Monthly Portfolio Update for January 2016 & Market Outlook

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

For the month of January, the stock markets drifted lower and continued to hover near the lows, as traders and investors speculated whether they would break new lows or start a rebound.

Fundamentally, nothing much has changed, and the outlook continues to be bearish. As such, I will not be adding any equity positions till I see a stronger bottom for the market. I am looking at 2,200 or 2,000 for the STI index.

As part of my defensive strategy, I have increased my holdings in Gold, which should act as a good hedge if the stock markets continue to head lower.

For my long-term capital appreciation strategy, I have also increased my holdings in Oil, as I foresee a possible rebound some time this year.

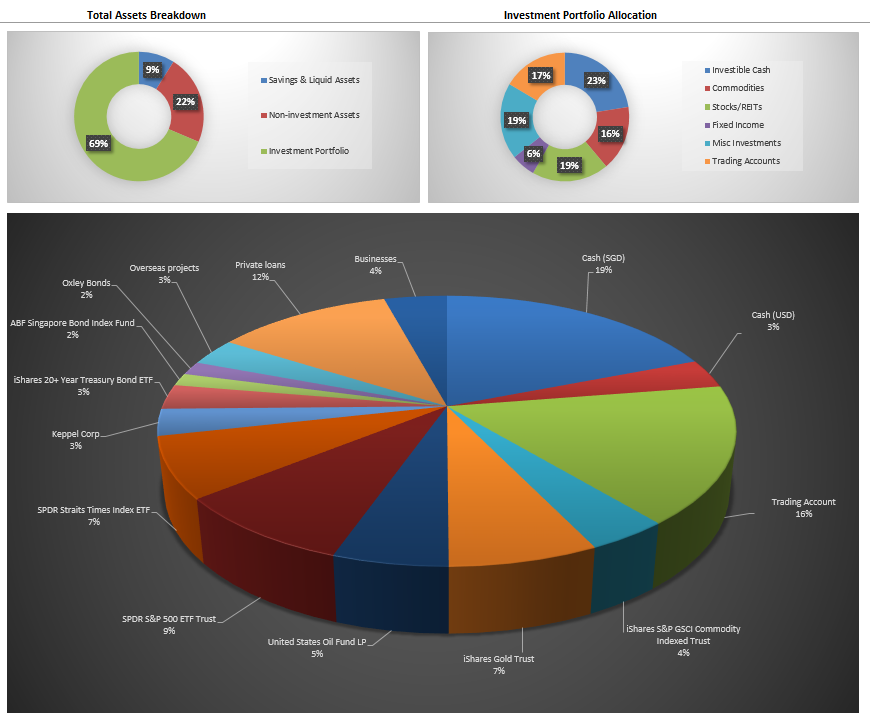

For my total assets, 9% was kept in Savings & Liquid Assets, 22% was Non-investment Assets, while the rest (69%) was used to build my investment portfolio.

For my investment portfolio allocation, there is a small amount in Fixed income (6%), slightly more in stocks (19%) and commodities (16%), and the rest was in cash (23%), Trading Accounts (17%) and Misc Investments (19%).

Stay tuned for next month’s update, or subscribe for our mailing list to receive monthly updates in your email!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!