Monthly Market Wrap (September 2025)

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Table of Contents

Global Stock Market Trends

U.S. equity markets bucked the usual September weakness, posting strong gains and even notching new records. The S&P 500 surged around 3.5% for the month, the Nasdaq Composite jumped roughly 5.6%, and the small-cap Russell 2000 climbed nearly 3%, making this the best September for stocks since 2010. All three major indices set fresh all-time closing highs mid-month as investors cheered supportive policy news.

The rally, which had previously been led by mega-cap tech, broadened further. Tech and AI-focused stocks still powered higher, but other sectors and smaller caps participated, reflecting improving market breadth. Seven of the S&P’s eleven sectors rose on the month, with technology leading while energy lagged due to falling oil prices.

Overseas, global stocks followed Wall Street’s lead. Major European indices advanced and some even broke records. Notably, London’s FTSE 100 hit a new record high by the end of the month, capping a 7% quarterly gain as defensive sectors like healthcare surged. Germany’s DAX and France’s CAC 40 hovered near multi-year highs, shrugging off a French credit rating downgrade.

In Asia, Japan’s market continued its stellar run. The Nikkei 225 briefly crossed the 44,000 mark for the first time ever before some profit-taking, underscoring how Japanese equities remain at their highest levels in over three decades. On the other hand, Chinese stocks lagged the global rally. China’s economy showed signs of strain, and only cautious stimulus from Beijing left the Shanghai and Shenzhen indexes relatively flat to modestly higher, underperforming Western peers. Overall, September 2025 delivered robust equity gains worldwide, with optimism about policy easing and economic resilience outweighing persistent pockets of risk.

Macroeconomic and Central Bank Developments

In the United States, economic indicators painted a mixed picture of a cooling yet still stable economy. The labor market showed clear signs of slowdown. Private payrolls unexpectedly declined in September for the first time in over two years, with ADP reporting a 32,000 drop in jobs, versus expectations of a gain. This came on top of very anemic job growth in August (which was revised to a slight decline as well). The unemployment rate edged up toward the mid-4% range, reflecting a labor market that, while not collapsing, is losing momentum.

Meanwhile, inflation ticked slightly higher but remained near the Federal Reserve’s target. The August Consumer Price Index came in around 2.9% year-on-year, up from 2.7% in July, due largely to base effects and rising energy costs over the summer. Importantly, underlying price pressures stayed moderate. The Fed’s preferred core PCE inflation measure held around 2.9% annualized, just a touch above 2%. In short, price growth is a far cry from the peaks of recent years, even as it bears watching.

All eyes were on the Federal Reserve, which at its mid-September FOMC meeting finally delivered the widely anticipated interest rate cut. The Fed lowered its benchmark federal funds rate by 25 basis points to a target range of 4.00% to 4.25%, marking the first rate reduction of 2025. This pivot to easing came after the Fed had kept rates unchanged for over half a year. Chair Jerome Powell cited the weakening job market and accumulating evidence of slowing economic activity as justification for injecting some stimulus. Notably, the Fed also updated its forecasts (dot plot), which indicated policymakers expect further rate cuts over the coming year as long as inflation continues to trend toward 2%.

Markets overwhelmingly priced in this policy shift. Futures had assigned nearly a 100% probability of the September cut following Powell’s dovish hints at August’s Jackson Hole symposium. In the aftermath, short-term Treasury yields tumbled, reflecting expectations of additional easing, and financial conditions loosened. By late September, the 2-year Treasury yield had fallen to about 3.6% (down sharply from ~5% earlier in the year), while the 10-year yield hovered around 4.2%. This rapidly steepening yield curve, now its least inverted in over two years, signaled that bond investors see the Fed firmly in easing mode.

Other central banks were also generally tilting dovish or holding steady. The Bank of England, which had enacted a surprise cut in August, kept its policy rate at 4.0% in September as UK inflation continued to recede from double digits toward the mid-single digits. The European Central Bank similarly held rates unchanged after a year of aggressive monetary easing brought Eurozone inflation down near 2%. European policymakers adopted a wait-and-see stance, monitoring risks like energy prices and the U.S. outlook. Over the summer the ECB had signaled the end of its cutting cycle, and September’s data gave little cause to restart cuts immediately. Japan’s ultra-loose policy remained in place. The Bank of Japan did not change its negative interest rate or yield-curve control settings, although there was continued speculation about a possible tweak later in the year if Japan’s inflation (around 3% recently) stays above target.

