Weekly Market Wrap: All Eyes on CPI & FOMC Next Week!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week, we anticipated that there would not be much action in the markets since the big news (CPI, FOMC) would only be happening this week.

That turned out to be true.

We also indicated that the best trading opportunities for last week were: Gold, Bonds (TLT), and possible USD rebound.

That turned out to be true as well, allowing us to make some quick profits.

We also found some excellent forex trades along the way, to add to the profit pile.

This week, we are expecting more exciting opportunities, and possibly a clearer trend direction, which will allow us to take larger trading positions for the medium/long-term.

Come join us in the “Daily Trading Signals” private Telegram channel for real-time signals and trading opportunities!

[Photo: Samarkand, Uzbekistan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (04 December 2022)

Not much news this week, with all the big news next week.

Fed has signalled a slowing of rate hikes, which has been priced in last week,

But can markets really turn bullish while rates are still increasing (and kept at such high levels) for one more year?

Best trades this week are: Gold, Bonds (TLT), and possible USD rebound.

Additional point regarding divergence of US stock indices: for a bullish trend reversal to work, all 3 indices need to turn bullish, not just 1 or 2.

Portfolio Highlights

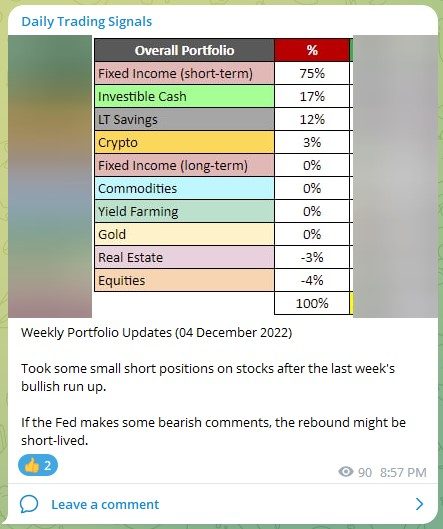

Weekly Portfolio Updates (04 December 2022)

Took some small short positions on stocks after the last week’s bullish run up.

If the Fed makes some bearish comments, the rebound might be short-lived.

Forex & Commodities Market Highlights

Currency strength comparison

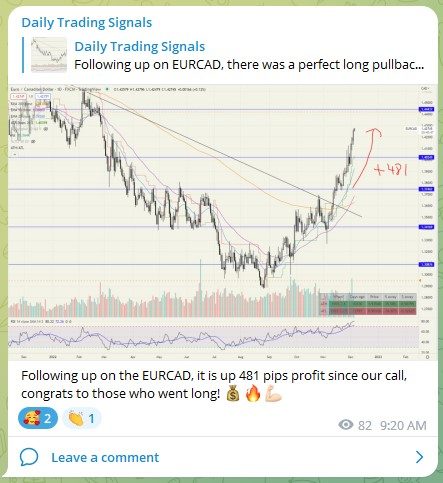

Following up on the EURCAD, it is up 481 pips profit since our call, congrats to those who went long! ????

Following up on the short trade on USDJPY, it has hit the profit target at the support level! ????

The RSI is now in the oversold region, so it is likely to have some rebound.

Looks like a giant rising wedge breakdown for AUDJPY, and if prices stay below the 200-EMA, it is an additional sign of bearishness.

Good chance that it will continue falling to the next support level.

Confluence of support for CHFJPY, at the previous resistance-turned-support level, and the channel line of the trend channel.

Major trend is still bullish, so this is a potential larger pullback again the major trend.

Following up on Gold (XAUUSD), it has rebounded off the support zone as predicted, and is now hovering slightly above all 3 EMAs.

If it can hold above that, and form a small consolidation zone, prices have a good chance of heading higher.

Stock & Bond Market Highlights

Following up on the 20-yr Bond ETF (TLT), the price recently crossed above the 20 & 50 EMAs.

If prices can stay above those 2 EMAs, and build a small base, it has a good chance of breaking higher.

We need to wait for a consolidation or pullback before entering because prices are now a bit overbought (refer to RSI).

The Dow is beating the broader market to a degree not seen in nearly a century.

With the Fed set to keep raising rates into next year, investors and strategists say the Dow could continue to lead the market.

https://www.wsj.com/articles/dow-shines-as-higher-rates-squeeze-nasdaqs-tech-stocks-11670099206

This is the final monthly employment report before the Fed’s two-day meeting on Dec. 13 and 14, in which the central bank is expected to raise its fed funds target rate by a half percentage point. A 50 basis point increase would mark a slowing from the prior 75 basis point rate hikes set by the central bank.

https://www.cnbc.com/2022/12/01/stock-market-futures-open-to-close-news.html

https://www.wsj.com/articles/must-inflation-be-brought-down-all-the-way-to-2-11670162817

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!