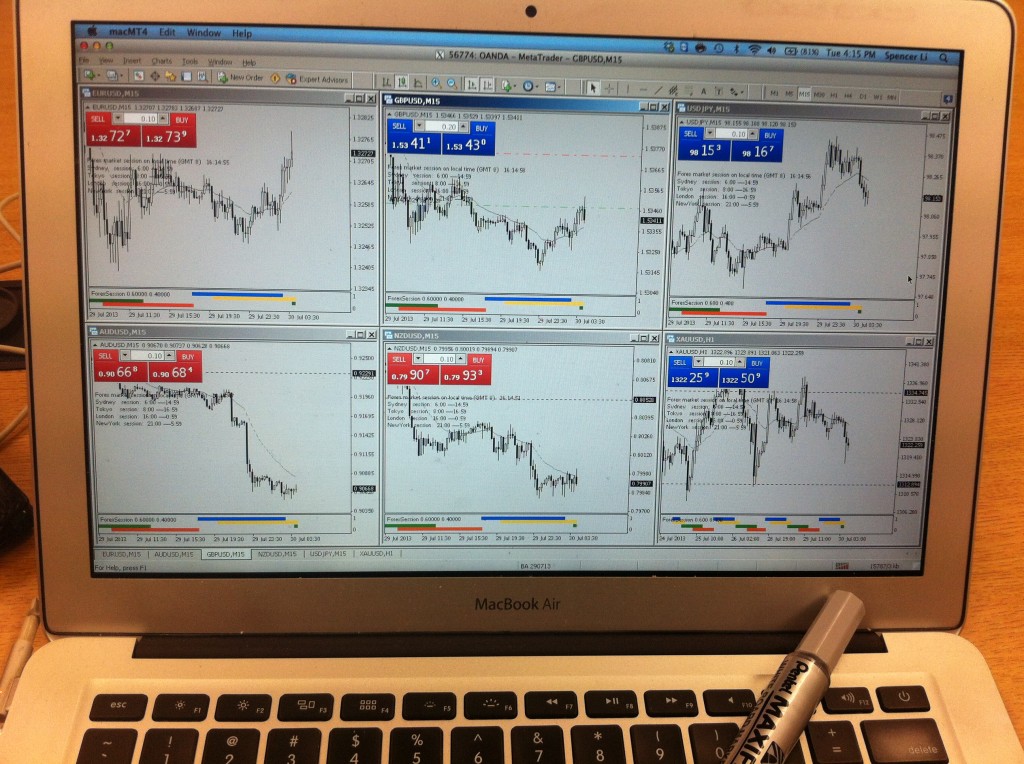

Wow, another exciting day of shorting and raking in profits. As I explained to some new traders today, there are 2 kinds of positions – the intraday trades and the overnight positions. Both require a different mentality and strategy to trade.

Most people get confused by trying to both at the same time, often with dismal results.

Most people who started off trading stocks (many of our students also trade SGX stocks, and so do I) initially tried to use traditional methods like indicators, which you might get away with for long-term stock trades, but for intraday trading, speed and precision is more refined.

After using such precise techniques, you will find the timing of your stock trades dramatically enhanced as well.

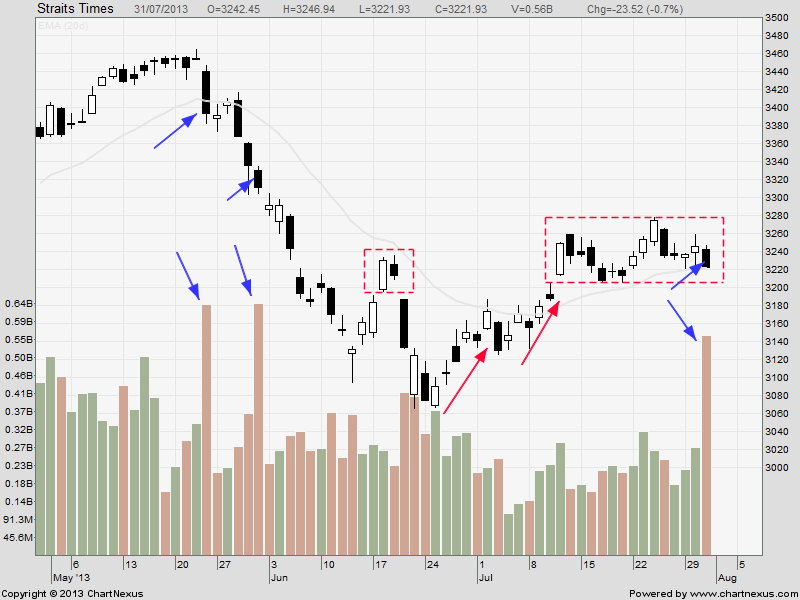

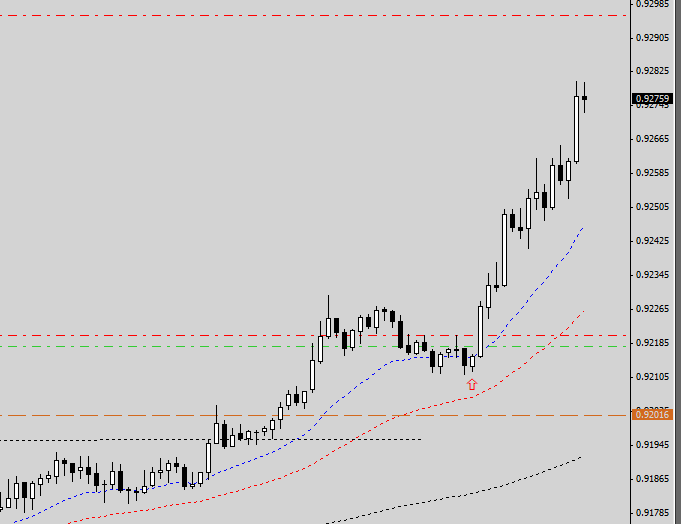

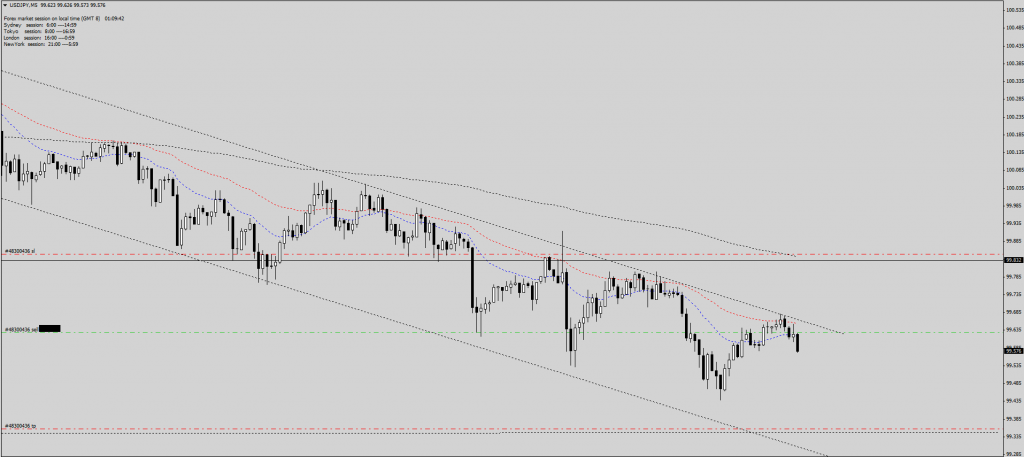

As you can see from the charts below, these timely shorts can easily be spotted on blank charts, and executed quickly without the confusion of numerous conflicting indicators and signals.