In China, the central bank (PBOC) took a more cautious approach despite the country’s economic slowdown. Chinese authorities left key interest rates unchanged in September, opting not to follow the Fed’s cut. Officials noted that parts of China’s economy showed resilience, for instance exports had perked up, and there was concern that too much easy money could inflate asset bubbles. Instead, the PBOC used more modest tools: injecting liquidity into the banking system and indicating willingness to cut reserve requirements or trim rates later in the year if necessary.

China’s leadership appears focused on meeting the ~5% GDP growth goal without unleashing excessive stimulus. Nonetheless, economic headwinds persist in China. Consumer spending is sluggish, the property sector is still in a downturn, and even deflationary pressures have appeared (consumer prices were slightly negative year-on-year over the summer). Beijing’s restrained policy in September suggests a preference to save ammunition and deploy targeted support rather than a broad rate slash, at least until conditions worsen or markets falter.

Trade War and Political Developments

Geopolitics and domestic politics provided plenty of market-moving headlines in September. On the international front, there were tentative signs of easing trade tensions, particularly between the U.S. and China. In mid-September, U.S. President Donald Trump and China’s President Xi Jinping held their first direct call in months, reportedly making progress on trade issues. This outreach raised hopes that the two economic superpowers might dial back some of the tit-for-tat tariffs and tech restrictions that have weighed on global growth. The Trump administration had earlier implemented a limited 90-day tariff reduction on select Chinese imports, and by late month officials hinted at the possibility of renewed trade negotiations. While no comprehensive deal is in place, markets viewed the revived dialogue as a positive step that reduces the risk of a new trade war escalation.

Separately, the U.S. also smoothed over trade frictions with key allies. A long-standing issue with Japan saw resolution as tariffs on Japanese auto imports were lowered effective mid-September as part of a prior bilateral agreement. However, not all trade news was sanguine. For example, China launched a probe into U.S. chip export policies earlier in the month, a move seen as retaliation in the ongoing tech and trade spat. Still, investors largely focused on the thawing U.S.-China tone as a bullish development.

A major political shock hit the U.S. at month’s end. The federal government entered a partial shutdown for the first time since 2023. With Congress deadlocked along partisan lines and failing to pass a budget or even a temporary funding bill by the September 30 deadline, large parts of the U.S. government ceased operations starting October 1. This shutdown immediately injected uncertainty into markets. Beyond the direct economic impact of furloughed workers and halted services, it also threatened to delay key economic data releases like the Labor Department’s September jobs report.

Indeed, investors and the Fed suddenly faced the prospect of making decisions in the dark without fresh government statistics, depending instead on private data. Equity markets wobbled a bit on the news of the shutdown, though the impact was relatively contained as traders assumed a short-lived impasse. The political brinksmanship in Washington did, however, dent the U.S. dollar and consumer sentiment slightly. At the time of this writing, the duration of the shutdown remains uncertain, and it has become a new risk factor to monitor as Q4 begins.

In Europe, one notable development was credit rating agency Fitch downgrading France’s sovereign debt rating by one notch (from AA- to A+) in September, citing concerns over France’s fiscal outlook and debt levels. Surprisingly, markets largely shrugged off the downgrade. French bond yields barely moved and the CAC 40 stock index actually jumped to a multi-week high afterward. Analysts suggested that with the European Central Bank still accommodating and France’s situation long known, this downgrade did not materially alter investors’ view. Elsewhere in European politics, no major elections or crises disrupted markets during the month, though ongoing negotiations over EU budgets and energy policy remained background points of contention.

Geopolitical conflicts saw mixed turns. The war in Ukraine ground on with no decisive breakthroughs. However, Russia’s oil infrastructure came under periodic attack (Ukrainian drone strikes on Russian refineries), which kept a modest risk premium in energy markets. In the Middle East, there was a surprising glimmer of potential progress. The U.S. reportedly brokered a tentative Gaza peace proposal that even won the backing of Israel’s Prime Minister Netanyahu.

While the response from other parties remained uncertain, the mere hint of a peace deal in the Israel-Palestinian conflict was enough for oil analysts to speculate about normalizing Middle East trade flows such as through the Suez Canal and easing geopolitical risk. Overall, September saw a slight reduction in global political risk, with trade wars thawing and a potential Middle East peace gesture, even as new uncertainties like the U.S. shutdown emerged. Markets, for the most part, took these events in stride, with the dominant narrative being one of policy support overcoming political noise.

