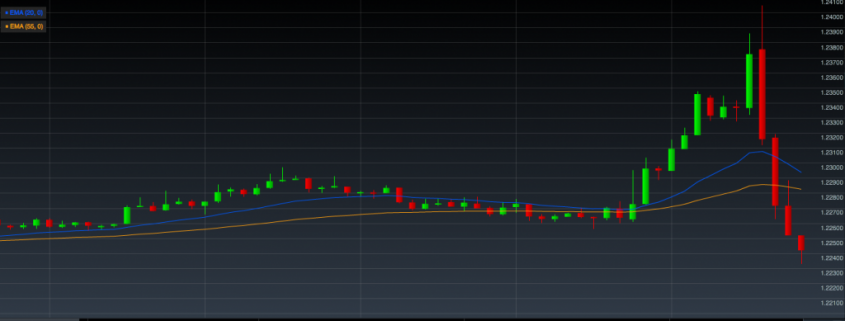

Memorable speech by Draghi 🙂

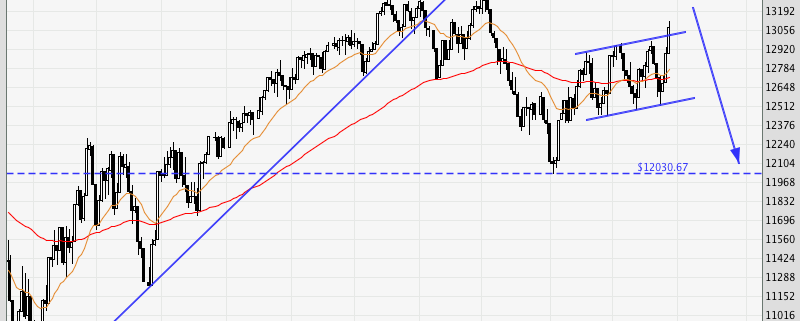

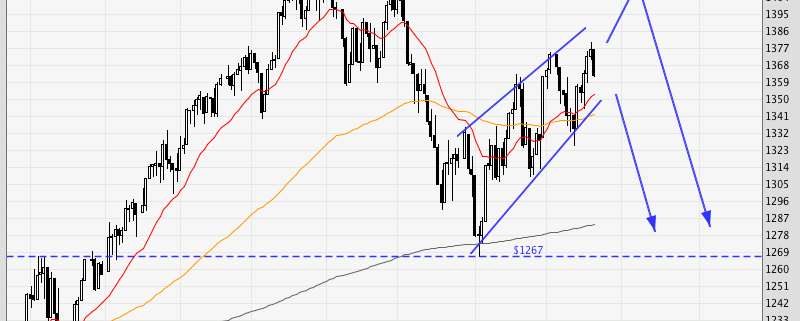

If you were using the daily chart, you would have the added conviction to short on new highs, since the daily chart is still bearish.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.