I have always loved to travel, because I always learn something new while travelling, and globe-trotting is always an adventure to me.

Having previously visited other majestic man-made structures like the Great Wall, the Taj Mahal, the Angkor Wat, the Colosseum and the Kiyomizu temple, this time I was looking forward to see the Borobudur. Along the way, I also got the chance to experience the Indonesian lifestyle for a couple of days.

“Borobudur is a Buddhist stupa and temple complex in Central Java, Indonesia dating from the 8th century, and a UNESCO World Heritage Site. This is one of world’s truly great ancient monuments, the single largest Buddhist structure anywhere on earth, and few who visit fail to be taken by both the scale of place, and the remarkable attention to detail that went into the construction. Set as it is in the heart of the verdant Kedu Plain, the backdrop of mighty active volcanoes only enhances the sense of awe and drama.” – Wikitravel

To see the full photo albums for this trip, please visit: https://synapsetrading.com/travel-log/

Here are some photos from the trip:

Snakeskin fruit season

Snakeskin fruit season

Borobudur symmetry

Borobudur symmetry

Was surprised when some random locals asked us to take a photo with them 😮

Was surprised when some random locals asked us to take a photo with them 😮

There was a volcano eruption nearby during our stay

There was a volcano eruption nearby during our stay

The rare luwak (civet cat) coffee

The rare luwak (civet cat) coffee

Our Reserved VIP seats! :]

Our Reserved VIP seats! :]

Don’t remember what happened here :s

Don’t remember what happened here :s

A glorious finish. Wow!

A glorious finish. Wow!

Some souvenirs for my upcoming Christmas Parties! :]

Some souvenirs for my upcoming Christmas Parties! :]

The best part about this was that I had open positions while travelling, but I did not have to worry or monitor them at all, because that’s basically what hands-free trading is about. I plan to do at least 2 new countries a year, so I guess it’s time to start making more profits and planning for my next trip!

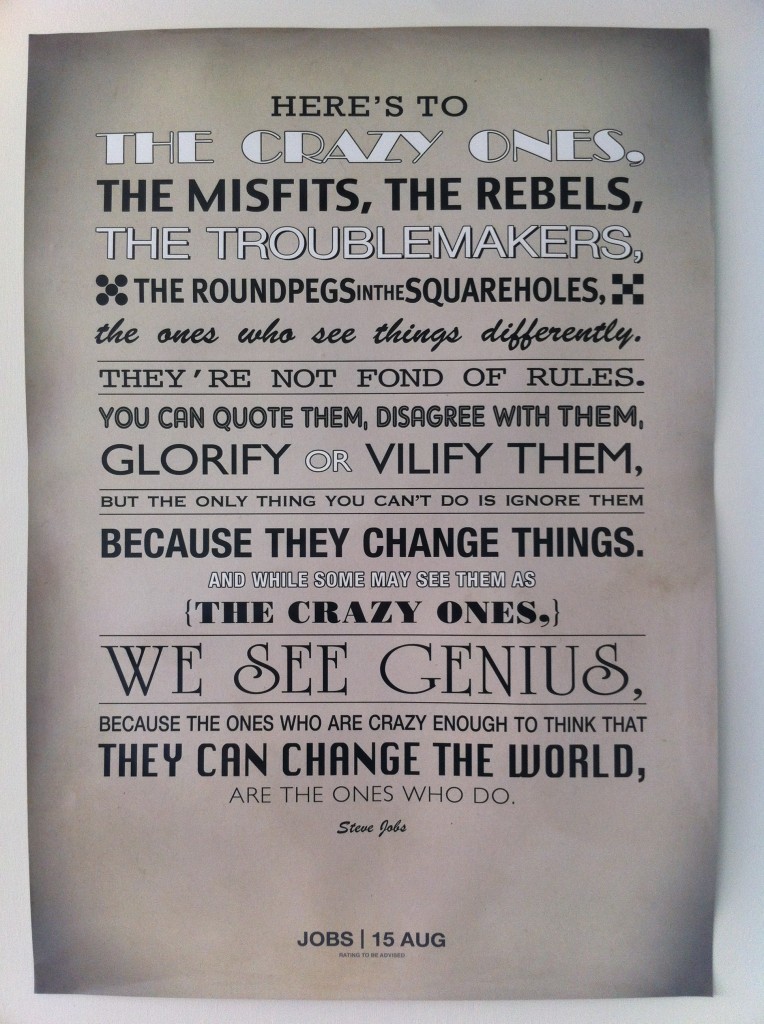

As Steve Jobs said, “Stay young, stay foolish!” Woot!

Once again, to see the full photo albums for this trip, please visit: https://synapsetrading.com/travel-log/

Enjoy! 😀

SGX Sectors

SGX Sectors SGX Penny Stocks

SGX Penny Stocks