Corporate Earnings and Stock Market Movers

Between earnings reports and corporate news, several notable U.S. companies saw big stock moves in September. Though this was not a core earnings season for most (with the bulk of Q3 results due in October), a few early reporters and off-cycle firms grabbed headlines. In the transportation sector, FedEx delivered an upbeat surprise. The delivery giant announced quarterly profits and revenues that beat analyst estimates, thanks to aggressive cost-cutting and resilient U.S. package volumes. FedEx’s stock popped about 2 to 3% on the news, and its optimistic outlook provided a positive read-through for the broader economy, suggesting consumer demand and supply chains remain healthy.

On the flip side, homebuilder Lennar signaled continued housing sector challenges. It reported weaker earnings and a soft outlook, including forecasting lower home deliveries than expected, sending its shares down over 4%. The U.S. housing market has been cooling under higher mortgage rates, and Lennar’s results underscored that trend, though with the Fed now cutting rates, some hope for relief is on the horizon.

The technology sector, a stalwart of 2025’s market rally, saw major corporate developments that excited investors. Nvidia announced it will take a 5 billion dollar stake in Intel, forging a new partnership with the struggling chipmaker. Nvidia’s move, coming just weeks after the U.S. government itself had taken a large stake in Intel, provides a lifeline to Intel’s turnaround efforts. The deal will see the two companies collaborate on certain chip technologies, particularly for AI and data centers, though Nvidia stopped short of committing to use Intel’s foundry for its own GPUs.

Markets reacted swiftly. Intel’s stock skyrocketed 23% on the announcement, its biggest one-day gain in decades, as investors saw Nvidia’s backing as a vote of confidence. Nvidia’s shares also rose around 3.8%, as the tie-up potentially opens new avenues for growth without compromising its supply chain flexibility. This unprecedented alliance was a highlight of the month, reflecting the massive strategic shifts underway in the semiconductor industry driven by the AI boom.

Other tech names also pushed markets higher. Apple’s stock jumped over 3% in one trading session after a major brokerage raised its price target, citing optimism around Apple’s latest iPhone launch and services growth. Oracle was another winner as its stock climbed after strong cloud sales and AI-focused partnerships boosted earnings. Meanwhile, Palantir Technologies saw its stock surge during the month amid buzz around its AI offerings and some large government contracts. By contrast, energy sector stocks lagged in September as oil prices declined. Integrated oil companies and shale producers saw their shares pull back from recent highs.

In the consumer sector, one standout was Nike. Nike reported fiscal Q1 results and managed a surprise increase in revenue of 1%, defying expectations of a decline. The company also beat earnings estimates comfortably, indicating its turnaround strategy is beginning to bear fruit even as challenges remain. Nike noted it was successfully clearing excess inventory and saw a return to growth in its wholesale segment. However, executives warned that tariffs and weakness in China are still drags. Higher U.S. import tariffs are expected to cost Nike 1.5 billion dollars this year, more than previously anticipated. Nike’s stock jumped about 3 to 4% in after-hours trading on the earnings beat, providing a boost to retail and apparel stocks. The results were a hopeful sign that U.S. consumer spending is not falling off a cliff and that big brands can navigate the choppy demand environment.

Overall, U.S. corporate news in September was dominated by tech sector moves and a few early earnings beats. The Nvidia-Intel deal underscored the seismic shifts in tech and gave a jolt of excitement to the market. The successful FedEx and Nike reports suggested parts of the economy are holding up better than feared, while some companies like Lennar reminded of pockets of softness. The overall tone from corporate America was cautiously optimistic heading into Q4.

Commodities, Bonds, and Other Assets

Commodity markets experienced notable price swings in September, often in opposite direction to risk assets. The standout story was crude oil’s sharp pullback. Oil prices tumbled after a summer rally as traders braced for a potential wave of new supply. By late September, Brent crude had fallen to around 66 to 67 dollars per barrel, and U.S. WTI crude dropped into the low 60s. For the month, oil was down roughly 5 to 6%, a significant reversal. Several factors drove this decline: reports emerged that OPEC+ might accelerate its output increases, effectively ending production cuts earlier than planned.

Saudi Arabia and allies were said to be considering a 500,000 barrel per day supply hike in November. Those rumors sent oil prices skidding. Compounding the pressure, Iraq’s northern oil exports resumed in September after a long halt, adding supply to markets. On the demand side, concerns about weakening global growth and the U.S. government shutdown weighed on the outlook. The result was a bearishly tilting oil market. Energy equities reflected this weakness, underperforming the broader market.

