Having just returned from reservist, I did a quick review of all my trades and positions, and noticed some interesting observations.

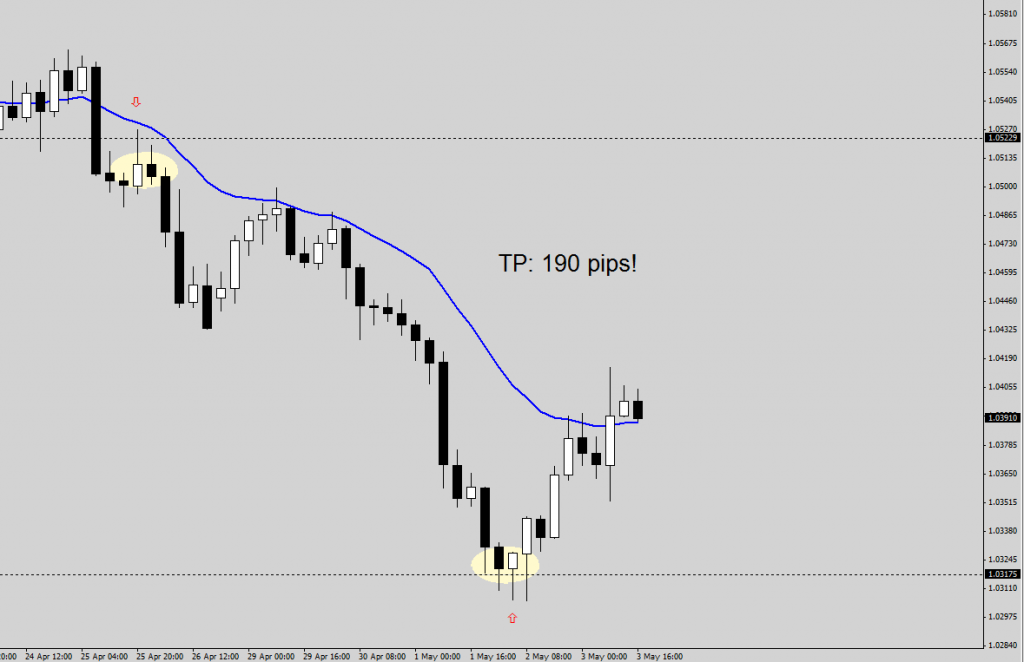

1. USD/JPY hitting our TP

Firstly, the USD/JPY has finally hit 100, after my numerous previous post predicting this magnetic number, and calling for a buy. This is a good milestone to take some profits off the table.

https://synapsetrading.com/more-easy-trades-on-the-usdjpy-buying-with-the-big-boys/

https://synapsetrading.com/usdjpy-nearing-our-predicted-price-target-of-100/

https://synapsetrading.com/follow-up-on-usdjpy-up-300-pips-since-our-last-call/

https://synapsetrading.com/usdjpy-chance-to-hop-on-the-super-swing/

https://synapsetrading.com/usdjpy-will-it-really-reach-100/

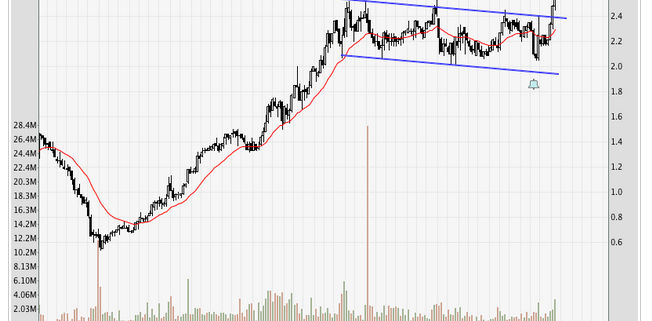

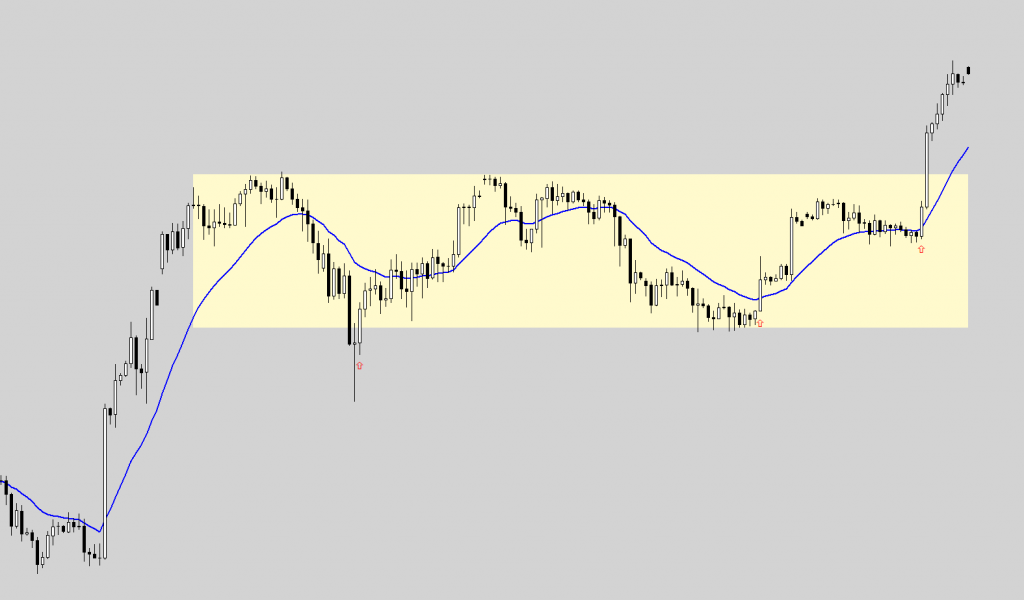

2. Breakout on the STI and other Blue Chips

There have been breakouts on the Straits Times Index and other bluechips, fortunately we saw it coming and were able to take long positions before the breakouts started.

https://synapsetrading.com/straits-times-index-how-i-predicted-the-breakout/

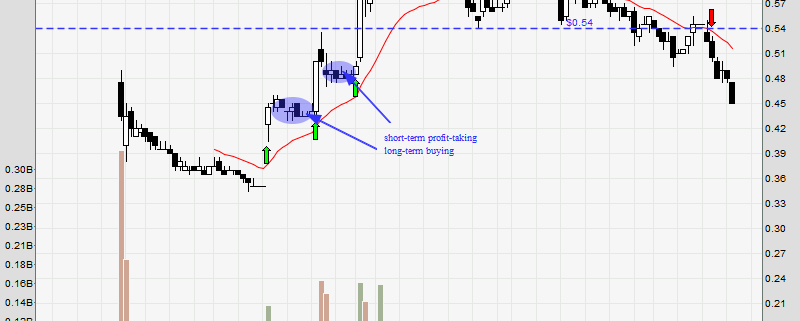

3. Croesus Retail Trust IPO

This IPO was a surprise windfall for many of us, and personally I’m not a big fan of IPOs, since I don’t have much time to research, but fortunately we were tipped off by one of our trainers. This was a good punt, netting us a quick 20% profit in a single day.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.