Back from my Holidays – Made a Killing in STI, Oil & AUD/USD! $$$

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

I’m finally back from my holiday! 😀

Before leaving for my holidays last week, I conducted a monthly workshop, where I shared some of the best trading opportunities for the week that I would be away.

Some of them included going long on the STI (Stratits Times Index), going long on Crude Oil, and going long on the AUD/USD.

Table of Contents

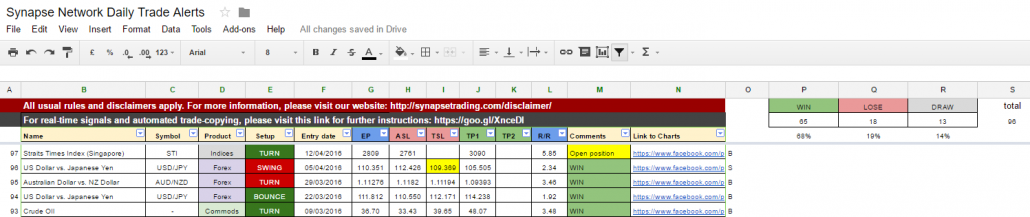

DAILY TRADE ALERTS:

GOING LONG ON THE STRAITS TIMES INDEX (STI)

Amazingly, we managed to go long on the STI at the exact turning point, and almost immediately, the STI rocketed 75 points within the next few days. How did we managed to spot the turning point with such uncanny precision?

GOING LONG ON CRUDE OIL

Crude oil prices soared on hopes of the talks, and applying the “buy on rumour, sell on news” principle, we managed to take our profits near the high before the talks. Eventually, the talks did not turn out well and prices gapped down.

LONG POSITION ON AUD/USD

We are still holding onto this position to ride it for a larger profit. 😀

HOW DID I MANAGE TO DO IT??!??!

If you would like to find out how I manage to make money consistently from the markets with 15 minutes a day using just my mobile phone from anywhere in the world, join me for a free training workshop next week: https://synapsetrading.com/events/training-workshops/

See you there! 😀

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!