Precious metals soared. Gold prices rocketed to all-time highs in late September, fueled by safe-haven demand, falling real yields, and a softer dollar. The yellow metal broke its previous record and hit 3,895 dollars per ounce at one point. By the end of the month, spot gold was holding around the 3,850 to 3,880 range, up about 10 to 12% in September alone, marking its best month in 16 years. Investors flocked to gold as the Fed’s dovish turn ignited fears of currency debasement and as U.S. political drama injected uncertainty.

A weaker U.S. dollar contributed as well. The dollar index fell roughly 2% over the month, its lowest in several months, which mechanically makes gold cheaper in other currencies. Additionally, the plunge in short-term Treasury yields made non-yielding assets like gold more attractive. Silver also spiked to about 47 dollars per ounce, a level not seen in 14 years. The ferocity of the rally suggested investors are hedging against potential turbulence. With the Fed expected to continue cutting, gold bugs are optimistic the uptrend has more room, with talk of 4,000 dollars per ounce on the horizon.

In bonds, the story was one of rallying prices and falling yields, at least on the short end. The Fed’s policy shift led to a significant drop in short-term rates. The 2-year Treasury yield plunged into the mid-3% range, down from over 5% in the spring. The 10-year yield ended around 4.2%. The very long end rose slightly to 4.7%. This steepening of the yield curve can be interpreted as bond investors pricing in easier Fed policy and a bit more long-term inflation or deficit risk. Notably, the spread between 10-year and 2-year yields turned positive for the first time since 2022. In corporate bonds, credit spreads remained relatively tight. With equity markets at highs, there was little sign of credit stress, except perhaps in high-yield energy bonds if oil continues to weaken.

Currencies reflected these moves. The U.S. dollar finally lost some of its strength as the Fed’s rate advantage shrank. The euro and yen both gained modestly versus the dollar. The yen’s move was noteworthy as it rallied back into the mid-140s from multi-decade lows earlier, amid speculation the Bank of Japan might tweak policy and as U.S. yields fell. Emerging market currencies broadly benefited from the weaker dollar. The Chinese yuan stabilized around 7.1 per USD after the PBOC took steps to support it.

Industrial metals were mixed, with copper roughly flat on the month. Agricultural commodities had no singular trend. Some crop prices fell on improved harvests, while others like sugar spiked to multi-year highs due to weather-related output hits.

Overall, September saw a rotation in the multi-asset landscape. What was good for stocks proved bad for oil but great for gold. Bonds embraced the Fed’s turn, and the dollar slipped. This reflects a market positioning for the next phase of the cycle, one where growth is slowing but monetary support is rising.

Cryptocurrency Highlights

Cryptocurrencies extended their upward momentum in September, with the focus squarely on Bitcoin and Ethereum. Bitcoin had a historic month, surging to roughly 110,000 to 115,000 dollars at its peak, establishing a new all-time high well above its previous 2021 record. It finished the month around 112,000. Ethereum also rallied, though more modestly, ending the month above 4,100 dollars per coin, its highest level in over a year. Bitcoin’s dominance in the crypto market increased as its rise outpaced many altcoins, suggesting investors were concentrating on the most established digital assets.

Several factors drove the bullish sentiment in crypto. The general risk-on environment, with stocks at highs and the Fed easing, spilled over into speculative assets like crypto. Bitcoin is often seen trading like a high-beta risk asset, so lower interest rates and abundant liquidity boost its appeal. Growing optimism about regulatory approval of Bitcoin investment vehicles gave a tangible catalyst. The U.S. Securities and Exchange Commission is reviewing applications for spot Bitcoin ETFs, and the market increasingly expects a favorable outcome. By late September, analysts put very high odds on multiple spot crypto ETFs being approved in the coming weeks.

The SEC also adopted new standards to streamline ETF approvals, meaning many products could launch without case-by-case greenlights. This regulatory progress opens the door for mainstream investors and institutions to gain exposure to crypto through traditional brokerage accounts. Traders bid up Bitcoin and Ethereum in anticipation of fresh inflows once these ETFs go live. Some analysts even suggested Solana and XRP ETFs could debut as soon as October.

