Bullish Gapping Play & Bearish Gapping Play

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Table of Contents

Bullish Gapping Play

Definition

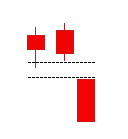

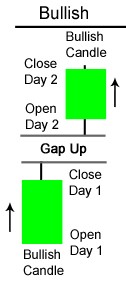

A bullish gapping play structure is comprised of three Japanese candlesticks.

The first two are small and bullish (green), indicating hesitation.

The opening of the third candlestick occurs with a bullish gap, and this candlestick must be large.

Illustration

Characteristic

A bullish gapping play follows a period of hesitation, represented by small candlesticks, after a significant increase characterized by several large green Japanese candlesticks.

The small candlesticks before the gap must remain in the upper area of the last large candlestick.

Significance

A bullish gapping play is a continuation pattern, serving as a strong signal that the bullish movement will continue.

Note

A bullish gapping play is considered stronger if the candlestick before the gap is red.

Invalidation

If the next candlestick is not bullish or does not open with a bullish gap, the bullish gapping play structure is invalidated.

Bearish Gapping Play

Definition

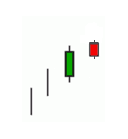

A bearish gapping play structure is comprised of three Japanese candlesticks.

The first two are small and bearish (red), indicating hesitation.

The opening of the third candlestick occurs with a bearish gap, and this candlestick must be large.

Illustration

Characteristic

A bearish gapping play follows a period of hesitation, represented by small candlesticks, after a significant decline characterized by several large red Japanese candlesticks.

The small candlesticks before the gap must remain in the lower zone of the last large candlestick of the descent.

Significance

A bearish gapping play is a continuation pattern, serving as a strong signal that the bearish movement will continue.

Note

A bearish gapping play is considered stronger if the candlestick before the gap is green.

Invalidation

If the next candlestick is not bearish or does not open with a bearish gap, the bearish gapping play structure is invalidated.

Concluding Thoughts

The bullish and bearish gapping play patterns are important continuation signals in technical analysis, highlighting potential ongoing trends after brief periods of hesitation.

These patterns gain additional strength if the candlestick preceding the gap is of the opposite color, suggesting a failed attempt to reverse the trend.

However, traders should always be vigilant and confirm the pattern with subsequent candlestick behavior, as invalidation occurs if the next candlestick does not follow the expected direction with a gap.

As with all technical indicators, it’s advisable to use these patterns in combination with other analytical tools for a well-rounded trading strategy.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

The Synapse Network is our dedicated global support team, including event managers, research teams, trainers, contributors, as well as the graduates and alumni from all our previous training program intakes.

Leave a Reply

Want to join the discussion?Feel free to contribute!