The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

The upcoming U.S. presidential election, set for November 5, 2024, is expected to have profound implications for the economy and financial markets.

The race, featuring Donald Trump for the Republican Party and Kamala Harris for the Democratic Party, has investors closely watching each candidate’s policy stance, as their win could influence tax rates, regulatory landscapes, and fiscal policies.

In this post, we’ll explore historical election impacts, candidate profiles, winning odds, and the asset classes that may benefit under each candidate’s leadership.

Table of Contents

Historical Impact of Elections on Financial Markets

Historically, U.S. presidential elections bring about market volatility and, in some cases, long-lasting shifts in market sentiment.

The stock market tends to perform differently based on the winning party and the subsequent policy shifts.

- 2008 Election (Obama vs. McCain): The financial crisis heavily influenced the 2008 election, and Obama’s win led to mixed reactions in the short term. However, his administration’s introduction of stimulus packages helped stabilize the economy, and the S&P 500 experienced a steady climb over the next several years.

- 2016 Election (Trump vs. Clinton): The unexpected Trump victory led to a rapid market rally. Known as the “Trump Rally,” the S&P 500 surged by approximately 25% in the following year, fueled by pro-business policies, tax cuts, and deregulation.

- 2020 Election (Biden vs. Trump): Amid the pandemic, Biden’s focus on infrastructure and renewable energy investment gave certain sectors a boost. However, his administration’s regulatory approach in technology and energy sectors introduced some volatility.

Data shows that markets often exhibit volatility before and after election days, with equities tending to recover and stabilize once results are confirmed.

When the incumbent party wins, markets generally rally, while a change in power brings a cautious approach from investors.

Brief Background of Each Candidate and Their Key Policies

Donald Trump (Republican):

- Background: Former President Donald Trump previously served from 2017 to 2021. Known for his business-first approach, he has emphasized economic growth through deregulation, tax cuts, and “America First” trade policies.

- Key Policies:

- Energy: Favors traditional energy sources, aiming to support oil, natural gas, and coal industries through deregulation.

- Defense and National Security: Advocates for increased military spending and a robust national security framework.

- Deregulation and Tax Cuts: Prioritizes corporate tax cuts and reduced regulatory burdens on businesses, particularly in finance and real estate.

- Trade Policy: Emphasizes protectionism, with a strong stance on tariffs, especially regarding U.S.-China trade.

Kamala Harris (Democrat):

- Background: Vice President Kamala Harris has a background in law and has supported progressive initiatives, including healthcare expansion, renewable energy investment, and climate-friendly infrastructure projects.

- Key Policies:

- Climate and Green Energy: Aims to increase investments in renewable energy, with incentives for solar, wind, and clean technologies.

- Healthcare Access: Supports expanding healthcare access and reducing healthcare costs, including potential drug pricing reforms.

- Infrastructure: Advocates for sustainable infrastructure, focusing on green construction and modernization of public transportation.

- Technology and Innovation: Promotes tech innovation, cybersecurity, and digital access, along with a stronger regulatory framework for tech giants.

Odds of Each Candidate Winning

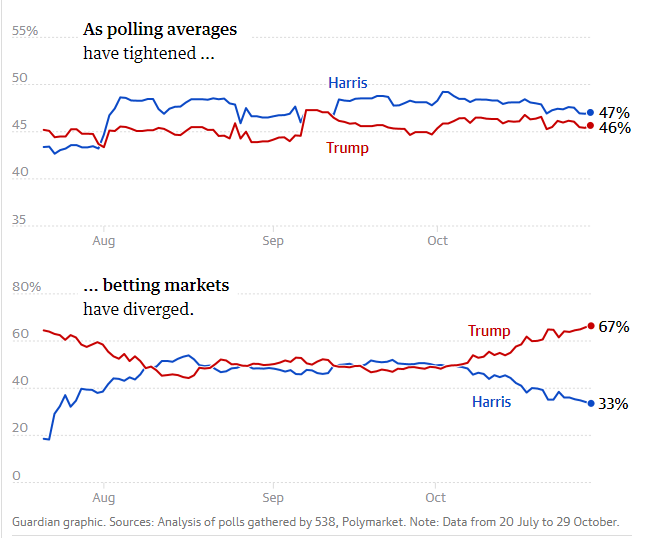

This election is shaping up to be one of the tightest races in recent history, with official polls indicating a neck-and-neck competition between Kamala Harris and Donald Trump. While traditional polls suggest a close contest, Trump and his supporters have pointed to alternative sources—particularly betting markets—that project him as the frontrunner. Trump recently cited these “gambling polls,” claiming they show him with a substantial lead, even stating figures like 65% to 35% in his favor at a campaign event.

Several popular betting platforms indeed reflect this sentiment. As of recent data:

- Polymarket, a prominent election betting service, currently puts Trump’s chances of winning at 67% and Harris’s at 33%.

- Kalshi, another major platform, shows similar odds, giving Trump 62% and Harris 38%.

