Recently, Bitcoin prices have crossed $4,800, and year-to-date, its price has surged nearly 400%, making it one of the best investments for the year. And it is not alone.

Other cryptocurrencies, such as Ethereum, have also been making new highs, and many more new products are hitting the market every day.

Which is why many of my friends, followers, and students have been asking me a lot about theses products, and most importantly, “when is a good time to buy?”

When I first started trading, I was mainly doing stocks and CFDs, and I developed my “15 minutes a day” price action strategies for these. And as I expanded to new markets, I was pleasantly surprised to find that the same strategies worked perfectly well. To date, I have used them successfully on forex, futures, options, and most recently, on cryptocurrencies.

This means that for a new product like Bitcoin, which behaves very similarly to IPO stocks or some less popular penny stocks, its behavior can be best understood by studying its underlying price behaviour.

Many people who take one look at its prior meteoric rise will immediately come to the conclusion that is it near its high and too late to buy. But many people probably thought the same way about Apple and Tesla’s stock a few years back.

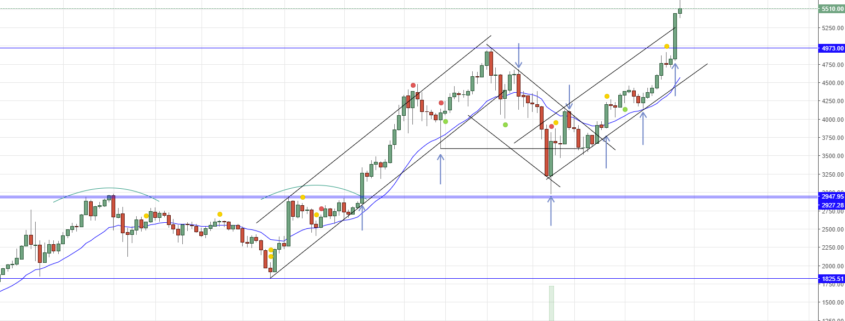

Hands-on analysis and study of Bitcoin chart for precise timing (at my new cafe)

This means that there is potential for cryptocurrencies to go much higher, but how do we time our entry into something that is moving so fast?

