A big thanks to those who came down last Saturday, and for making this such an awesome event! Also a big thanks to CMC Markets for sponsoring the event, and to all the guest speakers and helpers who helped complete this great experience.

It is another milestone for Synapse Trading, having grown from a simple blog to thousands of followers and students, and a strong network of traders helping complete newbies start on their journey and achieve their dreams. I couldn’t have done this alone, so I want to thank all my supporters and students for selflessly sharing your trades and helping to spread the word about us. Thanks!

Lastly, for all those who signed up for our upcoming training program on 22&23rd June, be patient, for good things come to those who wait. As I mentioned during the seminar, this will be the final run at this greatly discounted price, for we will be raising prices (for all the new content we recently added) from the next run onwards. So, if you have any friends who are still sitting on the fence, we will be having a final sharing seminar on 19th June, and it will be the final chance to sign-up for this unique training program.

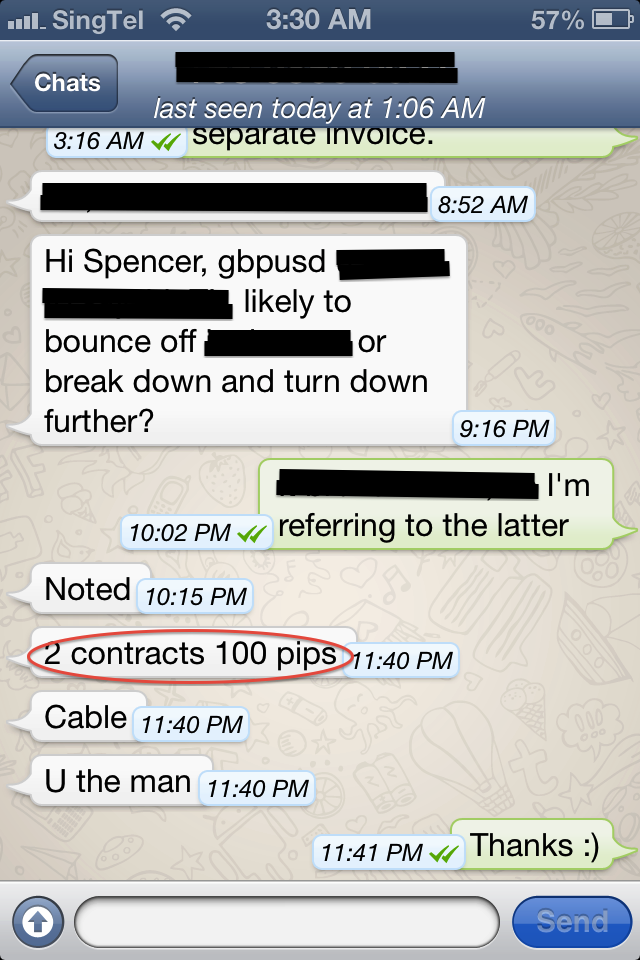

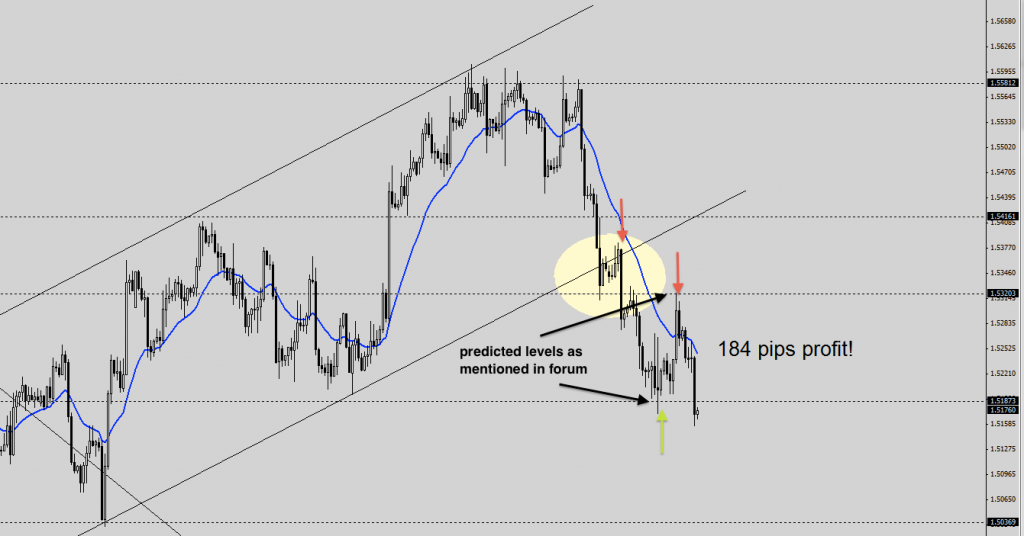

P.S. For those who were present at the seminar, I will be following up on my trade calls in my next blog post. Stay tuned!