For those who braved the haze last Wednesday to attend my sharing session, I believe it was very rewarding because I revealed some of my secret techniques of reading price behavior, and also did a comprehensive outlook and made several market predictions. Here are some snippets of the presentation slides:

Called for a long on USD/JPY, and it is up over 250 pips since we initiated our long positions.

Called to short Gold with a TP of 1135, and Gold has dropped over 70 dollars since we initiated our short positions. Still has a long way to go.

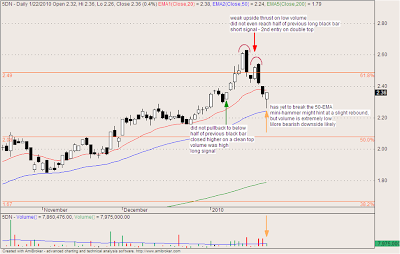

Called to initiate shorts near the turning zone (circled in red), and within the next 2 bars, price turned within that zone and yesterday the STI staged a dramatic drop of over 80 points. To all non-believers, these predictions were made in advance of the price movements, and in full view of the whole audience.

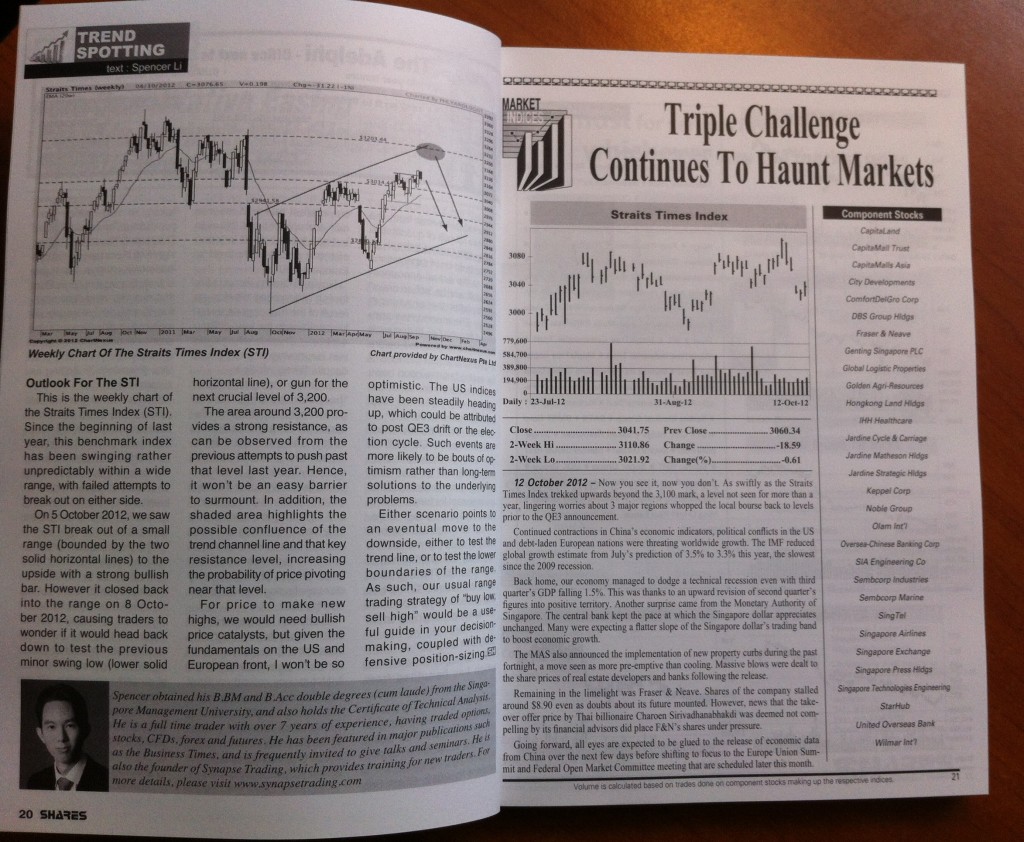

This weekend will be another full-house run of the Synapse Program, and for those who signed up, I am pretty certain this weekend will be a major turning point in your trading career, and an unforgettable eye-opening experience, as it was for all those who attended in previous batches. Below are some screenshots of the comprehensive course manual.

As of today, the June intake is officially closed, and the next intake will be 3 months later, but you can reserve your seats now for the September intake, which is at last count already half-full.

https://synapsetrading.com/the-synapse-program/

P.S. On an unrelated note, the STI index and PSI index looks like they are converging to the same value. Not sure which is more deadly.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.