Bullish Atekubi & Bearish Atekubi

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Below the Neckline – Bullish Atekubi

Definition

A bullish atekubi (line below the neckline) is a structure comprised of two Japanese candlesticks.

The first candlestick is a large bullish candlestick (green), followed by a small bearish candlestick (red) with a closing just above the closing level of the previous candlestick.

The second candlestick must be significantly smaller than the first.

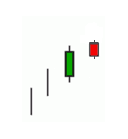

Illustration

Characteristic

A bullish atekubi often forms after a significant increase characterized by several large green Japanese candlesticks.

Significance

A line under the neckline (bullish atekubi) is a continuation pattern, indicating a continuation of the bullish movement.

Note

For the structure to be validated, the next candlestick must be bullish and close above the opening level of the small bearish candlestick (red).

Invalidation

If the lowest point of the small bearish candlestick surpasses the next candlestick, the structure can be considered invalidated.

Below the Neckline – Bearish Atekubi

Definition

A bearish atekubi (line below the neck) is a structure comprised of two Japanese candlesticks.

The first candlestick is a large bearish candlestick (red), followed by a small bullish candlestick (green) with a closing just below the closing level of the previous candlestick.

The second candlestick must be significantly smaller than the first.

Illustration

Characteristic

A bearish atekubi often forms after a significant decline characterized by several large red Japanese candlesticks.

Significance

A line below the neckline (bearish atekubi) is a continuation pattern, indicating a continuation of the bearish movement.

Note

For the structure to be validated, the next candlestick must be bearish and close below the opening level of the small bullish candlestick (green).

Invalidation

If the highest point on the small bullish candlestick surpasses the next candlestick, the structure can be considered invalidated.

Concluding Thoughts

The bullish and bearish atekubi patterns are valuable continuation signals within a trending market.

They provide insight into the potential for ongoing momentum in the direction of the current trend, offering traders opportunities to position themselves accordingly.

However, as with all candlestick patterns, confirmation from subsequent candlesticks and additional technical indicators is crucial to ensure the reliability of the signal and to avoid false setups.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

The Synapse Network is our dedicated global support team, including event managers, research teams, trainers, contributors, as well as the graduates and alumni from all our previous training program intakes.

Leave a Reply

Want to join the discussion?Feel free to contribute!