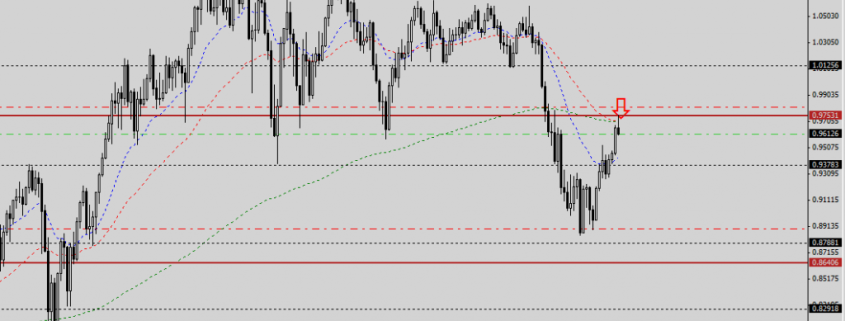

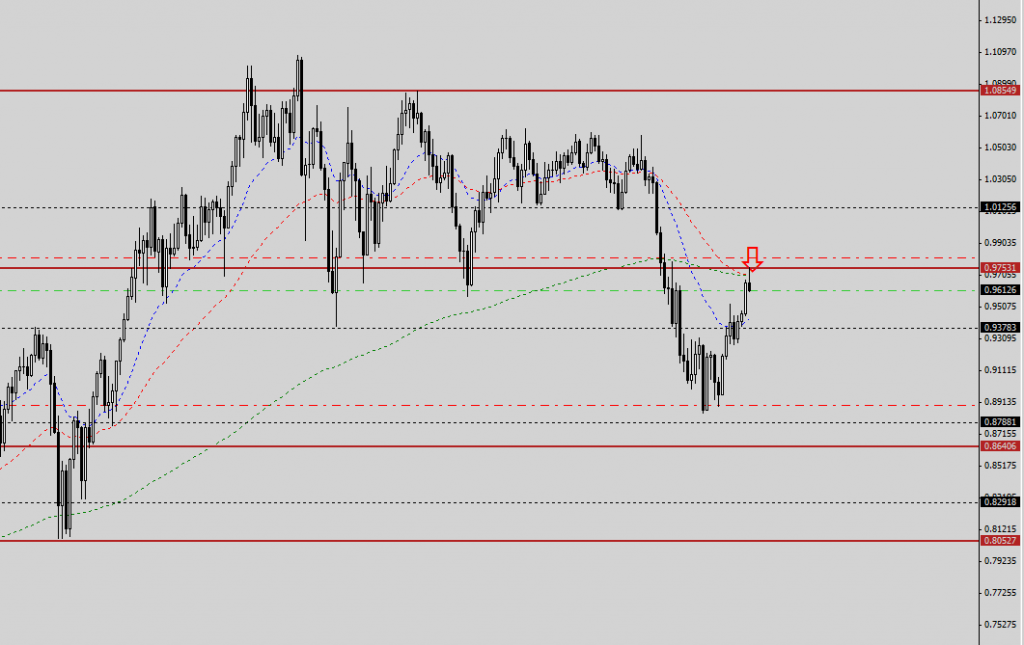

This is the weekly chart of the AUD/USD chart, and price has pulled back nicely to test the key resistance level. This is a crucial pattern on the weekly chart, and I feel that it is a good opportunity for a long-term short, so I have taken my first short position here.

I will continue to watch and monitor for more chances to add on shorts. I will elaborate more this evening during the sharing session. All are welcome to join :]