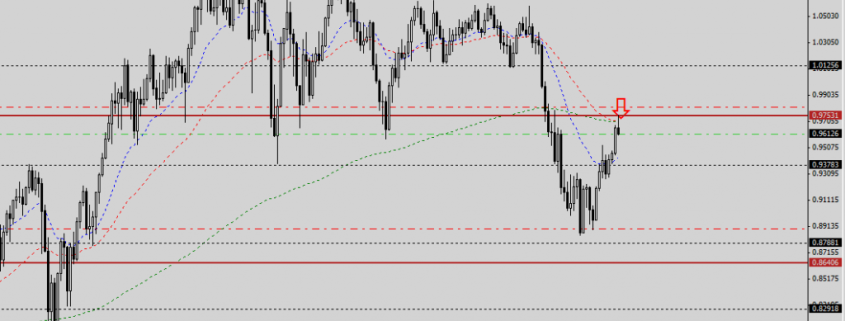

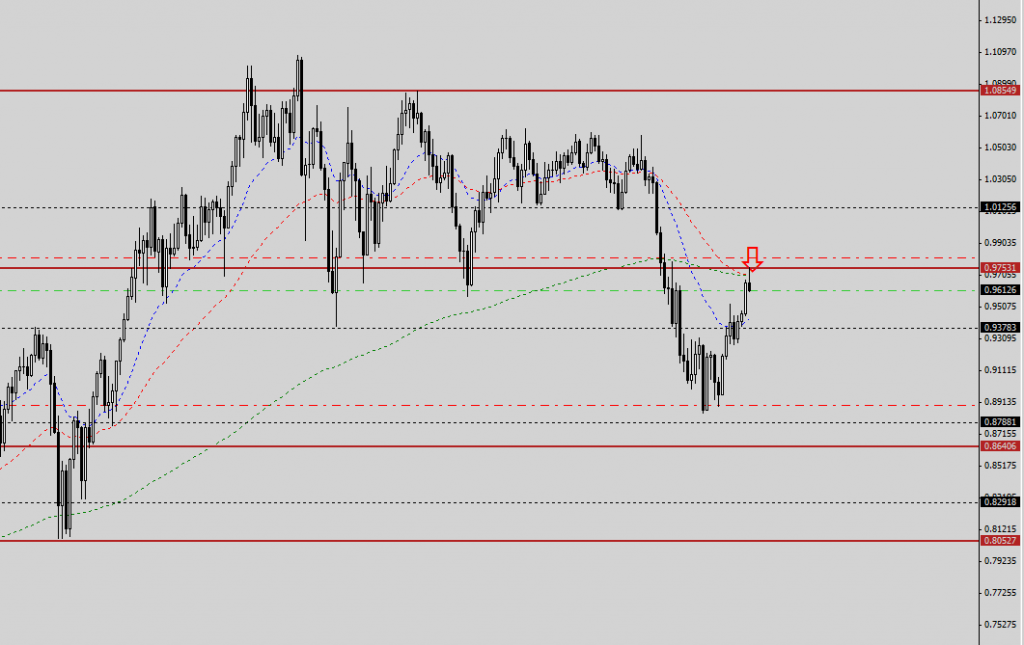

Following up from my massive shorts last week, I continued to add more positions as the market moved in my favour, accumulating a large position as I waited patiently for the market to move in my predicted direction.

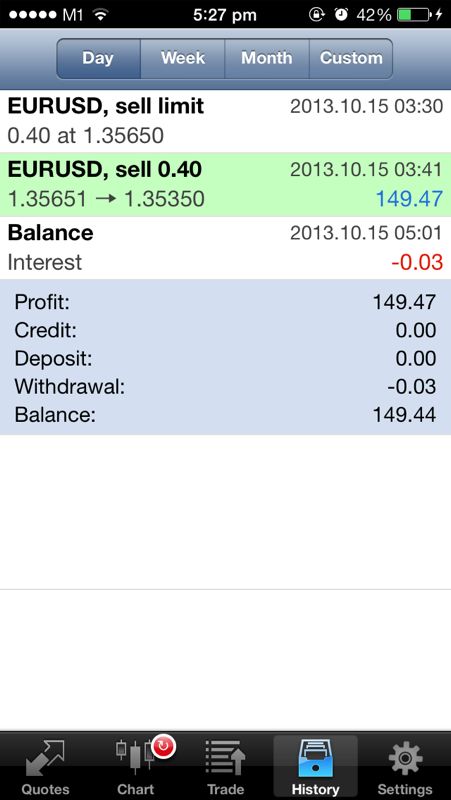

Today, after the market dropped 135 pips, we started reaping some profits from our positions, and adjusted our stops to lock in profits, while allowing our positions to run further for maximum profits.

This is the previous link:

https://synapsetrading.com/singapore-forex-trading-audusd-the-crucial-weekly-pattern/

I am glad we managed to make profits on this trade by helping one another in the Synapse Network, and having the discipline to stick to the setups learnt in the course.

For those who signed up for the December course, I hope this will help you cover back part of your course fees even before you attend the course. Cheers!

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.