Parkway is still headed up in a neat parallel price channel, and is currently forming what seems to be a double bottom bull flag. A good chance for entry would be on the double bottom pullback, and it would also be a 2nd entry. This means that we should wait for a bullish reversal bar signal before making an entry. Good luck!

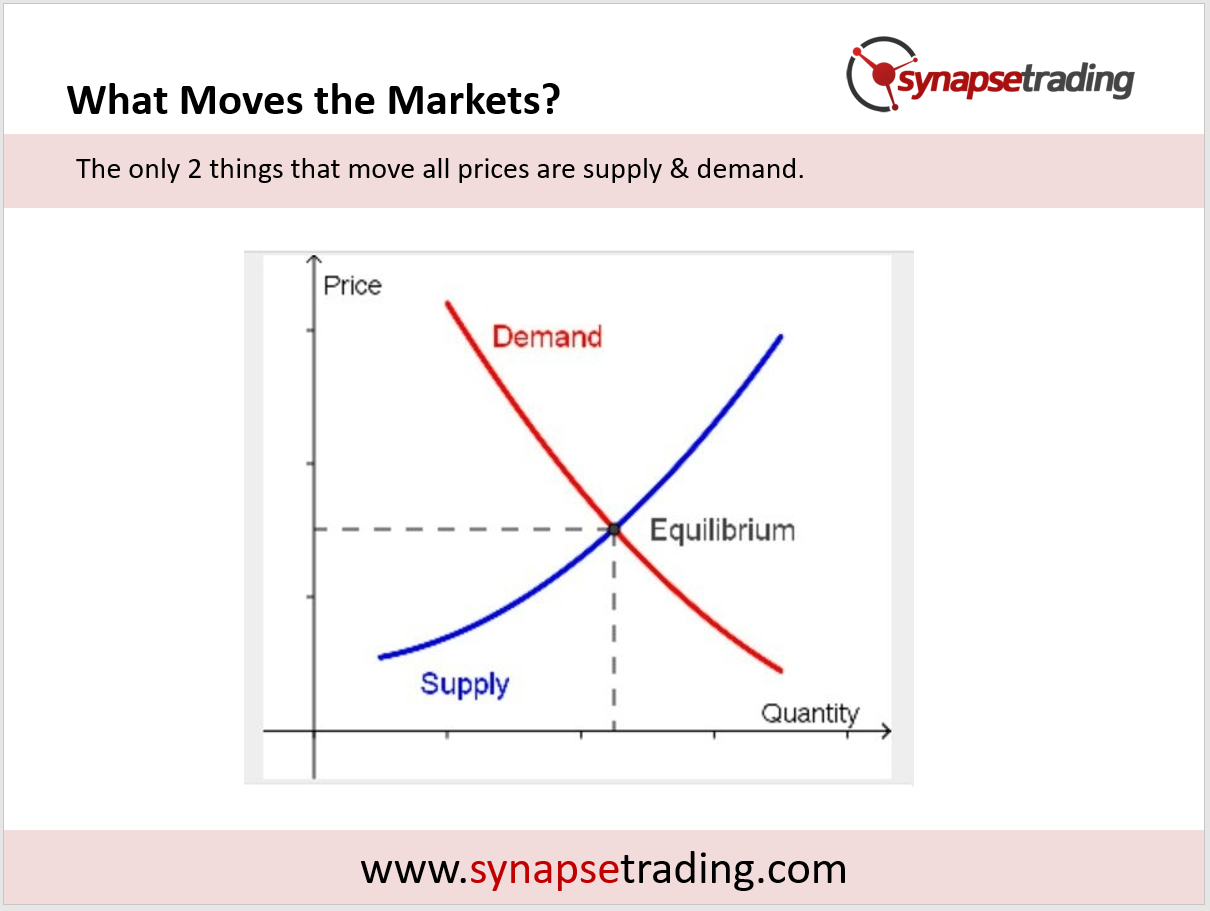

Despite what people may otherwise tell you or any preconceived ideas you may have, there are only two things that move stock prices.

They are supply and demand – nothing more and nothing less. This is the foundation of basic economics as shown in the graph below.

Since quantity remains the same, price is what fluctuates as a results of supply and demand.

If there is more demand than supply for a stock, then the price shall rise.

Conversely, if there is more supply than demand for something, then the price shall fall.

This is absolutely true in any market.

The next question is what affects the supply and demand for a particular security or traded instrument.

Is it the profits in the financial statements? The upcoming expansion plans? The new product? Is it dividend payments?

No one can be absolutely sure at any point why people may be buying and selling shares.

That’s where technical analysis comes into play.

At no time does technical analysis attempt to determine why there might be supply and demand, only that there are certain levels of supply and demand.

By studying actual movements in the price and volume, we can go a long way to determining what the present demand and supply is and therefore predicting the future direction price will take.

All fundamental and economic influences on a share price are already taken into consideration in the market, which is reflected in the price.

As a trader, what you are buying and selling is the actual price, not financial statements or ratios like the P/E ratio or ROE figures.

Ultimately, it is the price that ultimately determines whether you make money or not, and what you think the price should be has NO influence whatsoever on the price.

The next big revelation is that the bulk of supply and demand does not come from retail traders or retail investors.

They come from the big boys (BB) and smart money (SM) like traders and fund managers in banks, funds and other institutions.

They are the ones who move the market.

Learning to interpret price action and volume is our window to tap into their psyche and profit from their actions.

Supply refers to the sellers (bears) who are looking to sell (which pushes prices down), whereas demand refers to the buyers (bulls) who are looking to buy (which pushes prices up).

The constant battle between the buyers and sellers creates fluctuations in prices, which can be as short as a few seconds, or create trends which can last for years.

As a trader, finding the sweet spot where there is an imbalance in the forces (such a a huge build-up of buyers or sellers on either side) can give you an edge in the market, so that you can enter the market just as a big move is about to occur.

If you would like to learn how to get started in trading, also check out: “The Beginner’s Guide to Trading & Technical Analysis”

The Euro is going down, and is showing extremely weak technicals, which underlie the festering Greece debt fundamental problems. This is the first test of the 20-EMA after staying away for quite a long time, showing the bearish pressure. It also coincides with a breakout below the support of 1.92 and a pullback. On an unrelated note, it seems that my holiday here in Europe is getting cheaper and cheaper. I will be timing my exchange of SGD to EUR near the support levels.

After completing an inverted H&S, the S&P 500 has proceeded to make new highs. Judging by the numerous strong white bars, the upward pressure is quite strong. It might be a good idea to go long on a pullback, perhaps on a test of the breakout to new highs. On a side note, I will be heading to Budapest this weekend.

A similar-looking pattern suggests a lot of upside, especially if it finds support at the W-pivot and both EMAs. Please ignore the volume, it’s not working right for this index. Based on the length of this pattern, we could be seeing upside moves of beyond 12,000. Be ready to start buying!

Latest Blog Posts

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm

Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

Contact Us

Synapse Trading Pte Ltd

Registration No. 201316168H

FB Messenger: synapsetrading

Telegram: @iamrecneps

Email: info@synapsetrading.com

Disclaimer

Privacy policy

Terms & Conditions

Contact us (main)

Partnerships