With trust in traditional media and polling declining, betting platforms have gained traction as alternative “predictive” tools, with some public figures, including Elon Musk, suggesting that these markets might be more reliable indicators. Unlike poll respondents who often answer based on preference, those betting on outcomes are motivated by profit and thus tend to focus on who they think will actually win rather than who they hope will prevail.

Betting Market Trends and Potential Biases: Interest in betting on the 2024 election is reportedly higher than ever, driven by the widespread legalization of sports betting and recent legal victories for platforms like Kalshi. Some, however, have raised concerns over the potential for market manipulation. Reports indicate that a single French national placed roughly $28 million worth of bets on Trump across four accounts on Polymarket. Although this activity has been labeled as “personal views” rather than manipulation, the absence of strict betting limits could allow wealthy individuals to skew the odds in favor of their preferred candidate.

Regulatory Scrutiny: The rise of election betting has not gone unnoticed by regulators. The Commodity Futures Trading Commission (CFTC) has attempted to shut down or restrict several platforms, citing concerns over unregulated political betting markets. However, Kalshi recently won a legal battle that permits it to take U.S. bets on election outcomes, a ruling that may pave the way for further growth in election betting.

While official polls continue to portray a tight race, betting markets currently lean toward Trump as the favorite, with Trump’s campaign embracing this narrative. As betting markets and traditional polls offer differing views, investors and observers remain divided on which source may ultimately prove more predictive.

Asset Classes Likely to Benefit if Each Candidate Wins

If Donald Trump Wins:

- Energy and Fossil Fuels: Trump’s support for traditional energy likely favors oil, gas, and coal sectors. Investors may gain exposure through ETFs like XLE (Energy Select Sector SPDR), which holds major oil and gas companies.

- Defense and Aerospace: Increased defense spending would benefit aerospace and defense contractors such as Lockheed Martin and Raytheon. ETFs like ITA (iShares U.S. Aerospace & Defense ETF) could offer broad sector exposure.

- Financial Services: With Trump’s pro-deregulation stance, large financial institutions may see increased profitability. ETFs like XLF (Financial Select Sector SPDR) and KBWB (Invesco KBW Bank ETF) offer access to major banks and financial stocks.

- Real Estate and Infrastructure: Real Estate Investment Trusts (REITs) may benefit from favorable tax policies. Look into REIT-focused ETFs like VNQ (Vanguard Real Estate ETF) for broader exposure, particularly in commercial real estate.

- Industrial Metals: A continuation of protectionist policies could favor domestic steel and aluminum producers. Consider SLX (VanEck Vectors Steel ETF) to gain exposure to steel companies that would benefit from tariffs and support for heavy industry.

If Kamala Harris Wins:

- Renewable Energy and ESG Investments: Harris’s focus on green energy would likely boost clean energy companies. ETFs like ICLN (iShares Global Clean Energy ETF) or TAN (Invesco Solar ETF) offer direct exposure to renewable energy stocks.

- Healthcare and Biotechnology: Harris’s stance on healthcare access could benefit managed care providers and biotech firms focused on affordable healthcare. XLV (Health Care Select Sector SPDR) and IBB (iShares Nasdaq Biotechnology ETF) are options for healthcare exposure.

- Green Infrastructure: Companies involved in eco-friendly construction and infrastructure may gain from Harris’s policies. Infrastructure ETFs like PAVE (Global X U.S. Infrastructure Development ETF) could be a way to access companies expected to benefit from sustainable projects.

- Technology and Innovation: Increased emphasis on tech infrastructure, 5G, and cybersecurity may support growth for technology companies. QQQ (Invesco QQQ ETF) provides exposure to the Nasdaq 100, with high concentrations in tech firms.

- Commodities for Green Tech: Harris’s renewable push would increase demand for lithium, copper, and other materials used in green technologies. LIT (Global X Lithium & Battery Tech ETF) offers exposure to lithium and battery producers, while COPX (Global X Copper Miners ETF) focuses on copper.

Conclusion: Navigating Election-Driven Market Changes

The 2024 election could steer financial markets in distinct directions based on the victor’s policy focus.

Trump’s administration would likely prioritize traditional industries and a deregulated business environment, benefiting sectors like fossil fuels, defense, and financials.

Harris’s administration, on the other hand, would champion renewable energy, healthcare reform, and sustainable infrastructure, presenting opportunities in clean energy, ESG investments, and green technologies.

For investors, understanding these dynamics can inform strategic portfolio adjustments ahead of the election.

While each candidate’s policies may initially drive market volatility, focusing on diversified asset exposure aligned with either candidate’s strengths can help manage risks and capitalize on opportunities in a changing economic landscape.

As we come to the end of the blog post, here are some questions to ponder about:

- How much weight should investors place on betting markets compared to traditional polls, and could this shift signal a broader change in how we interpret political forecasts?

- In an era of increasing political polarization, how can investors best prepare for the potential market volatility and policy swings that come with close and contentious elections?

- With significant differences in each candidate’s approach to key issues like energy, technology, and healthcare, how might this election reshape America’s economic priorities—and what could this mean for the future of sustainable and responsible investing?

Let me know your answers in the comments below!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!