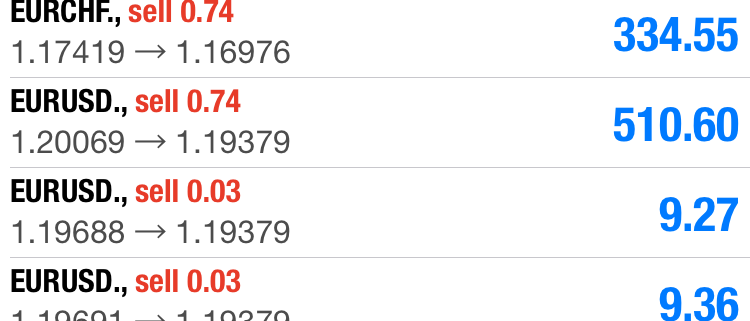

“In economics, Kondratiev waves (also called supercycles, great surges, long waves, K-waves or the long economic cycle) are hypothesized cycle-like phenomena in the modern world economy. It is stated that the period of a wave ranges from forty to sixty years, the cycles consist of alternating intervals between high sectoral growth and intervals of relatively slow growth.” – Wikipedia

After the global financial crisis in 2008, the market bottomed in 2009, and since then we saw the start of a new major cycle, which could last till 2050/60. This means that we are still in the early stages (fast growth stage) of a big long-term trend. This trend consists of not just cryptocurrencies, but also things like blockchain, AI, VR/AR, machine learning, etc.

Will it Crash Like the Dot Com Bubble?

In every phase of innovation, it will start off with radical innovation, where a new technology is introduced. This will be a period of experimentation and flux, as many new products come into the market. Cryptocurrencies are currently in this stage, which is why prices are so volatile.

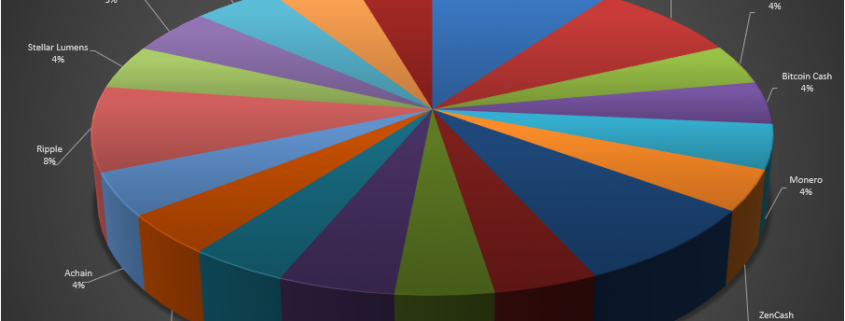

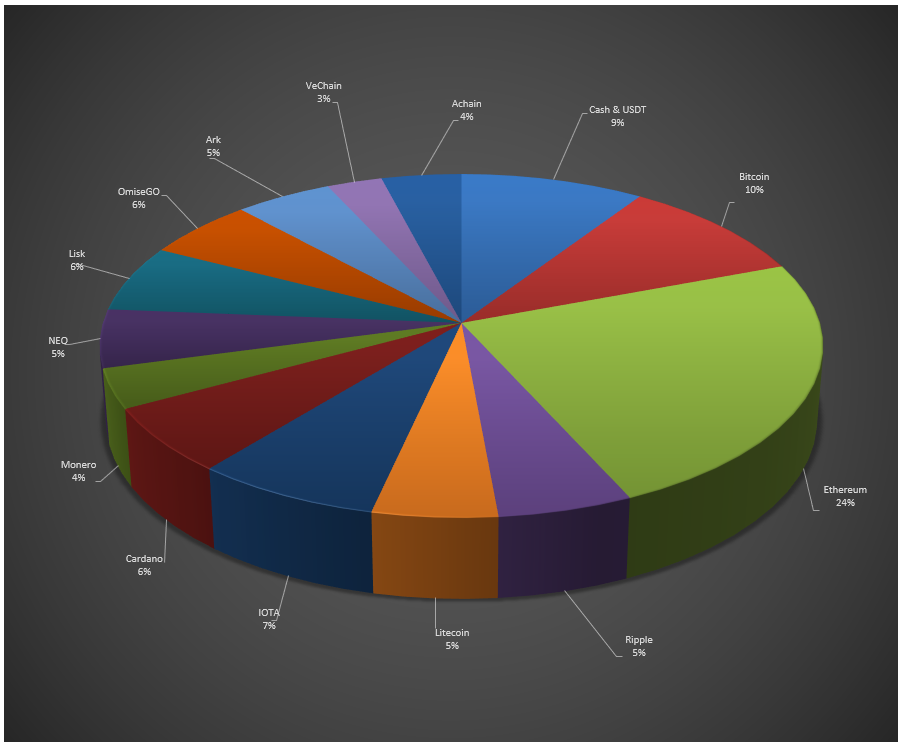

As you might be aware, there are 3 main types of coins: currency, platform, and applications. Some people also include a 4th type called privacy coins, like Monero and Zcash, which are meant to allow completely anonymous transactions. Some examples of currency coins include Bitcoin, Litecoin & Bitcoin Cash, and their main purpose is to serve as a virtual currency. However, Bitcoin behaves more like an asset rather than a currency now, since people are buying it for capital appreciation rather than to use it for transactions. Platform coins refer to ones like Ethereum, which do not directly provide a function to the consumer, but allow applications to be built on their platform. Lastly, applications are like the iphone apps, which serves a particular function for the end user.

After the market has gone on long enough to enter the bubble stage, the next phase of innovation is the “shake out” phase, where the market gets rid of “useless” or bloated/weak products. This will typically be the part associated with a market crash, but it is also possible that the bubble deflates slowly instead of bursting.

In an early stage boom, the application coins will tend to proliferate, and there will be a lot of them. This means that this class of coins would be the most risky to invest in, because a lot of them will be the first to die out when the market crashes.

After the dust settles, the ones who survive will likely become the dominant players (Facebook, apple, Amazon), and it is worth noting that the best products/technology may not necessarily be the ones that survive, rather it is the one with the widest adoption. Do keep this in mind when building your Crypto portfolio and deciding which coins to invest and hold for the long-term.

After the crash, the trend may take a while to resume, but it will be more majestic than before. The next phase involves incremental innovations, where products are further refined, such as improvements in the products, or new applications for existing products, etc.

So Should I Buy Now?

Although we know we are at the early stages of a mega-trend, we also have to keep in mind the “shake out” phase which has not occurred yet.

If you are willing to hold through that and capture the subsequent big upside, then you will not need to worry so much about timing the market now. But if you prefer to take a more cautious approach, you can wait till the “shake out” is over before entering the market.

And lastly, if you prefer the best of both worlds, you can use swing trading to capture the short/medium-term moves in the market, while waiting for the “shake out”, and then going all-in when the dust settles. Whichever approach you choose, just make sure you don’t miss out on this 50-year wave, because it is literally once in a lifetime. 😀

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.