After my introspective getaway for a week, which included touring temples, tubing down a lazy river, and jumping from 10m high cliffs, I am much refreshed and energised for the week ahead! (More photos will follow in my subsequent posts 🙂 )

The best part was the surprise windfall I had upon my return. The AUD/USD shorts and USD/JPY longs I was holding was up a couple of thousand, and is still growing. I will update these forex trades in a separate post.

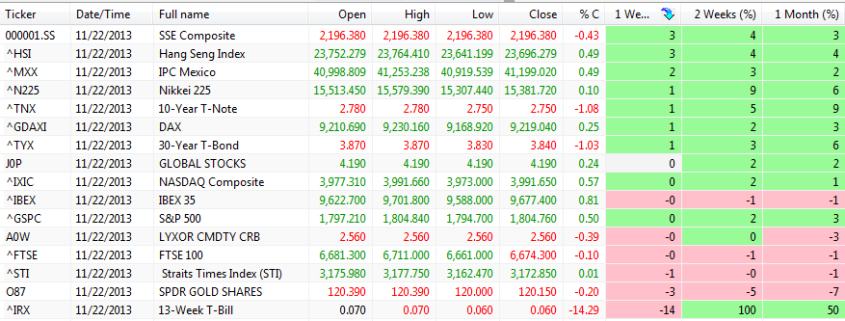

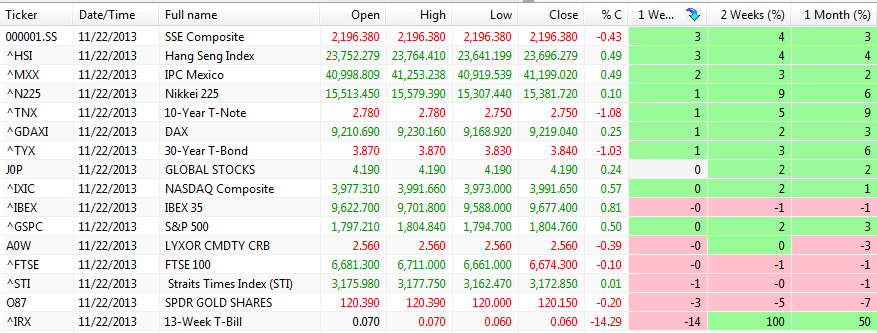

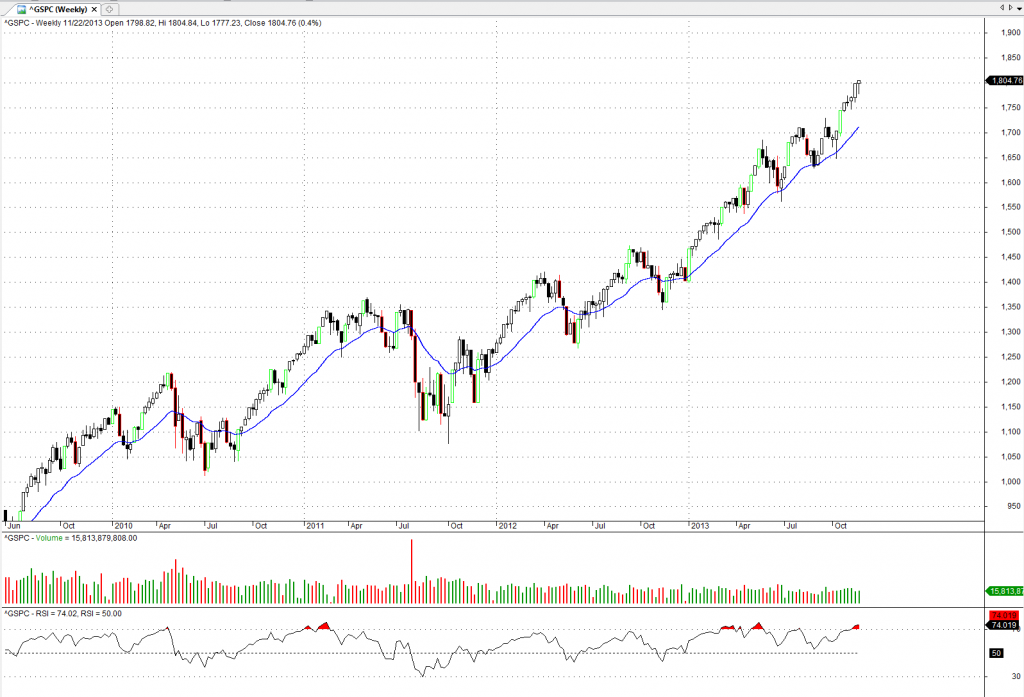

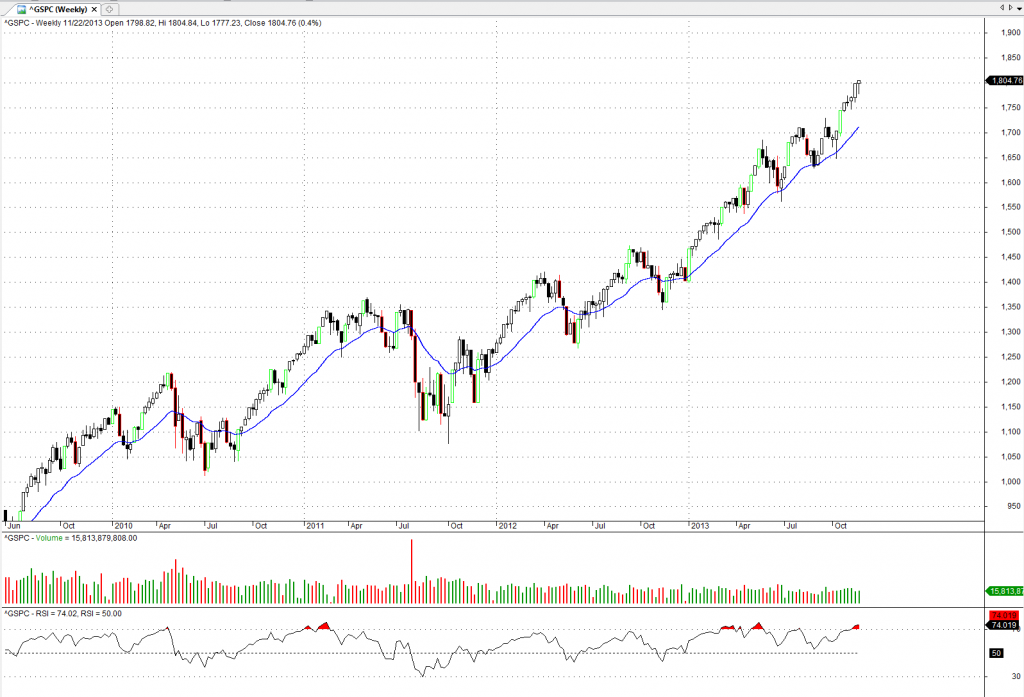

Now, for a quick update on the stock markets.