Beyond the ETF narrative, network fundamentals remained strong. Bitcoin’s hash rate and active addresses hovered at record levels. Ethereum’s Shanghai upgrade, completed earlier in 2025, improved staking and liquidity. Ethereum continues to anchor DeFi and NFTs, which saw renewed activity amid the broader crypto rally. Volatility persisted, with Bitcoin briefly pulling back below 110,000 mid-month on profit-taking. But dips were quickly bought by investors demonstrating fear of missing out.

Institutional adoption also advanced. More traditional financial firms explored crypto offerings, and some major tech companies hinted at integrating blockchain services. Macro investors also viewed Bitcoin as a potential hedge, much like gold, given fiat currency uncertainty. With both gold and Bitcoin hitting records in the same month, the debate over Bitcoin as digital gold intensified.

In summary, crypto markets were exuberant in September 2025. Bitcoin’s climb past 110,000 and Ethereum’s solid advance reflected both macro tailwinds and crypto-specific breakthroughs. As Q4 begins, crypto traders are keenly awaiting the SEC’s final ETF decisions and any further central bank easing, both of which could further propel this strong uptrend.

Concluding Thoughts

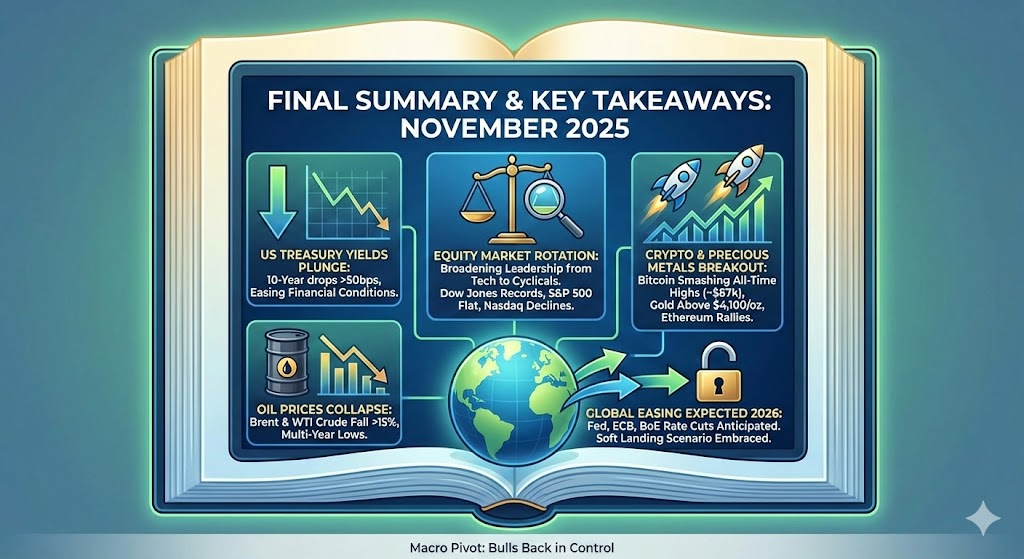

September 2025 capped an exceptional third quarter for financial markets. Equities rallied broadly to record or near-record levels, supported by cooling inflation and the long-awaited pivot by central banks toward easing. The U.S. Federal Reserve’s first rate cut, in particular, marked a key inflection point. Policymakers are now prioritizing growth risks after a long battle with inflation. This policy U-turn provided a green light for risk assets, even as it came in response to signs of economic fatigue. Markets are celebrating the prospect of Goldilocks: inflation is back near target, interest rates are set to fall, and while growth is slowing, it is not collapsing.

That said, investors are not without challenges heading into the final quarter of the year. The U.S. government shutdown introduces uncertainty and could dent confidence if it drags on. Global growth remains a question mark, with China’s recovery fragile and Europe facing fiscal headwinds. U.S. consumer strength will be tested in the holiday season. Corporate earnings in Q4 will be crucial to justify valuations. Additionally, geopolitical wildcards linger, though September showed some risks can surprise to the upside.

For now, the dominant market theme is cautious optimism. Bonds are signaling easier days ahead, commodities are not flashing inflation alarms, and equities are buoyed by the Fed’s readiness to support growth. The balance of data suggests the soft landing scenario remains possible. Risk assets could continue to perform well if this holds, though vigilance is needed if inflation resurges or growth falters.

In summary, September’s wrap reveals a financial world in transition. From tight policy to accommodative policy, from fear of inflation to concerns about growth, and from narrow leadership to broader participation. Investors have reason to be encouraged by the trends, but the final quarter will determine if 2025 truly ends as a standout year across asset classes.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!