Recently the stock markets have been rather unpredictable, surging one way on political news and flipping the other way when new statements are released. For example, gold plunged over $30 in just under 5 minutes, dragging the EUR and other currencies down. Later that same night, “positive statements” regarding the fiscal cliff fiasco gave markets a sentiment boost, which has carried on today.

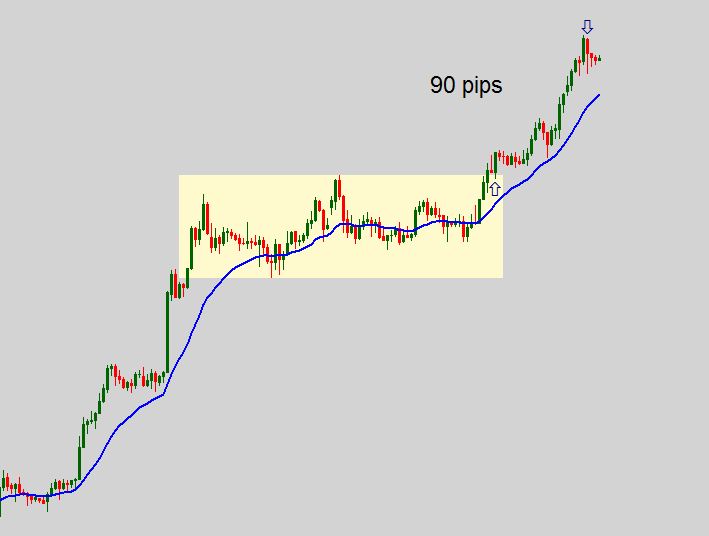

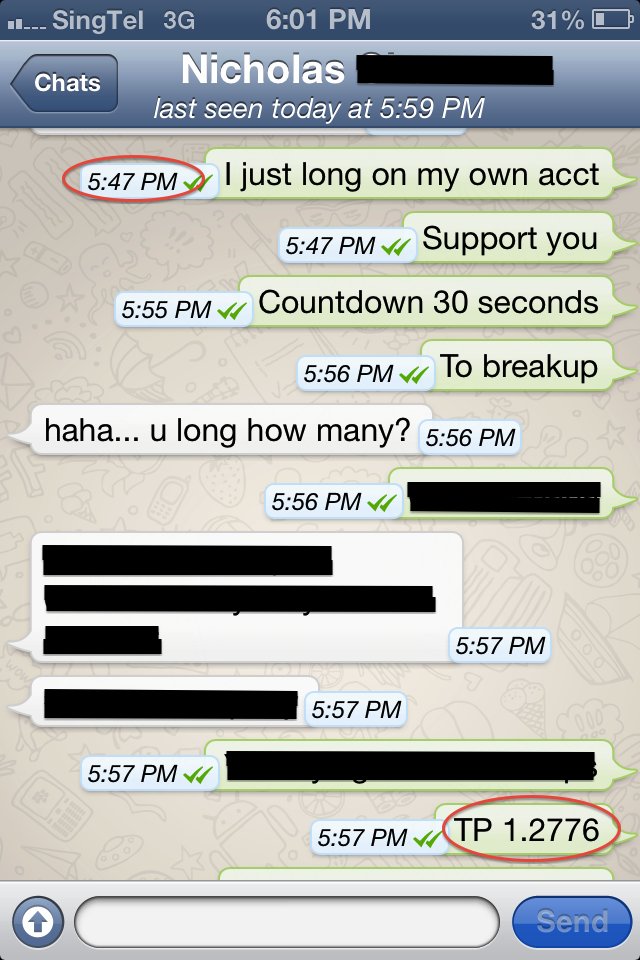

I was bearish on the Singapore markets, but I have liquidated my shorts for a small profit and now watching on the sidelines. I am ready to flip based on the price action. It doesn’t matter whether it’s long or short, as long as I am on the winning side. In the mean time, I am putting my skills to good use by consistently building up my capital in the forex markets, so that I will be ready when the move in the stock market comes.