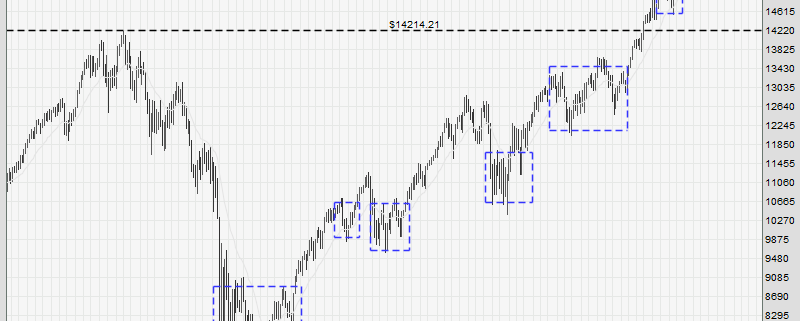

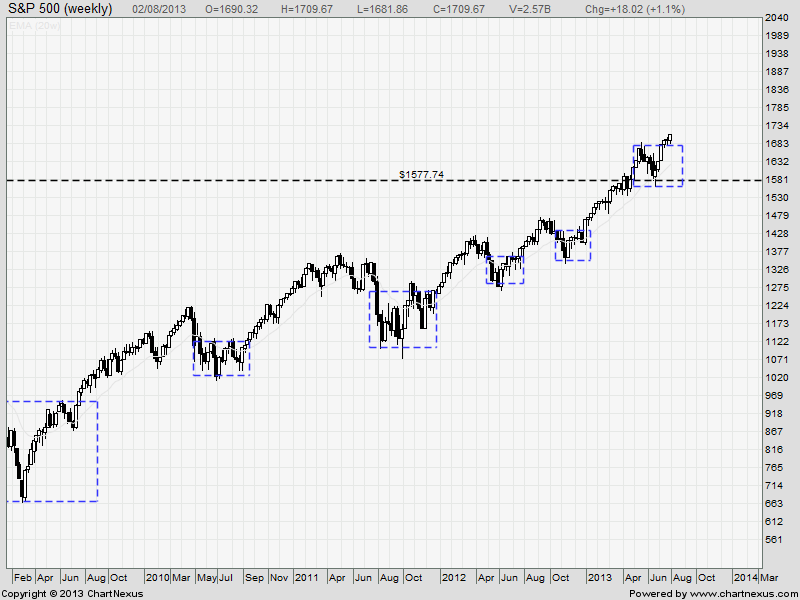

Last Friday, the US markets once again made relentless highs, defying gravity with its strong inertia. When applying the concept of human behavior, all I can is that greed builds on greed, and the bandwagon effect can provide the fuel for strong trends, which always last longer than you think.

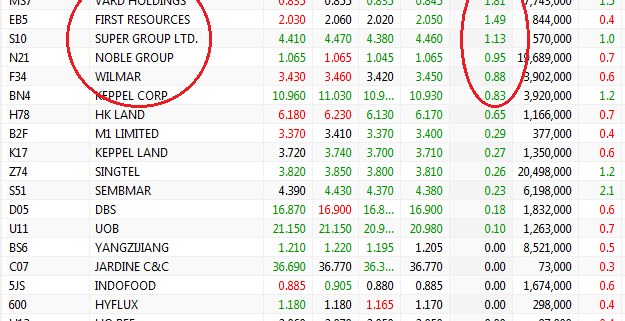

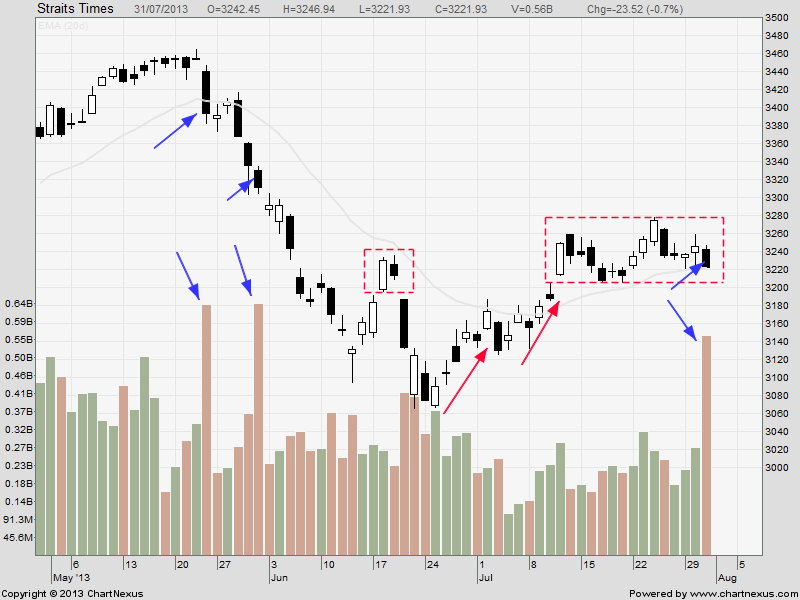

The Singapore market, on the other hand, is displaying signs of weakness, which I pointed out in my public seminars a few weeks back. This is in stark contrast with the US markets, giving rise to a confusing divergence. My advice is to trade what you see, and not what you think. Hence, those with long positions should trade with extra caution.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.