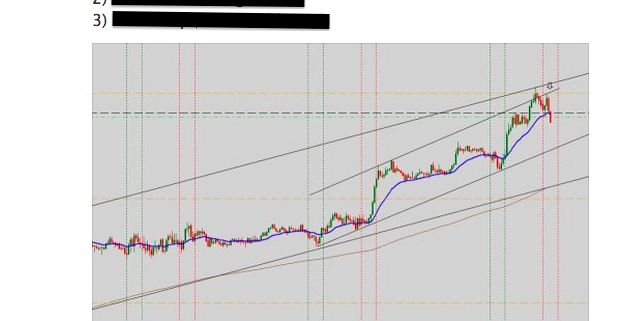

Overall, this was a rather good week, with the EUR and GBP trending strongly upwards in the early part of the week. On Thursday and Friday, I already saw the signs of a major pivotal point, signifying a high chance of prices turning down.

I waited patiently for the market to confirm my opinion before taking my short positions, and my patience was rewarded by the market. I am glad that my opinions were confirmed by the market, and the satisfaction of reaping the rewards of self-discipline is better than the rewards of profits. After trading for so long, the profits no longer excite me as they used to.

Next week, I expect the market to be less lively, and I will be taking a break for Christmas, and to review my trades for the past year. This year has been rather decent, and as long as a trader keeps following the rules and sticks to a winning methodology, the consistency of profits will naturally follow.