Will there be easing for the SGD, and is it a good chance to go long on USD/SGD?

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

This week, the central bank is predicted to ease monetary policy for Singapore, considering we have officially slipped into recession for the first time since the global financial crisis in 2008-09. Our economy was expected to have shrunk 0.1 per cent in the third quarter from the previous three months on an annualised and seasonally adjusted basis after a 4 per cent contraction, according to a Reuters poll.

For those unfamiliar with our monetary policy, the central bank manages monetary policy by letting the Singdollar rise or fall against the currencies of its main trading partners within an undisclosed trading band based on its S$NEER.

Of the 25 analysts surveyed by Reuters, 15 expect the Monetary Authority of Singapore (MAS) to loosen policy. And among those who predict an easing, seven expect the slope to be reduced to zero and four see a lower mid-point. Three others expect a slope reduction and re-centering, while one analyst expects a zero slope and band widening.

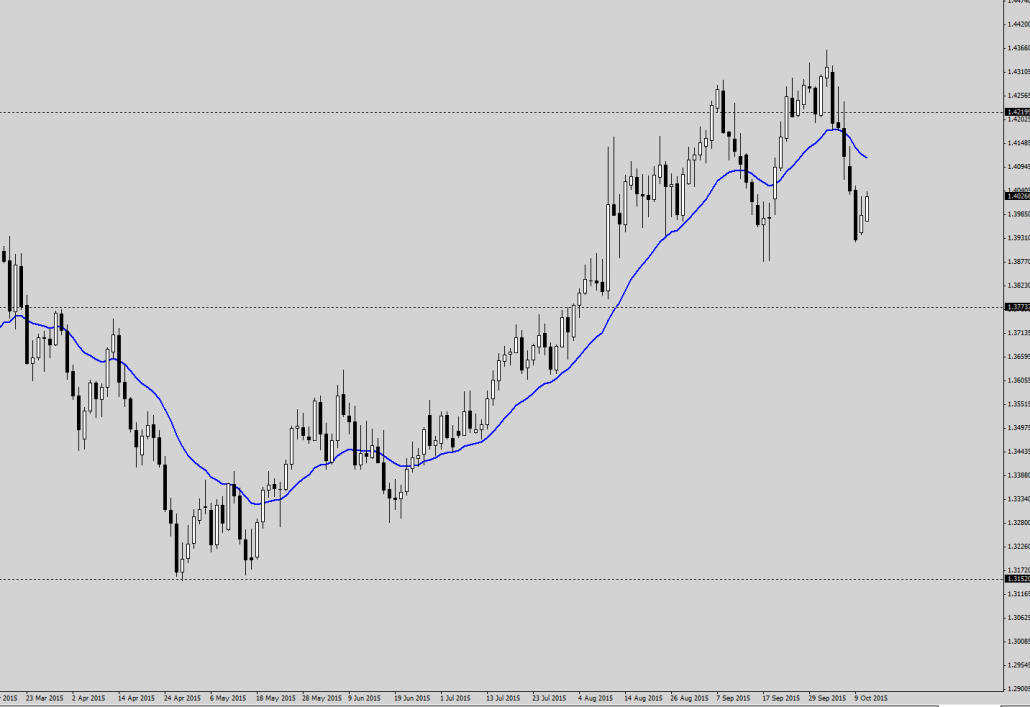

Looking at the chart of the USD/SGD, we can observe that the medium-term trend is still bullish, with the recent weakness in the USD causing a correction in the past week. This gives rise to a possible double-bottom bull flag pattern, resting on a previous level of support.

I think it would be a good opportunity to initiate a long position on the USD/SGD, as the strength in the USD is expected to persist. Good luck! 😀

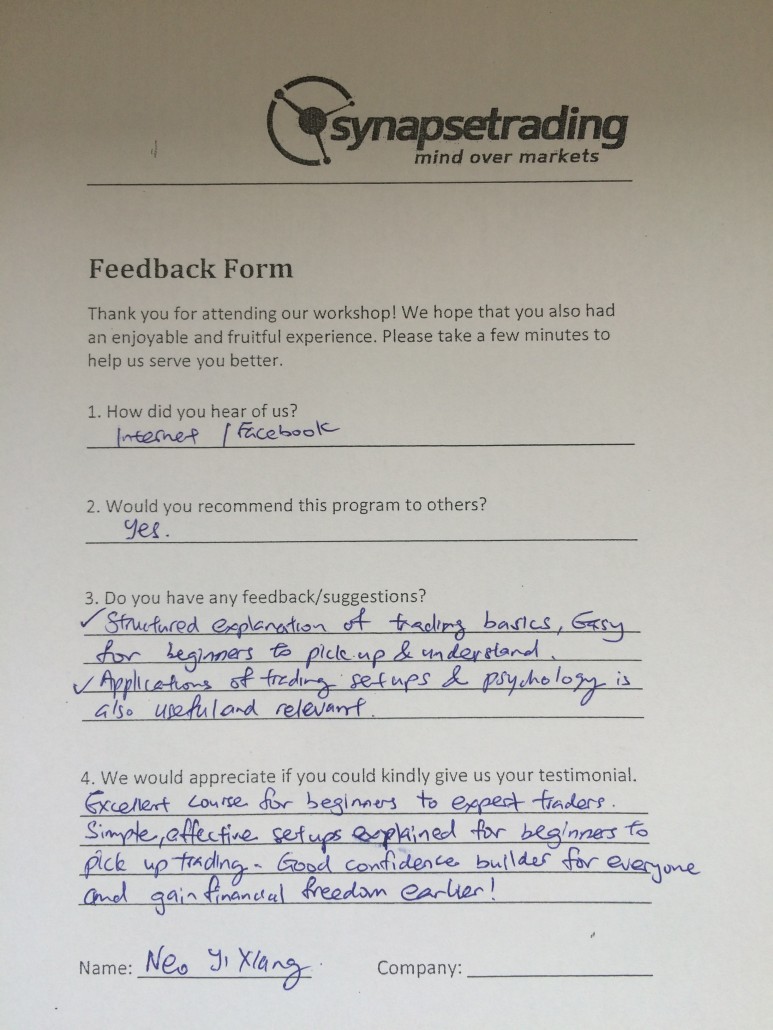

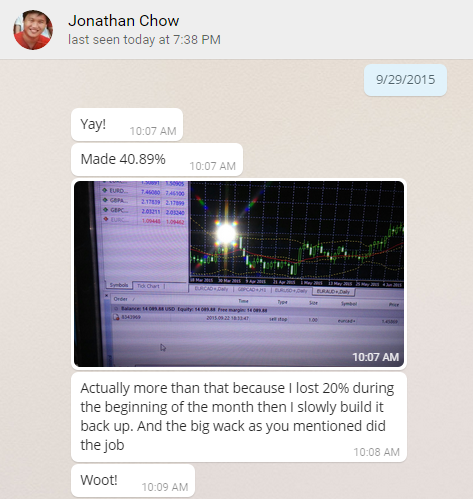

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!