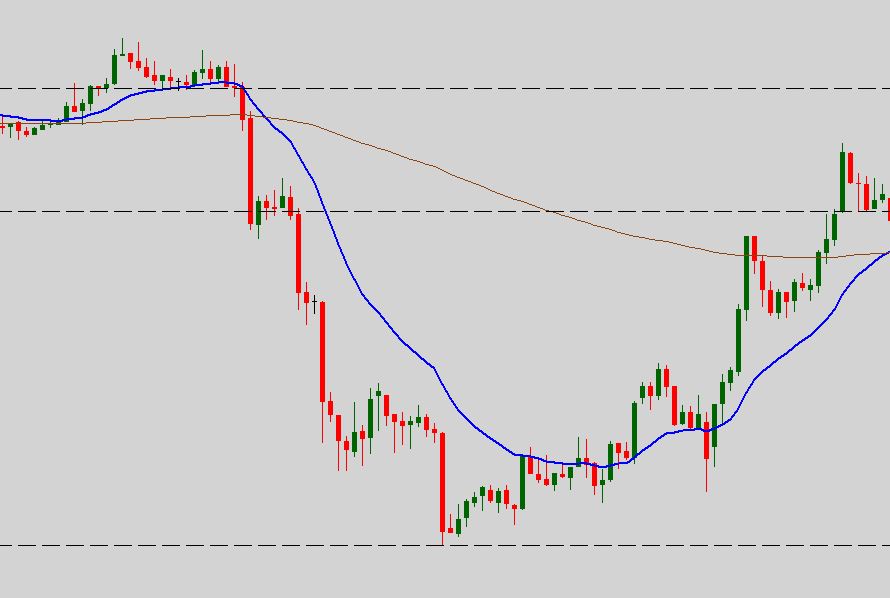

Screenshot taken from the STMP private discussion forum:

The Results after:

Sometimes, all it takes is one good trade to make the day. I spotted this trade in the morning and shared it with our STMP graduates, after which I shorted 15 lots and captured over 100 ticks on this trade.

Come to think of it, it really is getting quite boring nowadays, since what I do all day long is simply look out for the BIG 4 – break, swing, bounce, turn. Everything I need to know is in the price behaviour. No need for valuations, news, or analyst reports. No need to screen through indicators, divergences, scanners, wave counts, cycles, crossovers, etc

Sometimes, people don’t believe me when I show them how simple trading can be. As Leonardo Da Vinci once said, “Simplicity is the ultimate sophistication”, and I totally agree with him. Why complicate things when all you want to do is find easy opportunities and setups to make money?