Hi peeps

I hope the market has been treating you well, with bullish stock markets and volatile forex markets. This has provided many good trading opportunities, and I hope you didn’t miss out on them.

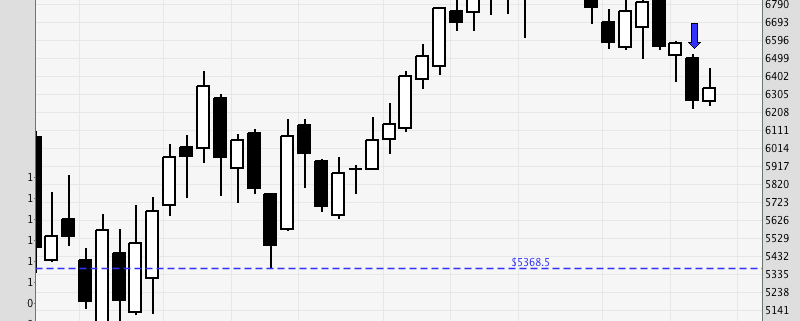

On the 29th of June, I was looking to initiate shorts, and subsequently did, using a range trading strategy to stack my position size. Although I did have several intraday trades on the 5-min charts, my larger view was bearish, hence I also held on to the bulk of my positions.

This is an example of a breakout play, where price breaks support and provides opportunities for trading when it comes back to test the breakout point.

For this EUR/USD chart, price came back twice to test the support-turned-resistance, giving me opportunities to stack my shorts.

If we zoom in on the smaller timeframe, such as the hourly charts, we start seeing more obvious signals like the shooting star reversal bar, and also a nice downward sloping trendline which provided many shorting opportunities.

My minimum target is the test of the previous swing low, which is likely to get hit before the market closes for the weekend, but I have already started scaling out my positions to lock in the profit.

Cheers

Spencer

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.