Today, although the market was relatively quiet (US Holiday), and rather erratic in the night (Draghi talking), there were still great opportunities to make a daily passive income from trading the forex markets. Of course, it requires precise market understanding and timing to capture the moves, but it gets easier the more you practice. For those club member who were asking me about position-sizing, the idea is to start small (I started with about $5,000 myself), and slowly build up your capital base and scale up your size. There is nothing wrong with trading small lot sizes until you have gained the confidence like the senior club members. Until then, you have to be contented with earning just $100-$200 a day, and treat it as a disciplined training to hone your skills to prepare you for the day your account becomes huge and you have to trade larger and larger size.

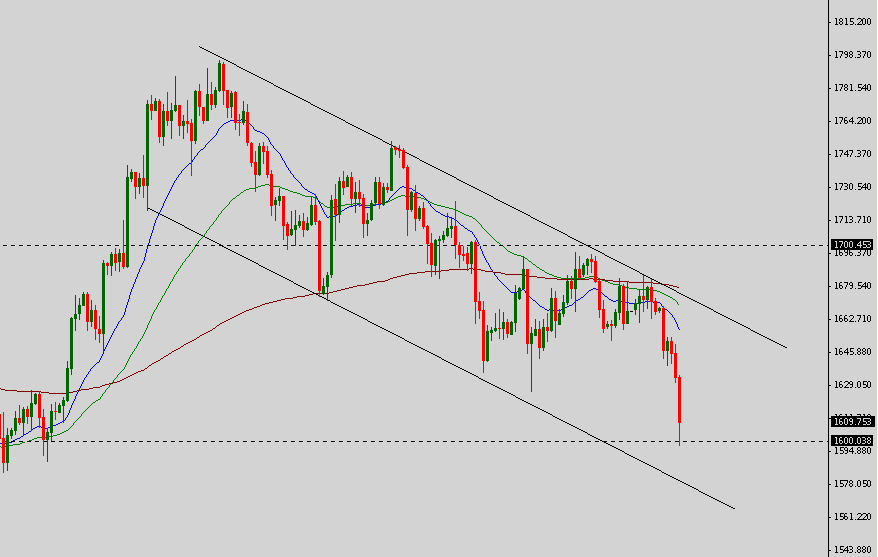

For those Gold traders out there, you will know that a $100 movement on Gold is equal to $10,000 profit per lot. That is why being aware of the large moves is very important if you want to catch the big swings in the market.

Still extremely bullish since I called for a buy during my January market outlook seminars. I have been buying on dips and selling near the start of pullbacks, since this is a rather easy trade to play. Today was a typical day of scalping and swing trading using the simple setups of behavioral analysis, and as you can see from the picture, I have already taken some profits off the table for the weekend. I have heard from some of our senior club members that the target for banks and funds is 95, 100, and perhaps even 120.

Let’s watch and see, and keep up the good work looking for simple setups every day and don’t be greedy, because even if you only make a few hundred on each trade, you will find that it adds up to a substantial amount at the end of the day. The idea is to be consistent, and strive to take money from the markets daily. For example, when I was reviewing my trade log, I realised that I only had one losing day in the past 2 weeks.

This is the weekly chart of the GBP/USD, containing an obvious symmetrical triangle pattern which encapsulates the struggles of the bulls and bears for the past few years. This week, we finally saw a potential breakout. If there is confirmation for this setup, we could be in for a fabulous trade of the year.

Here are some simple trades I held during CNY, which is a good example of hands-free position trading. This means that after taking a position, you do not have to keep watching the screen. You go visiting, play tennis, play mahjong, have family meals, etc. The idea is to leverage on time by taking a strategic position using the direction given by charts.

Here, I took a long position on the USD/JPY, as I am expecting it to head to 95 or even 100. At one point, I was up over $2k in profits, but there was some G7 news which caused a spike down, and I only got away with slightly over $900 in profits. Oh wells. I will be looking to buy again at cheaper prices.

I have taken long positions on the EUR/USD and the GBP/USD, both for different strategic reasons. Do note that I have reduced my position size drastically to accomodate for the increased risk of not watching the screen while having the open position.

Latest Blog Posts

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm

Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

Contact Us

Synapse Trading Pte Ltd

Registration No. 201316168H

FB Messenger: synapsetrading

Telegram: @iamrecneps

Email: info@synapsetrading.com

Disclaimer

Privacy policy

Terms & Conditions

Contact us (main)

Partnerships