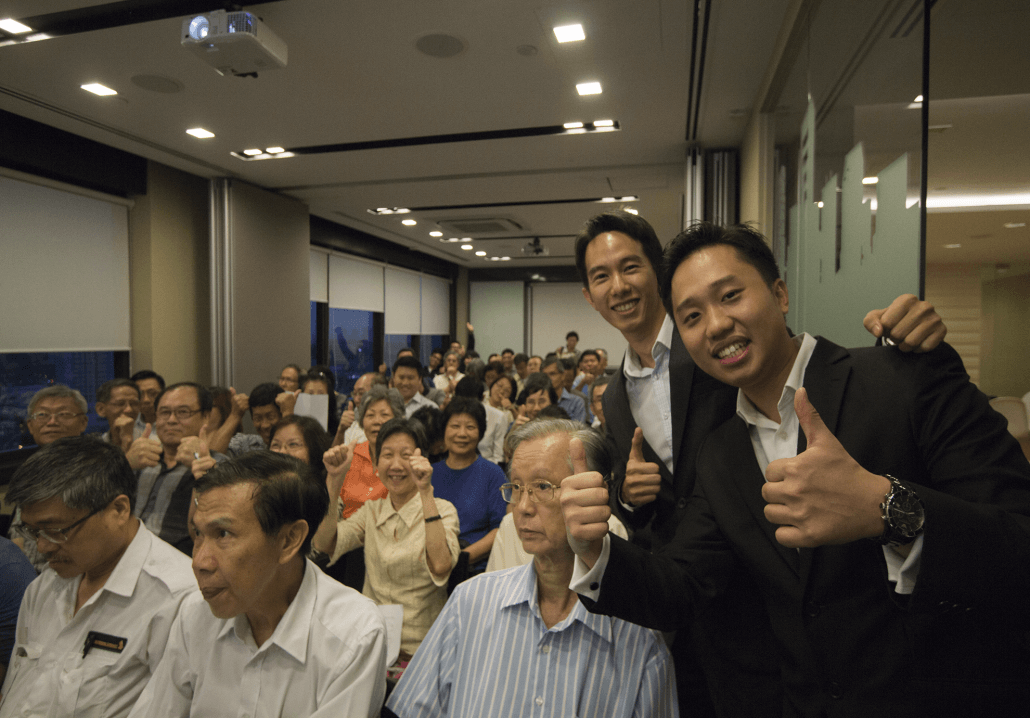

Last week, I paired up with my friend Rieve to conduct our very first sharing session in Chinese, and it was a great full-house event!

Following our LIVE! radio feature, there was an over-whelming registration for this session, with over 130 people messaging and calling in to register without a few hours.

Due to the limited number of seats, we could only allow the first 80 to register, but we will be having another session next week on 29 May 2015, to cater for those who missed it the first round.

If you are keen to attend this sharing session in Chinese, or want to attend The Synapse Program in Chinese (6 & 7 June 2015), please drop us an email at info@synapsetrading.com.

Thanks, and see you there! 😀

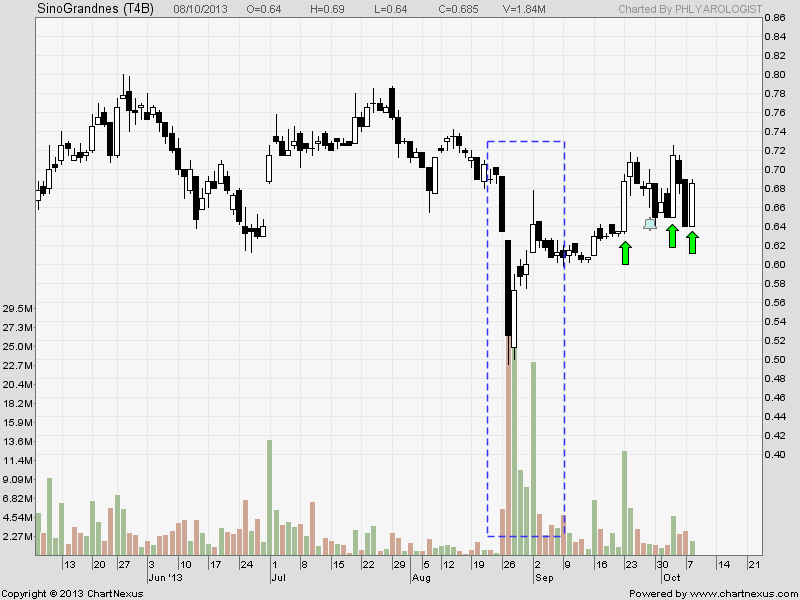

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.