Price Action Trading | Gold – Long-term View

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

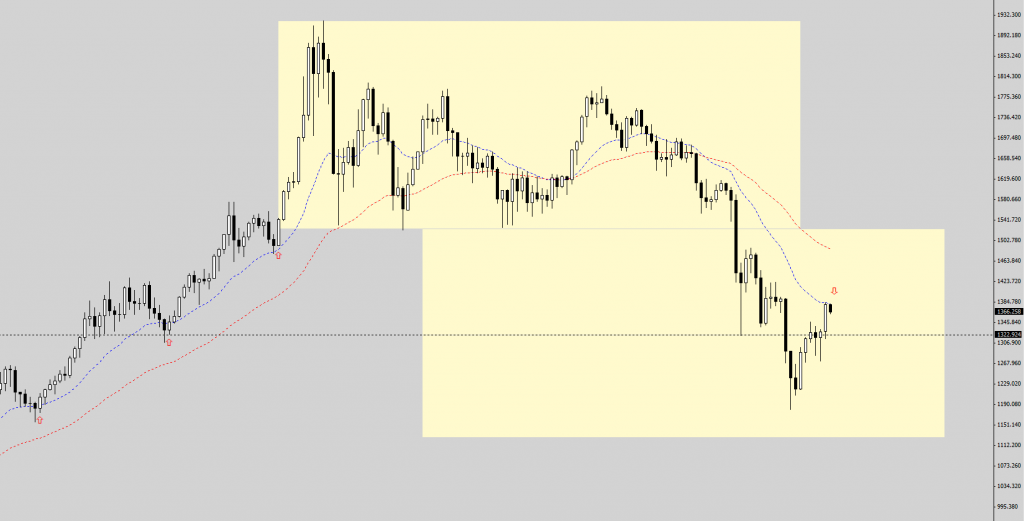

The first chart we see with the huge complex descending triangle at the top is the weekly chart of Gold, which we were calling for shorts a couple of months ago.

https://synapsetrading.com/gold-our-big-short-trade-of-the-year/

From there, Gold plunged more than $400 (ahh… the ol’ good days of easy money shorting Gold), and subsequently staged a strong rebound of about $200. Based on the price action, we have enough clues to know that the big players will be looking for an opportunity to resume their selling, which could begin anytime they feel that prices have retraced sufficiently.

Now we zoom in to the daily chart, and we noticed that Gold still looks pretty bullish, judging by the lack of any selling pressure… yet. I will be monitoring this closely so that I can find the perfect time to short Gold again. When the time is ripe, I will share with my students. Don’t forget to shore up your capital to get ready for this big short!

For my event on Thursday, I noticed that out of the 70 sign-ups, a few were duplicates, and there might be some last minute cancellations, so after tidying up, there are 2-3 new slots open for grabs. First come first serve. https://www.eventbrite.sg/event/7760228051?ref=ecal

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!