your own portfolio.

May the rest of your life, be the best of your life!

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.