Since the post-2007 crash recovery starting in 2009, how have the markets fared?

Stocks, represented by the S&P 500, have steadily climbed, gaining an impressive 130% over the 6+ years.

Commodities, represented by oil, silver and gold, did not fare so well.

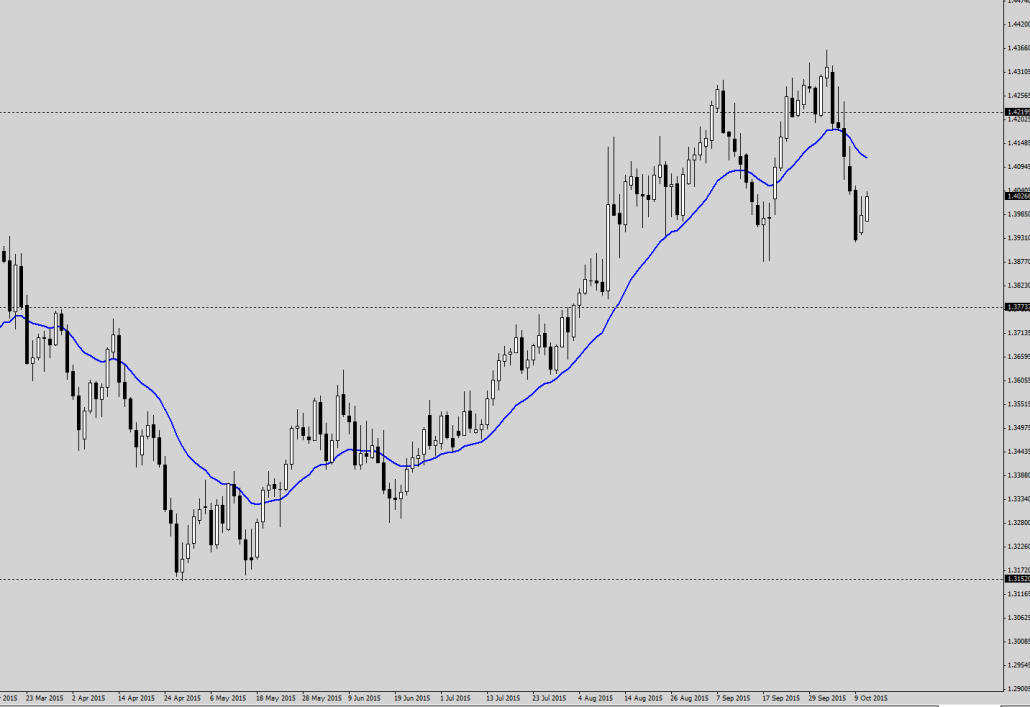

Oil peaked in the first half of 2011, consolidated for about 3 years, then made new lows in 2014.

Silver and Gold peaked in late 2011, then steadily declined all the way till today, giving up almost all its gains since 2009.

As the Fed gets ready to raise the interest rates, this is likely to give a boost to the US dollar, which will further suppress commodity prices. For oil, this is especially bad, since there is already an oversupply forecasted for 2016.

A higher interest rate will also bring down bond prices, ending the 30-year bull trend, and in months to come, act as a drag on stock prices. This means that the stock market is a ticking time bomb.

If all these happens, we will have a scenario with:

- Bullish US dollar

- Bearish oil, gold, silver, commodities

- Bearish bond prices

- Bearish stock prices

- Bearish economy?

That would be a pretty gloomy deflation scenario. 🙁

What is my current portfolio strategy?

Stay tuned for my monthly portfolio update (November 2015) and current portfolio strategy at the end of this month!

Subscribe for our mailing list to receive it in your mailbox! 😀

https://synapsetrading.com/resources/the-7-best-kept-secrets-of-professional-traders/

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.