Bearish Belt Hold

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

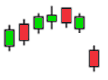

A bearish belt hold is a candlestick pattern that forms during an upward trend.

This pattern occurs when, following a series of bullish trades, a bearish or black candlestick appears.

The opening price, which becomes the high for the day, is higher than the close of the previous day.

The stock price then declines throughout the day, resulting in a long black candlestick with a short lower shadow and no upper shadow.

Table of Contents

Bearish Belt Hold Explained

The bearish belt hold often signals a reversal in investor sentiment from bullish to bearish.

However, this pattern is not considered highly reliable because it occurs frequently and is often incorrect in predicting future share prices.

When using this pattern, it is essential to consider more than just two days of trading to make accurate predictions about trends.

Understanding a Bearish Belt Hold

Bearish belt holds are relatively easy to spot but must be confirmed by looking at periods that extend beyond the day period.

Candlesticks from previous days should be in a clear uptrend to confirm that sentiment has changed.

To enhance the validity of the signal, the bearish belt hold candlestick should be long, and the next session’s candlestick should also be bearish.

Concluding Thoughts

The bearish belt hold pattern can be a useful indicator of a potential reversal in an upward trend, signaling a shift from bullish to bearish sentiment.

However, due to its frequent occurrence and potential for false signals, it is important to confirm this pattern with additional analysis and not rely on it in isolation.

Considering the broader market context and using other technical indicators can help improve the reliability of trading decisions based on this pattern.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

The Synapse Network is our dedicated global support team, including event managers, research teams, trainers, contributors, as well as the graduates and alumni from all our previous training program intakes.

Leave a Reply

Want to join the discussion?Feel free to contribute!