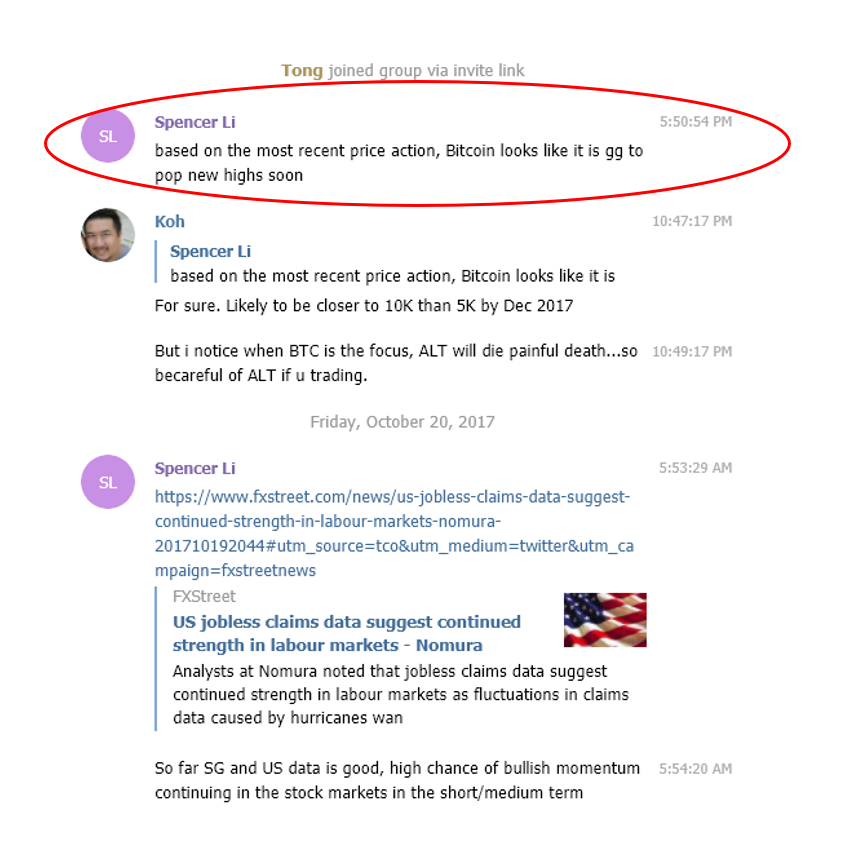

Turns out we do have the perfect strategy for that, which is similar to the strategy we use to enter fast-moving counters in times of a strong trend. In fact, I pointed this out using the chart of Bitcoin during my last few workshops, and also at Invest Fair.

Snippet from the “Synapse Network” private forum (posted 24 August 2017)

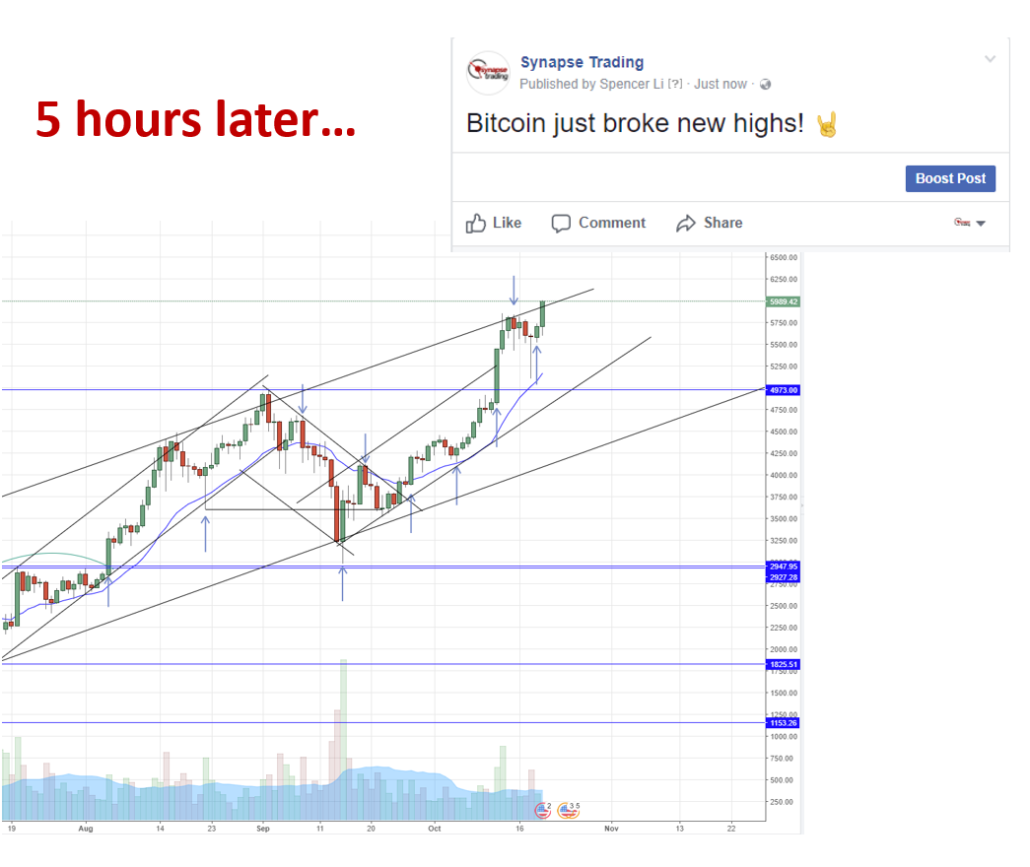

Bitcoin chart today (04 September 2017)

How far can this trend continue to run?

To be honest, no one can really tell, but all I know is that whenever there is a good buying opportunity, I will continue to add more positions to ride this strong trend until it ends. And when it does, I will get ready to short it down as well. 😀

But that is a story for another post.

Till then, trade safe, and aim big. Cheers!

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.