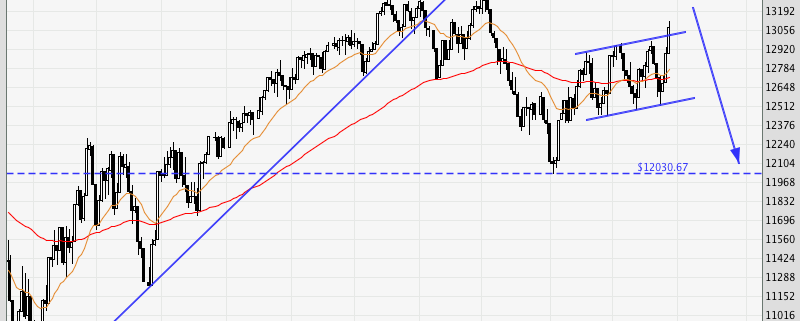

After breaking the trendline, the Dow has had a deep correction, and is now heading to test the previous swing highs. If the resistance holds, it could form a potential double top. The price action is currently contained in a mild uptrend channel, which had a small breakout on Friday. If we see follow-through on Monday, it is likely it will head to test the swing high, but if it falls back into the channel, we can expect it head down to test the swing low, as indicated by the arrow.

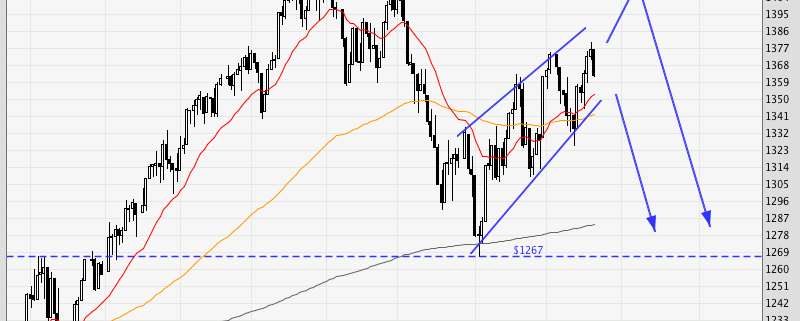

Making a great effort to rise, giving rise to a wedge-shaped pattern.

Market could either aim to test the old high of 1415 before coming back down, or go straight down from here to test the previous low of 1267.

For the former to occur, the market would have to take out the most recent swing high. Let’s see which plays out.

Breakout to new lows on the daily chart

Expecting more opportunities to the downside

Intraday wedge breakdown which coincided with news release…

Stars in Alignment: Price, Pattern, Time

An intraday double bottom near support after a long decline.

A pullback after the double bottom provided another long opportunity.

Let’s see if it can hit the top where the arrow is.

Initiated longs in anticipation of inverted H&S breakout

Took partial profits near neckline, and added longs after breakout

Exited all positions on weakness

Latest Blog Posts

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm

Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

Contact Us

Synapse Trading Pte Ltd

Registration No. 201316168H

FB Messenger: synapsetrading

Telegram: @iamrecneps

Email: info@synapsetrading.com

Disclaimer

Privacy policy

Terms & Conditions

Contact us (main)

Partnerships