Forex Trading | Behavioral Analysis – Spotting the Turning Point

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

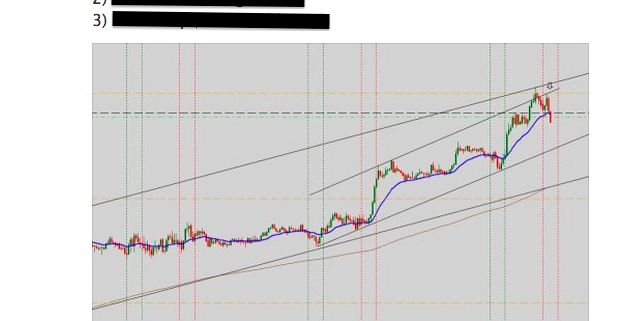

As mentioned in my previous post, I stuck to my trading plan for the day, which was to stick with the trend until I spot the reversal pivotal points. I went long on the EUR/USD in the early part of the day, netting about $3,000. I got out a bit too early, as the price behaviour did not feel right.

I went for dinner and waited for the right moment until I could be certain of the reversal turning point, then I struck without hesitation. I shorted EUR/USD, EUR/JPY and GBP/JPY, making about $4,000 in less than 30 mins.

Since there was no more news for the day, I decided to call it an early night.

Note to Mentoring Program Graduates:

Whether you are trading forex or stocks, the setups are almost the same. I tend to post more forex setups because they occur more frequently on an intraday basis, while stocks tend to move slower. Study the forex chart setups I post in the forum to get a better understanding of how to identify them on the stock charts.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!