A Mixed Market – Turning the Risk On?

Weekly AMA on Instagram - Ask me anything about trading & investing, stock picks, market analysis, etc!

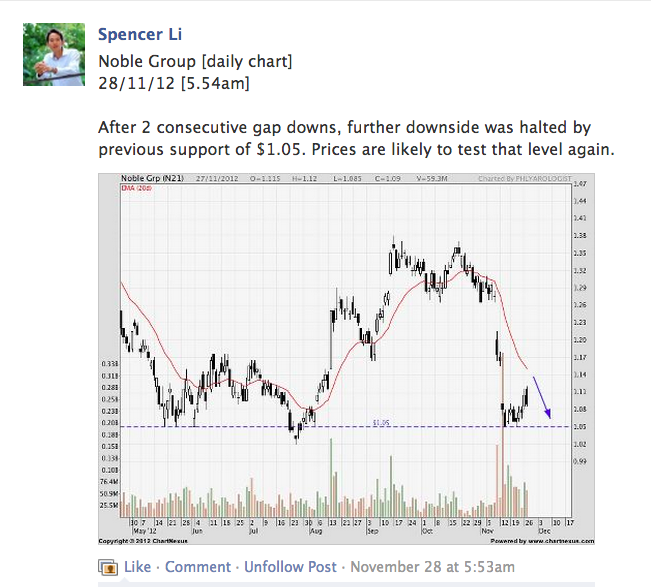

While most currencies exhibited a risk-on bullishness, the STI was experiencing intraday distribution (refer to top chart). This is in line with my forecast for the week, and I am expecting some profit-taking from the big players. My short call on Noble should be hitting its target soon, probably this week.

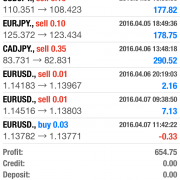

I started off the day with two big winners riding long on the EUR/USD and GBP/USD. I also wanted to short EUR/JPY and GBP/JPY, but a bullish spike when Spain requested for aid negated the setup. Instead, I shorted EUR/JPY after the spike. Let’s see how it turns out tomorrow.

Today, as I was looking through some of my previous trades, I realised that I could greatly improve my results by exiting trades once I knew they were wrong instead of waiting for them to hit my stoploss. Of course, this will require some judgment, but there are some simple guidelines which be easily applied. I will share more in my next seminar.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Trackbacks & Pingbacks

[…] quick follow-up from yesterday on the short trade I mentioned in my previous post. I shorted after the spike up once I saw weakness in the price behaviour. It was evident to me even […]

Leave a Reply

Want to join the discussion?Feel free to contribute!